- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A059120

What Ajinextek Co., Ltd.'s (KOSDAQ:059120) 28% Share Price Gain Is Not Telling You

Ajinextek Co., Ltd. (KOSDAQ:059120) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 60%.

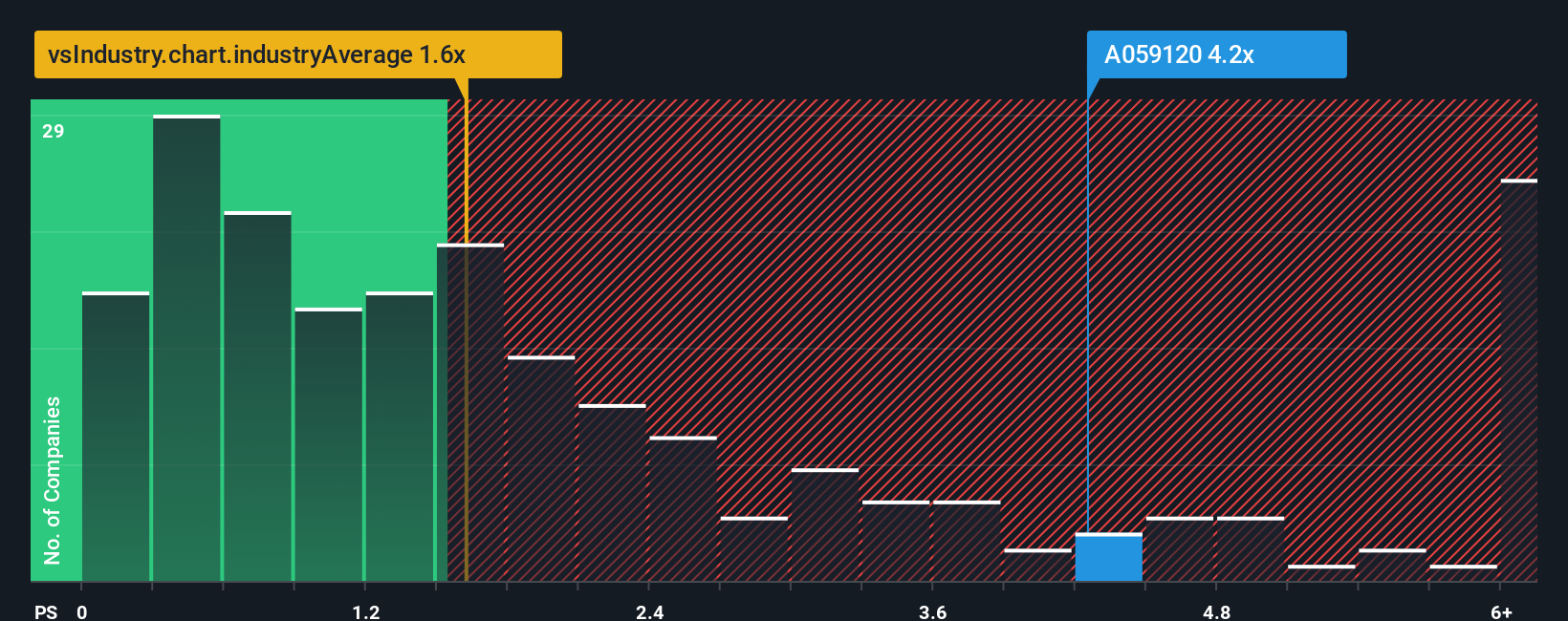

Since its price has surged higher, when almost half of the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Ajinextek as a stock not worth researching with its 4.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ajinextek

What Does Ajinextek's P/S Mean For Shareholders?

For instance, Ajinextek's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Ajinextek, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ajinextek's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. As a result, revenue from three years ago have also fallen 44% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 47% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Ajinextek's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Ajinextek have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Ajinextek revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ajinextek (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A059120

Ajinextek

Develops, manufactures, and sells motor control VLSI chips in South Korea.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026