- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A067310

Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In the wake of recent global market shifts, U.S. stocks have been buoyed by optimism surrounding potential growth and tax reforms following a significant political change. As major indices like the S&P 500 reach new heights, investors are increasingly focusing on companies with strong insider ownership, which can signal confidence in long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 32% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★☆

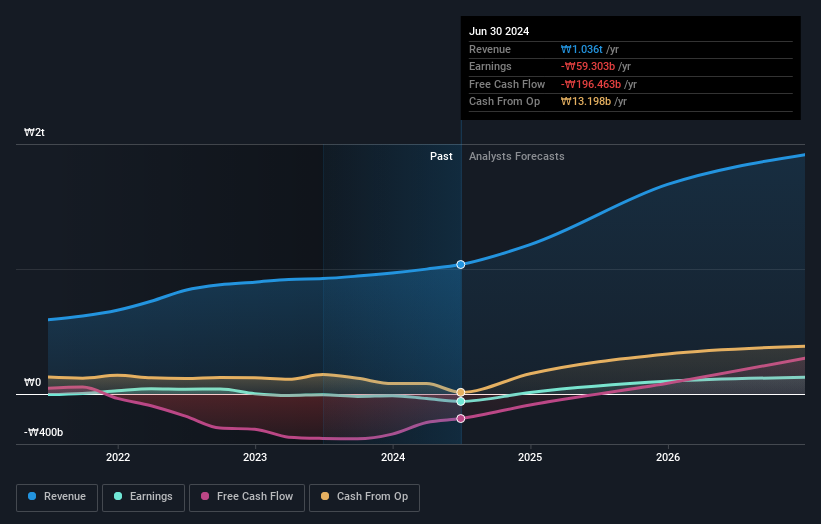

Overview: HANA Micron Inc. offers semiconductor back-end process packaging solutions in South Korea, with a market cap of approximately ₩557.07 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Manufacturing segment, which accounts for ₩1.41 billion, followed by the Semiconductor Material segment at ₩217.79 million.

Insider Ownership: 18.3%

Earnings Growth Forecast: 109.2% p.a.

HANA Micron's revenue is forecast to grow 23.3% annually, outpacing the KR market's 9.7%. Despite past shareholder dilution, it trades significantly below its estimated fair value, suggesting potential undervaluation. The company is expected to achieve profitability within three years, with earnings growth projected at 109.15% per year—above average market growth rates. However, a forecasted Return on Equity of 19.3% in three years indicates room for improvement in profitability metrics.

- Get an in-depth perspective on HANA Micron's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of HANA Micron shares in the market.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★☆☆

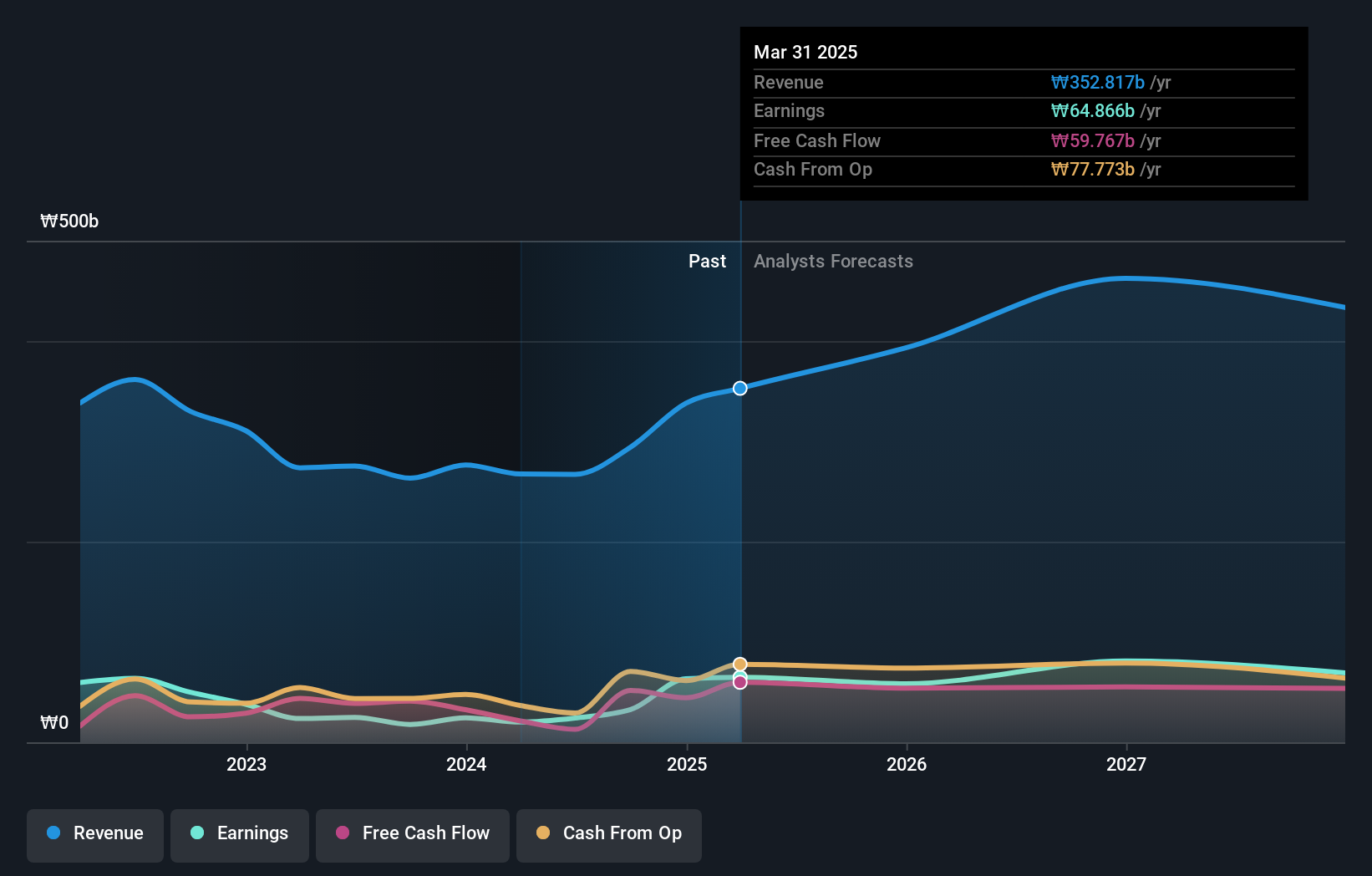

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩779.27 billion.

Operations: The company's revenue is primarily derived from its semiconductor equipment segment, which generated ₩256.56 billion, and its industrial gas for semiconductors segment, contributing ₩10.49 billion.

Insider Ownership: 37.5%

Earnings Growth Forecast: 35.9% p.a.

Eugene Technology's earnings are projected to grow at 35.9% annually, surpassing the Korean market's 29.3%. Revenue is expected to increase by 19.4% per year, also outpacing the market average of 9.7%. Analysts anticipate a stock price rise of 60.1%, indicating potential undervaluation despite low forecasted Return on Equity of 15.7% in three years. Recent participation in investor conferences suggests active engagement with stakeholders but lacks recent insider trading activity insights.

- Click to explore a detailed breakdown of our findings in Eugene TechnologyLtd's earnings growth report.

- Our valuation report here indicates Eugene TechnologyLtd may be overvalued.

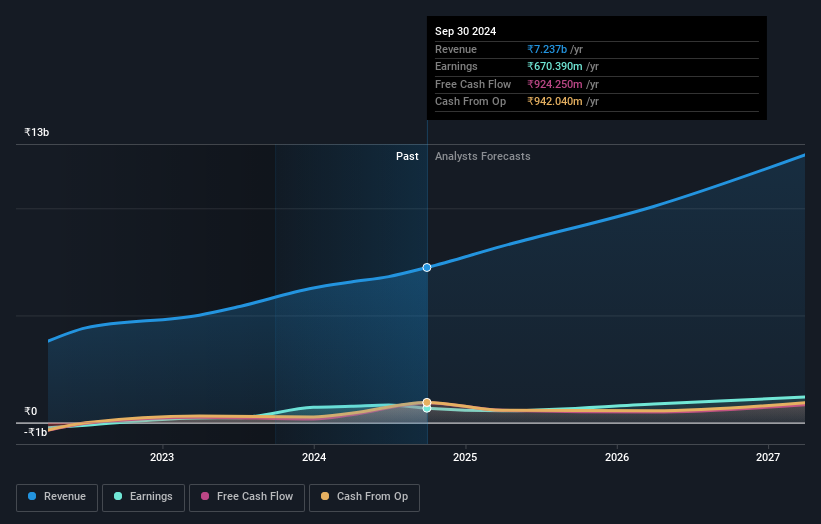

Le Travenues Technology (NSEI:IXIGO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Le Travenues Technology Limited operates online travel aggregator platforms in India with a market cap of ₹52.64 billion.

Operations: Revenue Segments (in millions of ₹):

Insider Ownership: 14.4%

Earnings Growth Forecast: 28.8% p.a.

Le Travenues Technology, known for its substantial insider ownership, reported a mixed financial performance recently. While revenue increased to INR 2.11 billion from INR 1.66 billion year-over-year, net income declined to INR 130.85 million from INR 279.48 million due to higher expenses or investments in growth initiatives. Despite this, the company is expected to achieve significant earnings and revenue growth rates of 28.8% and 21.9% annually, respectively, outpacing the Indian market averages significantly.

- Navigate through the intricacies of Le Travenues Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Le Travenues Technology implies its share price may be too high.

Turning Ideas Into Actions

- Investigate our full lineup of 1522 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HANA Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A067310

HANA Micron

Provides semiconductor back-end process packaging solutions in South Korea.

Exceptional growth potential and undervalued.