- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A098460

Koh Young Technology Inc. (KOSDAQ:098460) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Koh Young Technology Inc. (KOSDAQ:098460) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 30%.

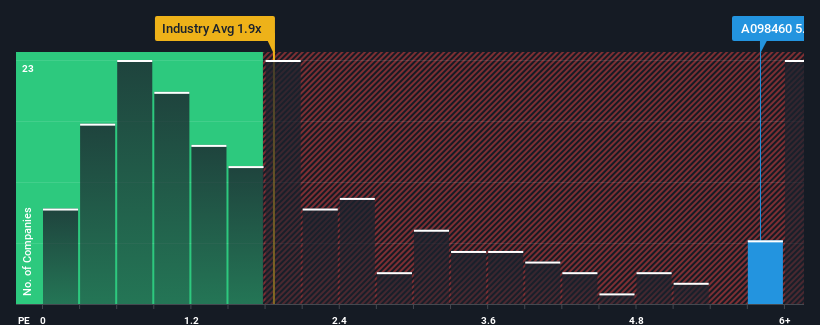

Following the firm bounce in price, you could be forgiven for thinking Koh Young Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Koh Young Technology

What Does Koh Young Technology's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Koh Young Technology has been doing relatively well. It seems that many are expecting the comparatively superior revenue performance to persist, which has increased investors’ willingness to pay up for the stock. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Koh Young Technology.How Is Koh Young Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Koh Young Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 7.0% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 35% per annum growth forecast for the broader industry.

With this information, we find it concerning that Koh Young Technology is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Koh Young Technology's P/S

Koh Young Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Koh Young Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Koh Young Technology you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of Koh Young Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Koh Young Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A098460

Koh Young Technology

Engages in the manufacturing and sale of automated inspection and precise measurement systems and equipment in South Korea and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives