- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A004170

Top Growth Companies With Insider Ownership December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, with the Nasdaq Composite reaching new highs and growth stocks continuing to outperform value stocks, investors are increasingly focused on insider ownership as a potential indicator of confidence in a company's future prospects. In this environment, companies with high insider ownership can be appealing as they often suggest that those who know the business best believe strongly in its growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Here we highlight a subset of our preferred stocks from the screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.15 billion.

Operations: The company generates revenue from installing and maintaining electronic shelf labels, amounting to €830.16 million.

Insider Ownership: 13.4%

VusionGroup is trading 29.2% below its estimated fair value, with analysts forecasting a 44.4% price increase. It is expected to become profitable within three years, outpacing average market growth, and its revenue is projected to grow at 23.4% annually, surpassing the French market's growth rate of 5.6%. Earnings are anticipated to rise by 81.77% per year, and Return on Equity could reach a high of 27.5%.

- Delve into the full analysis future growth report here for a deeper understanding of VusionGroup.

- Our valuation report here indicates VusionGroup may be undervalued.

SHINSEGAE (KOSE:A004170)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SHINSEGAE Inc. operates department stores in South Korea and has a market cap of ₩1.24 trillion.

Operations: The company's revenue segments include Duty Free at ₩1.94 trillion, Wholesale & Retail Business at ₩1.94 trillion, Department Store - Other Regions at ₩1.14 trillion, Department Store - Seoul City (Excluding Headquarter) at ₩1.07 trillion, Department Store - Seoul Metropolitan Region at ₩300.76 million, Real Estate at ₩227.52 million, and Hotel Business at ₩137.40 million.

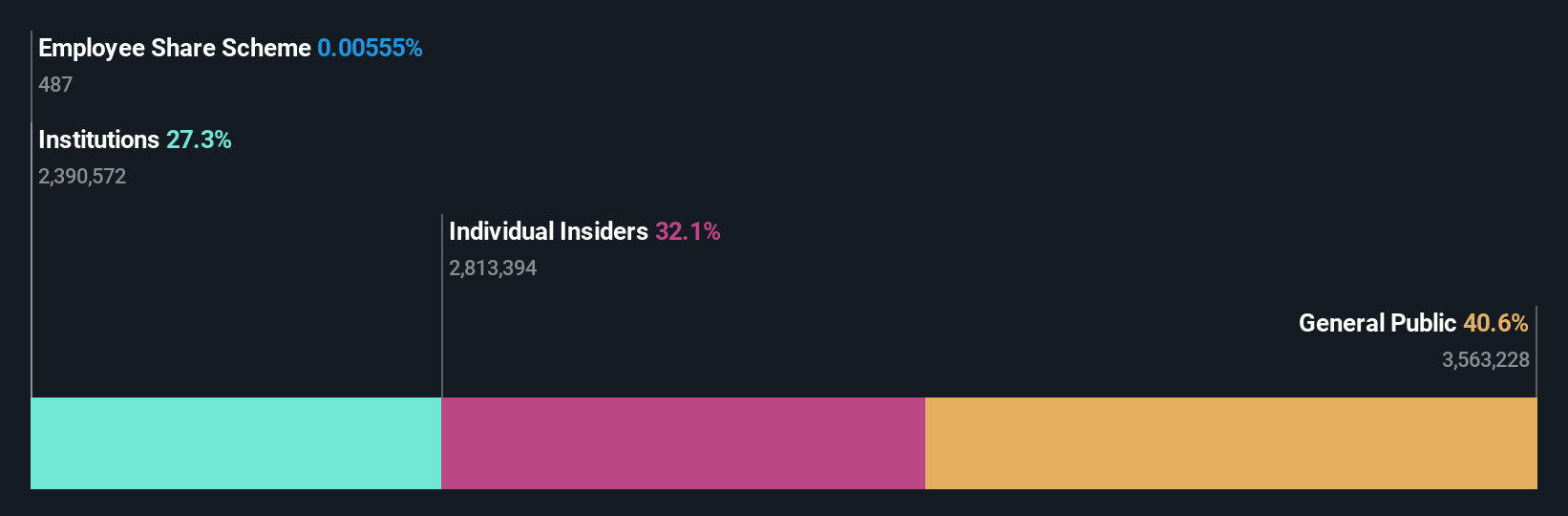

Insider Ownership: 30.5%

SHINSEGAE is trading at 75.2% below its estimated fair value, with analysts predicting a 41% price increase. Revenue growth is expected to outpace the Korean market, and earnings are forecasted to grow significantly at 23.14% annually over the next three years. Despite this potential, profit margins have declined year-over-year, and dividends are not well covered by free cash flows. Recent buybacks totaling KRW 104.99 billion indicate strong insider confidence in the company's future prospects.

- Get an in-depth perspective on SHINSEGAE's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that SHINSEGAE's current price could be quite moderate.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$39.53 billion.

Operations: The company's revenue segment includes Jewelry & Watches, generating CN¥5.28 billion.

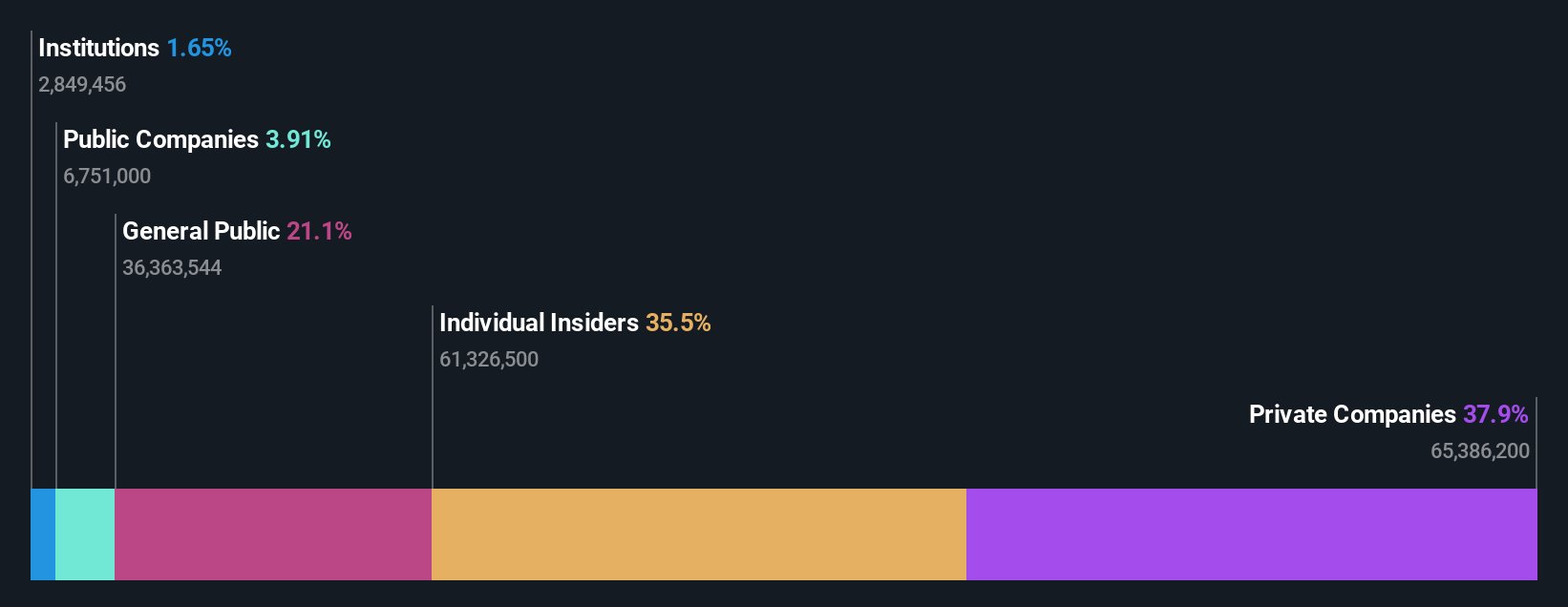

Insider Ownership: 36.4%

Laopu Gold's revenue is projected to grow 24.6% annually, outpacing the Hong Kong market. Earnings are forecasted to increase by 34.2% per year, significantly above the market average of 11.3%. While recent changes in company bylaws were approved, there has been no substantial insider trading activity over the past three months. Despite high non-cash earnings, its Return on Equity is expected to reach a robust 36.6% in three years.

- Click here and access our complete growth analysis report to understand the dynamics of Laopu Gold.

- The valuation report we've compiled suggests that Laopu Gold's current price could be inflated.

Key Takeaways

- Investigate our full lineup of 1528 Fast Growing Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004170

Slight with moderate growth potential.

Market Insights

Community Narratives