- South Korea

- /

- Specialty Stores

- /

- KOSE:A900140

LVMC Holdings'(KRX:900140) Share Price Is Down 64% Over The Past Five Years.

LVMC Holdings (KRX:900140) shareholders should be happy to see the share price up 20% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 64% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

View our latest analysis for LVMC Holdings

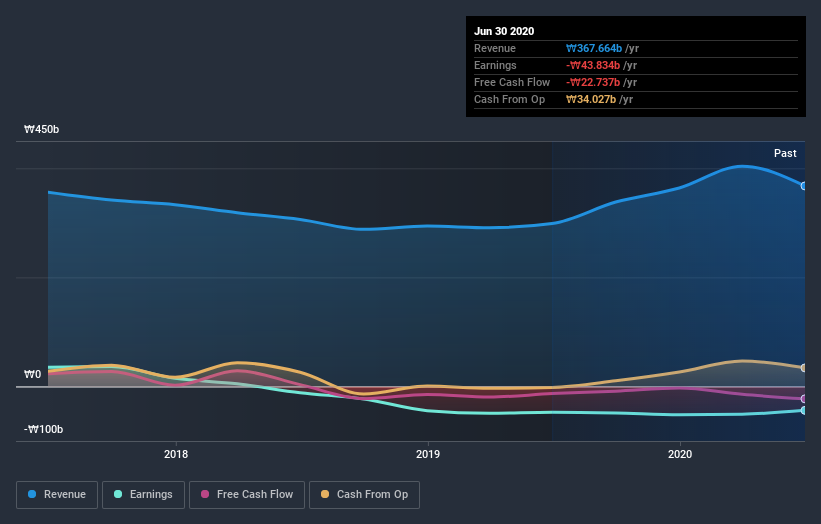

Given that LVMC Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade LVMC Holdings reduced its trailing twelve month revenue by 7.0% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 10% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on LVMC Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered LVMC Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. LVMC Holdings' TSR of was a loss of 55% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

LVMC Holdings shareholders gained a total return of 2.6% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand LVMC Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for LVMC Holdings you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading LVMC Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade LVMC Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A900140

LVMC Holdings

Manufactures, imports, and distributes automobiles and motorcycles in Vietnam and internationally.

Excellent balance sheet minimal.