- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A064290

The INTEKPLUS (KOSDAQ:064290) Share Price Has Soared 413%, Delighting Many Shareholders

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held INTEKPLUS Co., Ltd. (KOSDAQ:064290) shares for the last five years, while they gained 413%. This just goes to show the value creation that some businesses can achieve. It's also up 17% in about a month. But this could be related to good market conditions -- stocks in its market are up 7.5% in the last month.

Check out our latest analysis for INTEKPLUS

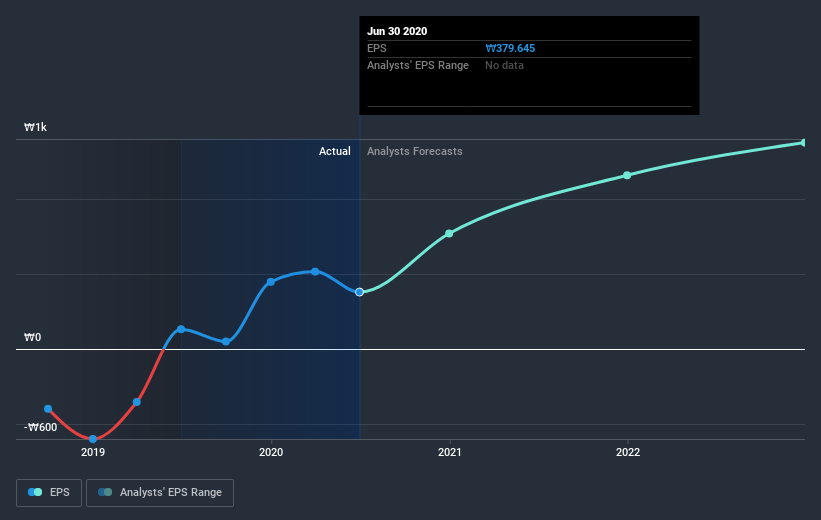

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years of share price growth, INTEKPLUS moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that INTEKPLUS has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling INTEKPLUS stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that INTEKPLUS shareholders have received a total shareholder return of 231% over the last year. That's better than the annualised return of 39% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - INTEKPLUS has 1 warning sign we think you should be aware of.

But note: INTEKPLUS may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading INTEKPLUS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A064290

INTEKPLUS

Develops and supplies semiconductor packages and visual inspection equipment.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives