- South Korea

- /

- Life Sciences

- /

- KOSE:A207940

Investing in Samsung BiologicsLtd (KRX:207940) five years ago would have delivered you a 137% gain

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Samsung Biologics Co.,Ltd. (KRX:207940) shareholders would be well aware of this, since the stock is up 135% in five years. It's also good to see the share price up 14% over the last quarter. But this could be related to the strong market, which is up 8.3% in the last three months.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

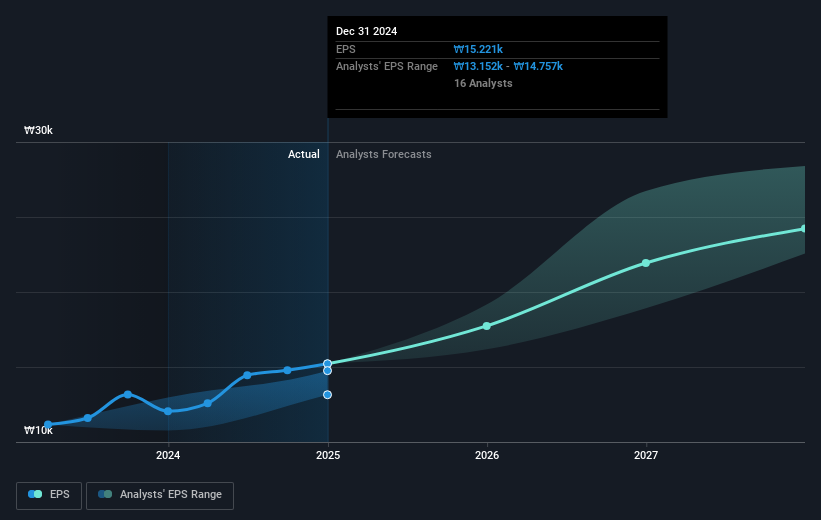

Over half a decade, Samsung BiologicsLtd managed to grow its earnings per share at 38% a year. This EPS growth is higher than the 19% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. Of course, with a P/E ratio of 70.43, the market remains optimistic.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Samsung BiologicsLtd has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Samsung BiologicsLtd stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Samsung BiologicsLtd's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Samsung BiologicsLtd's TSR, at 137% is higher than its share price return of 135%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Samsung BiologicsLtd shareholders have received a total shareholder return of 25% over the last year. That's better than the annualised return of 19% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Samsung BiologicsLtd cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A207940

Samsung BiologicsLtd

Together with its subsidiaries engages in the manufacturing of biopharmaceuticals products in South Korea, Europe, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives