- South Korea

- /

- Specialty Stores

- /

- KOSDAQ:A950170

The 12% return this week takes JTC's (KOSDAQ:950170) shareholders three-year gains to 28%

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at JTC Inc. (KOSDAQ:950170), which is up 28%, over three years, soundly beating the market decline of 1.7% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 18%.

The past week has proven to be lucrative for JTC investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for JTC

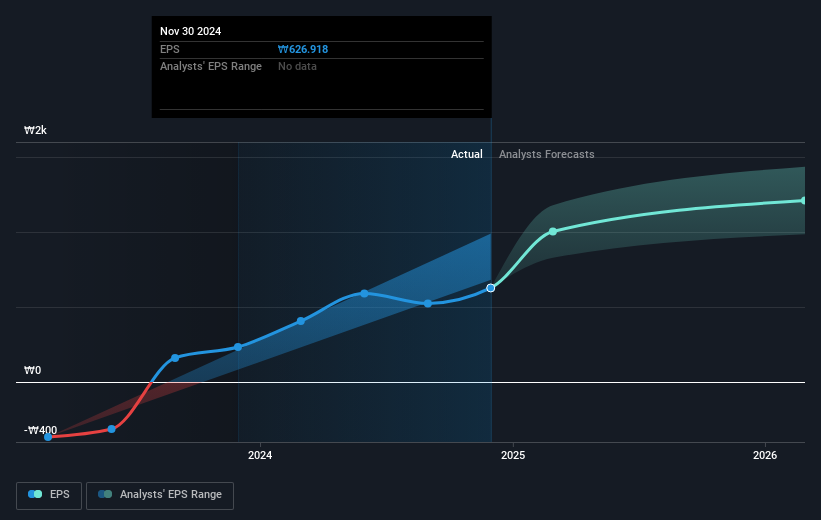

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

JTC became profitable within the last three years. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how JTC has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that JTC has rewarded shareholders with a total shareholder return of 18% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 3% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Is JTC cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A950170

JTC

Operates retail shops in Japan. It engages in the retail sale of foods, daily necessities, cosmetics, health products, precious metals, electronic devices, folk crafts, and other products.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives