- South Korea

- /

- Pharma

- /

- KOSE:A185750

The Chong Kun Dang Pharmaceutical (KRX:185750) Share Price Is Up 112% And Shareholders Are Boasting About It

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example Chong Kun Dang Pharmaceutical Corp. (KRX:185750). Its share price is already up an impressive 112% in the last twelve months. It's also good to see the share price up 27% over the last quarter. But this could be related to the strong market, which is up 24% in the last three months. Looking back further, the stock price is 65% higher than it was three years ago.

View our latest analysis for Chong Kun Dang Pharmaceutical

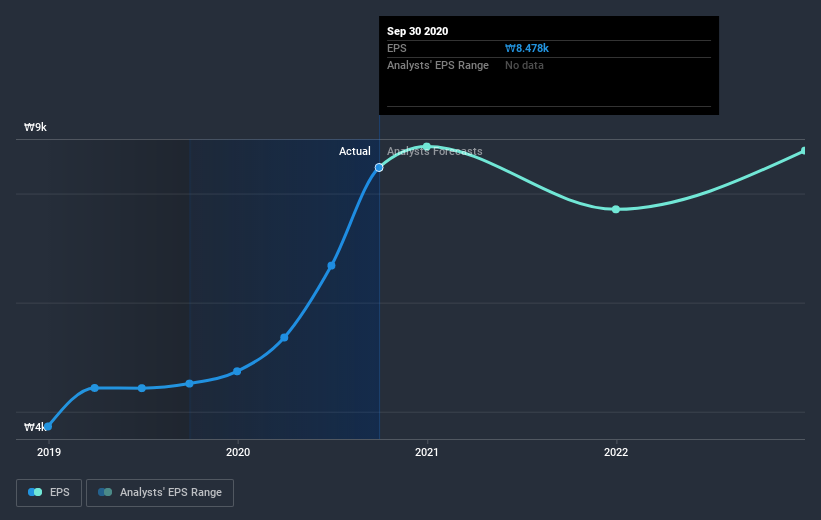

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Chong Kun Dang Pharmaceutical grew its earnings per share (EPS) by 88%. The share price gain of 112% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Chong Kun Dang Pharmaceutical has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's good to see that Chong Kun Dang Pharmaceutical has rewarded shareholders with a total shareholder return of 113% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 13%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Chong Kun Dang Pharmaceutical (including 1 which is concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Chong Kun Dang Pharmaceutical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A185750

Chong Kun Dang Pharmaceutical

Engages in the manufacturing, marketing, and sales of medicines in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives