- South Korea

- /

- Real Estate

- /

- KOSDAQ:A034810

Can Mixed Fundamentals Have A Negative Impact on Haesung Industrial Co., Ltd. (KOSDAQ:034810) Current Share Price Momentum?

Most readers would already be aware that Haesung Industrial's (KOSDAQ:034810) stock increased significantly by 18% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Haesung Industrial's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Haesung Industrial

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Haesung Industrial is:

2.5% = ₩3.5b ÷ ₩140b (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.03 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Haesung Industrial's Earnings Growth And 2.5% ROE

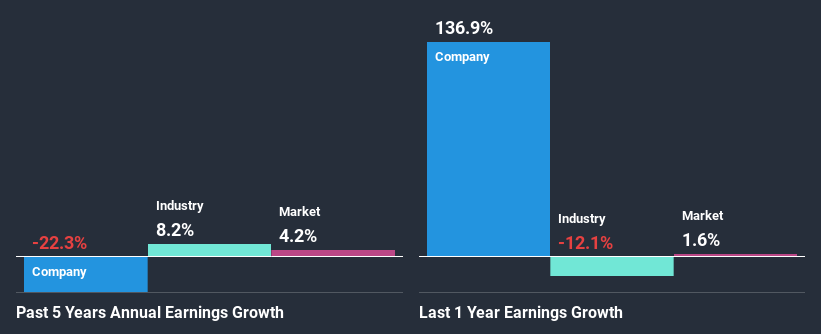

As you can see, Haesung Industrial's ROE looks pretty weak. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. For this reason, Haesung Industrial's five year net income decline of 22% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Haesung Industrial's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 5.1% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is Haesung Industrial fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Haesung Industrial Making Efficient Use Of Its Profits?

Because Haesung Industrial doesn't pay any dividends, we infer that it is retaining all of its profits, which is rather perplexing when you consider the fact that there is no earnings growth to show for it. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Conclusion

In total, we're a bit ambivalent about Haesung Industrial's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Haesung Industrial by visiting our risks dashboard for free on our platform here.

If you decide to trade Haesung Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Haesung Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A034810

Haesung Industrial

Engages in the real estate development, rental, and management business in South Korea.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)