- South Korea

- /

- Paper and Forestry Products

- /

- KOSDAQ:A025900

3 Growth Companies With Insider Ownership Up To 23%

Reviewed by Simply Wall St

In the current global market landscape, characterized by interest rate cuts from the ECB and SNB and a mixed performance across major indices, growth stocks have continued to outpace value stocks. Amidst these conditions, companies with substantial insider ownership can offer unique insights into potential growth opportunities as insiders often have a deep understanding of their company's prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Let's explore several standout options from the results in the screener.

Dongwha EnterpriseLtd (KOSDAQ:A025900)

Simply Wall St Growth Rating: ★★★★☆☆

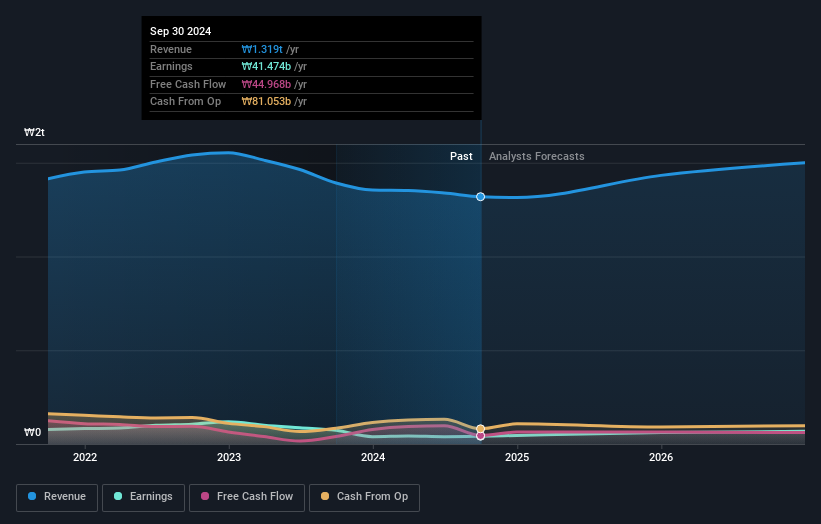

Overview: Dongwha Enterprise Co., Ltd is a South Korean company that manufactures and sells wood materials, with a market cap of ₩395.66 billion.

Operations: The company's revenue is derived from three main segments: Housing Business at ₩148.76 billion, Chemical Business at ₩195.73 billion, and Materials Business at ₩598.05 billion.

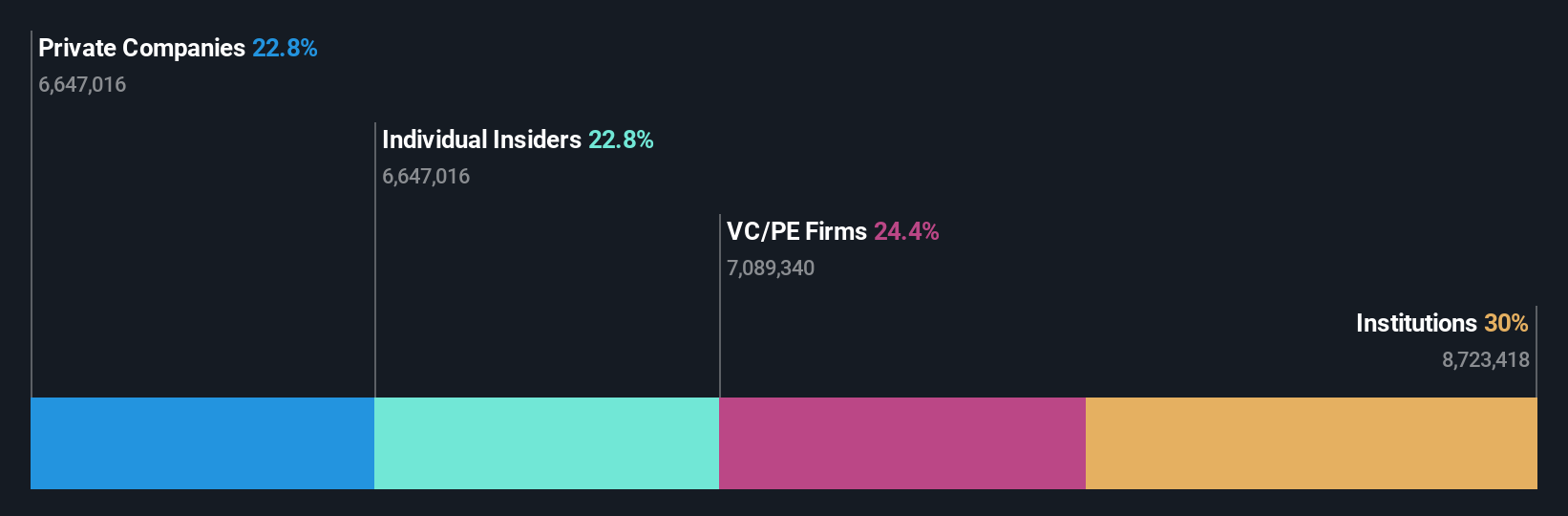

Insider Ownership: 14.8%

Dongwha Enterprise Ltd. is trading significantly below its estimated fair value, suggesting potential for upside. Despite current net losses, the company has reduced its loss per share substantially year-over-year and is forecast to achieve profitability within three years, outpacing average market growth. Revenue growth of 8.1% annually is expected to exceed the broader Korean market's rate. However, interest payments are not well covered by earnings, indicating financial challenges remain.

- Click here and access our complete growth analysis report to understand the dynamics of Dongwha EnterpriseLtd.

- In light of our recent valuation report, it seems possible that Dongwha EnterpriseLtd is trading behind its estimated value.

Shinsegae International (KOSE:A031430)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shinsegae International Co., Ltd. operates department stores and hypermarkets in South Korea with a market cap of ₩375.38 billion.

Operations: The company's revenue segments include ₩388.10 billion from domestic cosmetics, ₩13.35 billion from overseas cosmetics, and ₩917.43 billion from domestic fashion and lifestyle products.

Insider Ownership: 15.6%

Shinsegae International's recent earnings report shows strong growth, with Q3 sales and net income nearly doubling from the previous year. Despite a decline in profit margins from 5.2% to 3.1%, the company's stock is trading at a significant discount to its fair value estimate. While revenue growth is projected at 5.9% annually, below high-growth benchmarks, earnings are expected to increase significantly by 22% per year, surpassing market averages in Korea.

- Navigate through the intricacies of Shinsegae International with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Shinsegae International's current price could be quite moderate.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.14 billion.

Operations: The company's revenue is derived from two main segments: Solutions, contributing PLN141.44 million, and Subscriptions, adding PLN39.87 million.

Insider Ownership: 23.6%

Shoper is trading at a 27.3% discount to its estimated fair value, with earnings expected to grow significantly by 26.6% annually over the next three years, outpacing the Polish market's growth projections. Recent earnings for the nine months ended September 2024 showed revenue of PLN 137.67 million and net income of PLN 23.64 million, both up from last year. A recent M&A transaction valued Shoper at PLN 39 per share, highlighting investor interest despite slower revenue growth forecasts of 16%.

- Unlock comprehensive insights into our analysis of Shoper stock in this growth report.

- Our valuation report unveils the possibility Shoper's shares may be trading at a discount.

Seize The Opportunity

- Explore the 1524 names from our Fast Growing Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A025900

Dongwha EnterpriseLtd

Manufactures and sells wood materials in South Korea.

Fair value with moderate growth potential.

Market Insights

Community Narratives