- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A082800

Some Shareholders Feeling Restless Over Vivozon Pharmaceutical Co., Ltd.'s (KOSDAQ:082800) P/S Ratio

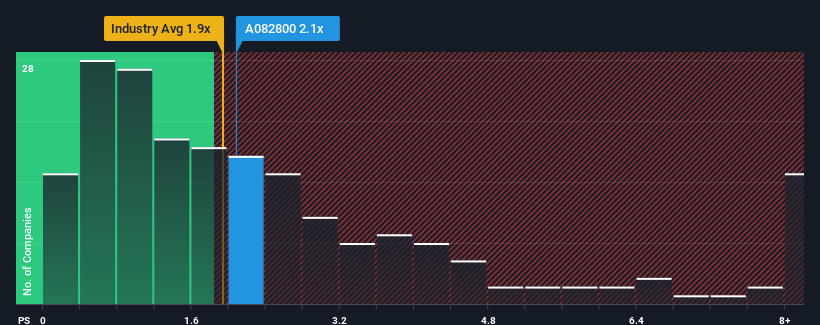

It's not a stretch to say that Vivozon Pharmaceutical Co., Ltd.'s (KOSDAQ:082800) price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" for companies in the Semiconductor industry in Korea, where the median P/S ratio is around 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Vivozon Pharmaceutical

How Vivozon Pharmaceutical Has Been Performing

Vivozon Pharmaceutical certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vivozon Pharmaceutical's earnings, revenue and cash flow.How Is Vivozon Pharmaceutical's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Vivozon Pharmaceutical's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 51%. Pleasingly, revenue has also lifted 58% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 75% shows it's noticeably less attractive.

With this information, we find it interesting that Vivozon Pharmaceutical is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Vivozon Pharmaceutical's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Vivozon Pharmaceutical's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Vivozon Pharmaceutical is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Vivozon Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A082800

Vivozon Pharmaceutical

Researches, develops, produces, and sells LED products primarily in South Korea.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives