- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084850

ITM Semiconductor (KOSDAQ:084850) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that ITM Semiconductor Co., Ltd. (KOSDAQ:084850) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for ITM Semiconductor

What Is ITM Semiconductor's Net Debt?

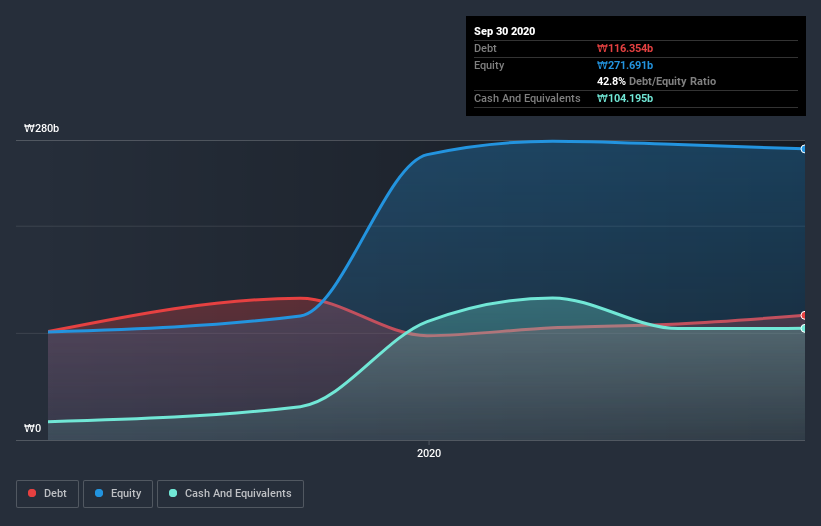

You can click the graphic below for the historical numbers, but it shows that ITM Semiconductor had ₩116.4b of debt in September 2020, down from ₩132.3b, one year before. However, because it has a cash reserve of ₩104.2b, its net debt is less, at about ₩12.2b.

How Strong Is ITM Semiconductor's Balance Sheet?

We can see from the most recent balance sheet that ITM Semiconductor had liabilities of ₩161.9b falling due within a year, and liabilities of ₩35.9b due beyond that. Offsetting these obligations, it had cash of ₩104.2b as well as receivables valued at ₩81.4b due within 12 months. So it has liabilities totalling ₩12.2b more than its cash and near-term receivables, combined.

Having regard to ITM Semiconductor's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₩1.26t company is struggling for cash, we still think it's worth monitoring its balance sheet. Carrying virtually no net debt, ITM Semiconductor has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ITM Semiconductor has a low net debt to EBITDA ratio of only 0.25. And its EBIT easily covers its interest expense, being 20.9 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The modesty of its debt load may become crucial for ITM Semiconductor if management cannot prevent a repeat of the 34% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine ITM Semiconductor's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last two years, ITM Semiconductor burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

While ITM Semiconductor's EBIT growth rate has us nervous. To wit both its interest cover and net debt to EBITDA were encouraging signs. Looking at all the angles mentioned above, it does seem to us that ITM Semiconductor is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with ITM Semiconductor , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade ITM Semiconductor, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A084850

ITM Semiconductor

Manufactures and sells components for secondary batteries worldwide.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026