- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A122640

YEST (KOSDAQ:122640 investor one-year losses grow to 25% as the stock sheds ₩39b this past week

While it may not be enough for some shareholders, we think it is good to see the YEST Co., Ltd. (KOSDAQ:122640) share price up 19% in a single quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 25% in the last year, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for YEST

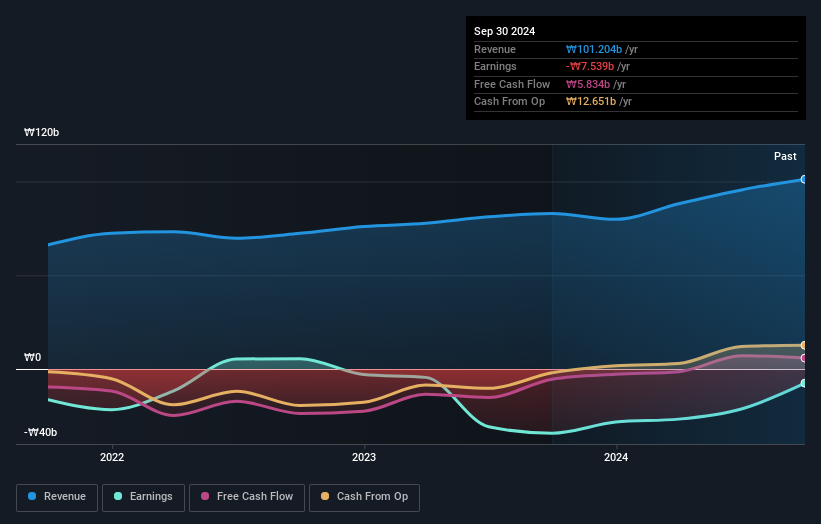

Given that YEST didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year YEST saw its revenue grow by 22%. We think that is pretty nice growth. Meanwhile, the share price is down 25% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 3.9% in the twelve months, YEST shareholders did even worse, losing 25%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for YEST (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

But note: YEST may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A122640

YEST

Engages in the manufacture and sale of semiconductors and display manufacturing equipment in Korea and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives