- South Korea

- /

- Pharma

- /

- KOSE:A102460

What Percentage Of REYON Pharmaceutical Co., Ltd. (KRX:102460) Shares Do Insiders Own?

The big shareholder groups in REYON Pharmaceutical Co., Ltd. (KRX:102460) have power over the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

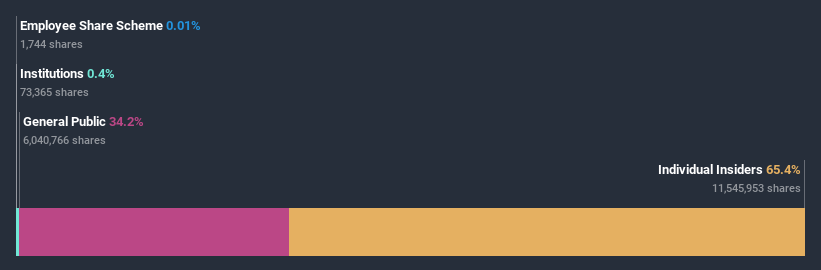

REYON Pharmaceutical is a smaller company with a market capitalization of ₩316b, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have not yet purchased much of the company. Let's delve deeper into each type of owner, to discover more about REYON Pharmaceutical.

Check out our latest analysis for REYON Pharmaceutical

What Does The Lack Of Institutional Ownership Tell Us About REYON Pharmaceutical?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

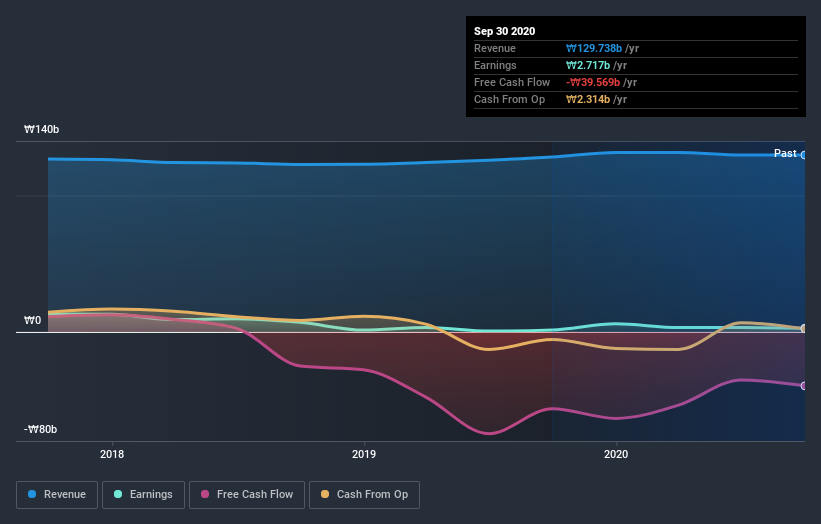

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. REYON Pharmaceutical's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in REYON Pharmaceutical. Our data suggests that Yong-Hwan Yoo, who is also the company's Co-Chief Executive Officer, holds the most number of shares at 30%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. The second and third largest shareholders are Jeong-Min Rue and Ae Suk Lee, with an equal amount of shares to their name at 9.1%. Furthermore, CEO Soon-Ock Jung is the owner of 8.6% of the company's shares.

On looking further, we found that 57% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of REYON Pharmaceutical

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of REYON Pharmaceutical Co., Ltd.. This gives them effective control of the company. So they have a ₩207b stake in this ₩316b business. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

With a 34% ownership, the general public have some degree of sway over REYON Pharmaceutical. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for REYON Pharmaceutical (of which 2 can't be ignored!) you should know about.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade REYON Pharmaceutical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A102460

Slight with poor track record.