- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7915

High Growth Tech Stocks To Watch In The Market

Reviewed by Simply Wall St

In the current global market landscape, U.S. equities have experienced a decline amid inflation concerns and political uncertainties, with small-cap stocks notably underperforming their large-cap counterparts as the Russell 2000 Index dipped into correction territory. As investors navigate these choppy waters, identifying high growth tech stocks that can withstand economic pressures and offer potential for robust performance becomes crucial in making informed investment decisions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.40% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.54% | 61.86% | ★★★★★★ |

Click here to see the full list of 1206 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★☆

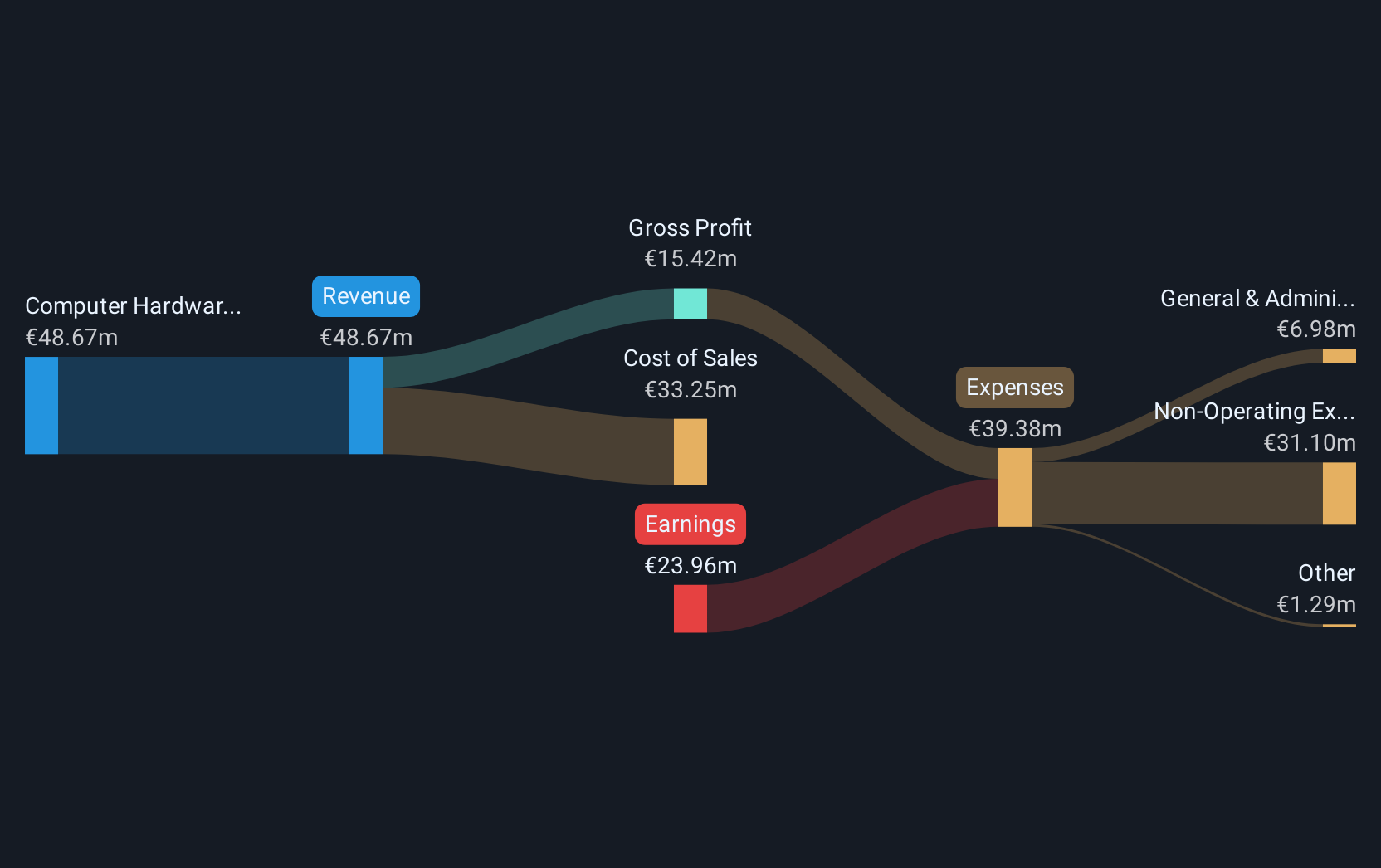

Overview: ParTec AG develops, manufactures, and supplies supercomputer and quantum computer solutions, with a market cap of €560 million.

Operations: ParTec AG focuses on the development and supply of supercomputer and quantum computer solutions. The company operates with a market capitalization of €560 million.

ParTec's recent performance and strategic direction indicate a promising trajectory in the tech sector, despite its current unprofitability. With a reported half-year sales of €5.08 million and net income reaching €5.67 million as of June 2024, the company is making significant strides. Particularly noteworthy is ParTec's commitment to innovation, reflected in its R&D expenses which are pivotal for future growth in this rapidly evolving industry. The firm's revenue is expected to surge by 32.5% annually, outpacing the German market's average of 5.5%. Moreover, earnings are projected to grow by an impressive 41.7% per year over the next three years, positioning ParTec well above many peers in terms of prospective financial health and market impact.

- Click here to discover the nuances of ParTec with our detailed analytical health report.

Understand ParTec's track record by examining our Past report.

GC Biopharma (KOSE:A006280)

Simply Wall St Growth Rating: ★★★★☆☆

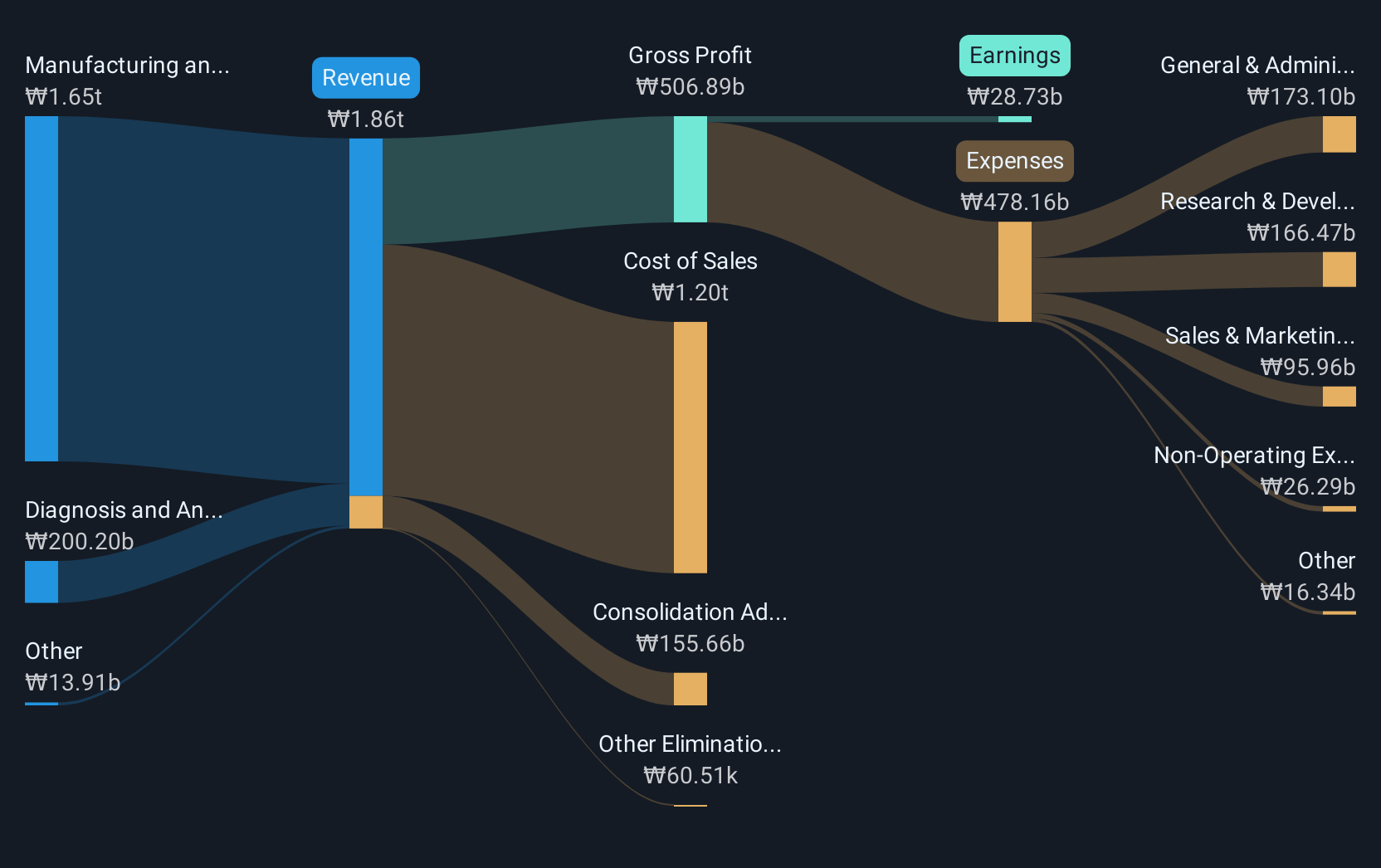

Overview: GC Biopharma Corp. is a biopharmaceutical company engaged in the development and sale of pharmaceutical drugs both in South Korea and internationally, with a market cap of ₩1.87 trillion.

Operations: GC Biopharma Corp. primarily generates revenue through the manufacturing and sales of pharmaceuticals, which account for approximately ₩1.50 trillion. The company also engages in diagnosis and analysis of samples, contributing ₩208.75 billion to its revenue stream.

GC Biopharma is shaping up as a pivotal player in the biotech sector, particularly with its innovative approaches to tackling rare diseases. The company's recent initiation of a Phase I clinical trial for 'GC1130A', targeting Sanfillippo syndrome type A, underscores its commitment to addressing unmet medical needs through advanced R&D efforts. Financially, GC Biopharma has demonstrated significant growth with third-quarter sales rising to KRW 0.00037 million from negative figures the previous year and net income soaring to KRW 33,262.23 million, up from KRW 13,921.77 million. This performance is bolstered by strategic leadership appointments and alliances aimed at expanding its therapeutic pipeline and enhancing market presence.

- Dive into the specifics of GC Biopharma here with our thorough health report.

Assess GC Biopharma's past performance with our detailed historical performance reports.

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

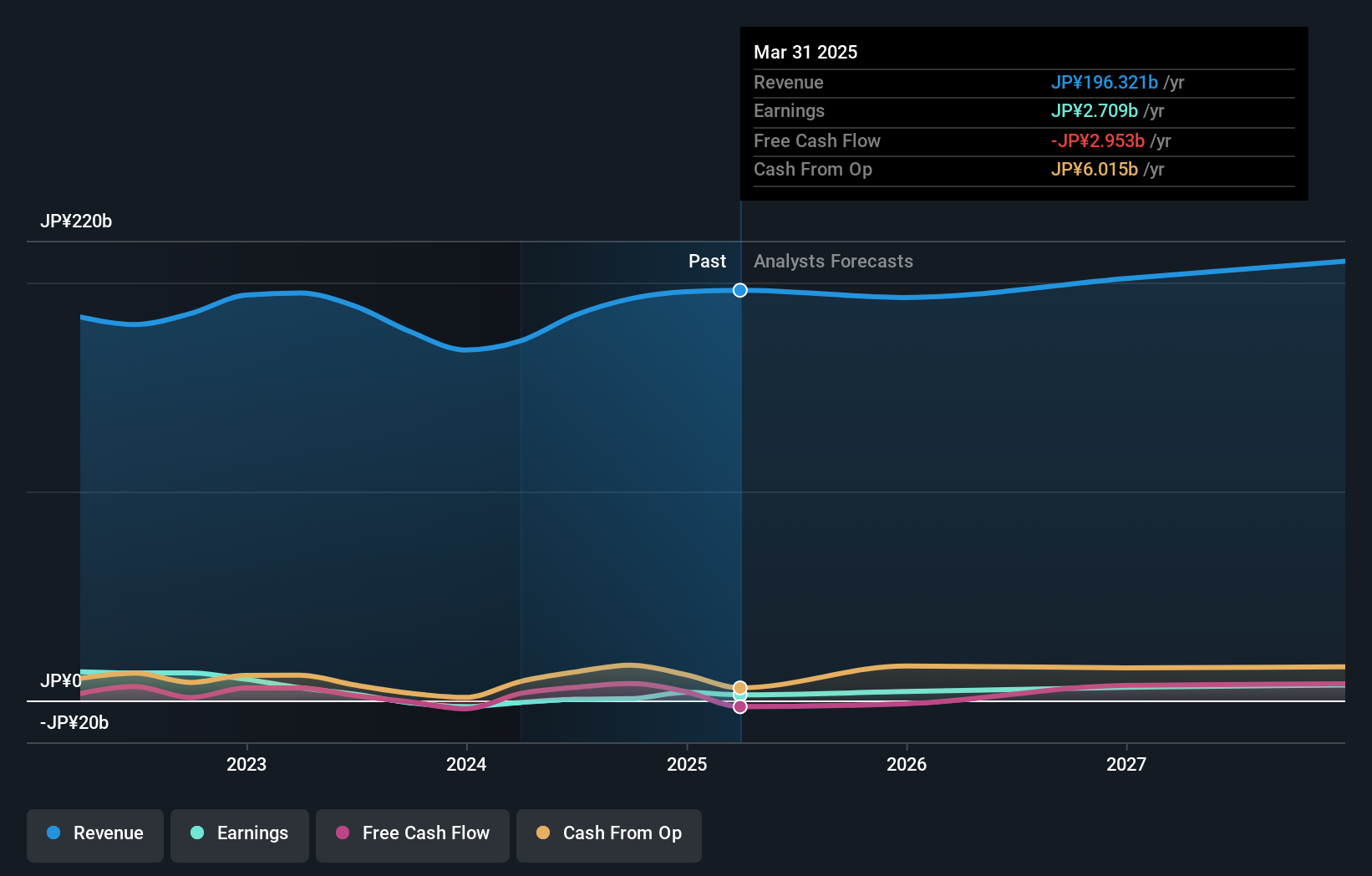

Overview: Nissha Co., Ltd. operates in the industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics sectors both in Japan and internationally, with a market cap of ¥76.20 billion.

Operations: Nissha Co., Ltd. generates revenue primarily from its industrial materials and device segments, contributing ¥73.12 billion and ¥67.26 billion respectively, with additional income from medical technology at ¥43.39 billion. The company's operations span multiple sectors internationally, focusing on innovation across diverse industries to sustain its market presence.

Nissha has recently demonstrated a strategic focus on enhancing shareholder value through its share repurchase initiative, buying back 174,300 shares for ¥275.62 million as part of a broader program aimed at repurchasing up to 600,000 shares. This move underscores the company's commitment to capital efficiency and investor returns. Financially, Nissha has shown robust growth prospects with an expected annual earnings increase of 27.1% over the next three years, significantly outpacing the Japanese market average of 7.9%. Additionally, its revenue is projected to grow at 4.2% annually, aligning with market trends but highlighting stable performance in a competitive industry environment.

- Get an in-depth perspective on Nissha's performance by reading our health report here.

Explore historical data to track Nissha's performance over time in our Past section.

Next Steps

- Embark on your investment journey to our 1206 High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7915

Nissha

Engages in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics businesses in Japan and internationally.

Excellent balance sheet with reasonable growth potential.