- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A092870

Exicon Co., Ltd. (KOSDAQ:092870) Shares May Have Slumped 28% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Exicon Co., Ltd. (KOSDAQ:092870) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

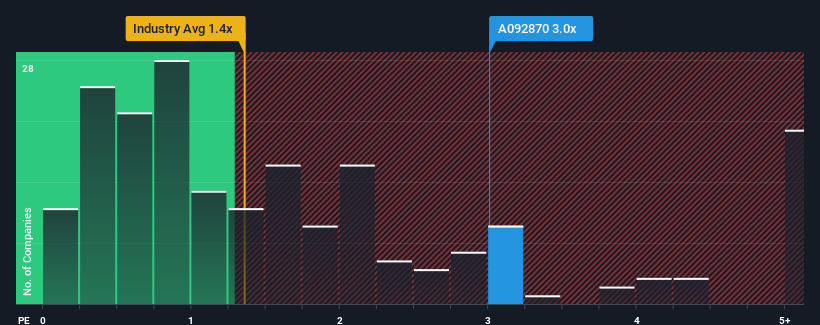

In spite of the heavy fall in price, you could still be forgiven for thinking Exicon is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Exicon

How Has Exicon Performed Recently?

As an illustration, revenue has deteriorated at Exicon over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Exicon's earnings, revenue and cash flow.How Is Exicon's Revenue Growth Trending?

In order to justify its P/S ratio, Exicon would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 63%. As a result, revenue from three years ago have also fallen 49% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 68% shows it's an unpleasant look.

In light of this, it's alarming that Exicon's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Exicon's P/S?

There's still some elevation in Exicon's P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Exicon revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

You need to take note of risks, for example - Exicon has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Exicon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A092870

Exicon

Operates as a semiconductor test solution company in Korea and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives