- South Korea

- /

- Specialty Stores

- /

- KOSDAQ:A309930

OHEIM& Company Co.,Ltd. (KOSDAQ:309930) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the OHEIM& Company Co.,Ltd. (KOSDAQ:309930) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

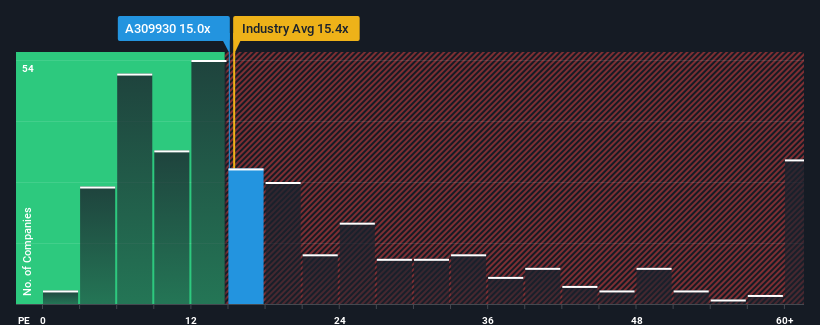

Even after such a large drop in price, given around half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may still consider OHEIM& CompanyLtd as a stock to potentially avoid with its 15x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's exceedingly strong of late, OHEIM& CompanyLtd has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for OHEIM& CompanyLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, OHEIM& CompanyLtd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 164% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 4,285% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that OHEIM& CompanyLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From OHEIM& CompanyLtd's P/E?

Despite the recent share price weakness, OHEIM& CompanyLtd's P/E remains higher than most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that OHEIM& CompanyLtd maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for OHEIM& CompanyLtd that you should be aware of.

You might be able to find a better investment than OHEIM& CompanyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A309930

Slight with mediocre balance sheet.

Market Insights

Community Narratives