- Japan

- /

- Professional Services

- /

- TSE:6028

3 Reliable Dividend Stocks To Consider With Up To 3.9% Yield

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing inflation concerns and political uncertainties, investors are increasingly seeking stability amidst the volatility. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration for those looking to weather uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.74% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

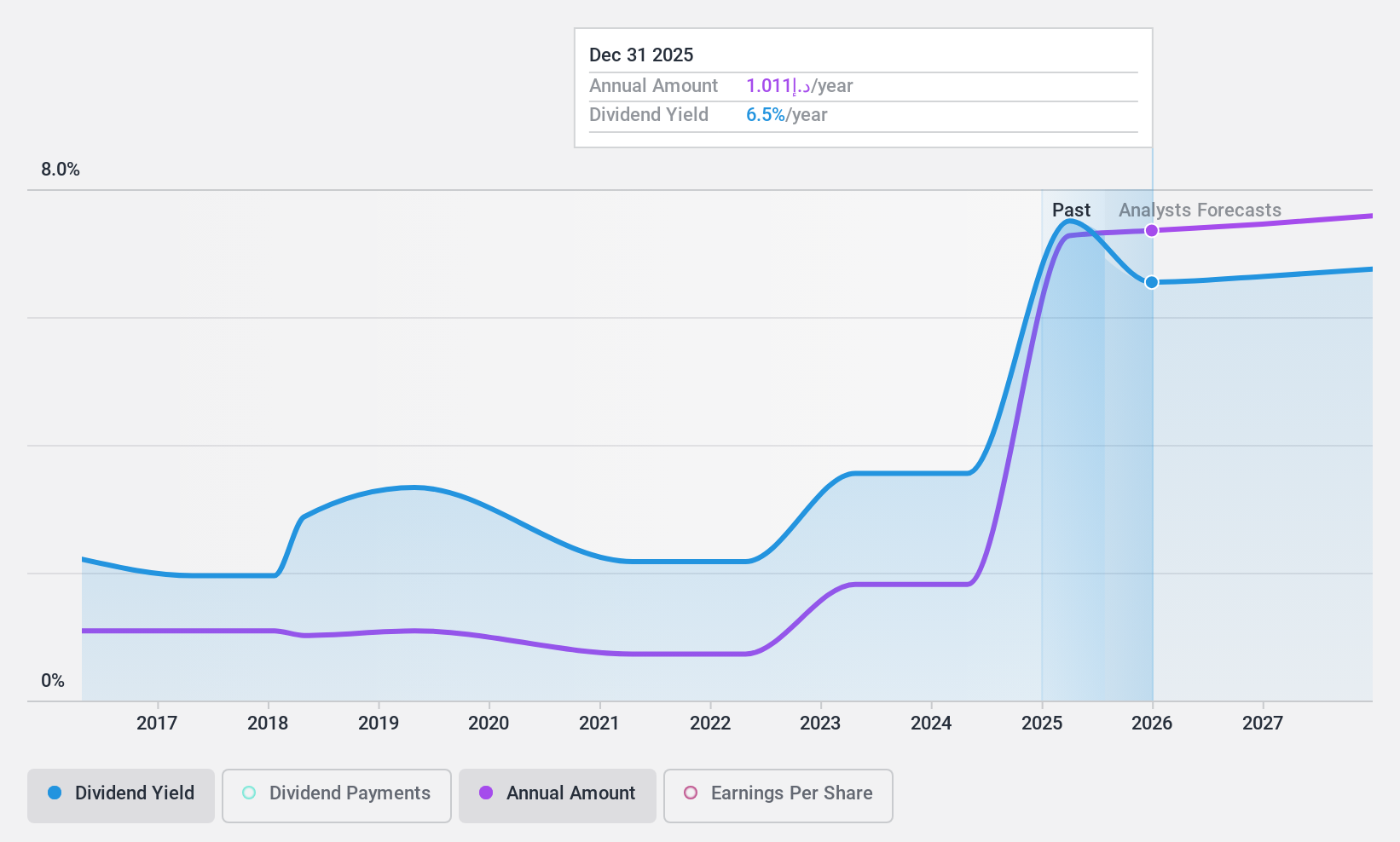

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emaar Properties PJSC, with a market cap of AED112.69 billion, operates in property investment, development, and management both in the United Arab Emirates and internationally through its subsidiaries.

Operations: Emaar Properties PJSC generates revenue through its segments: Hospitality (AED1.96 billion), Real Estate (AED23.24 billion), and Leasing, Retail and Related Activities (AED6.98 billion).

Dividend Yield: 3.9%

Emaar Properties PJSC offers a dividend yield of 3.92%, which is lower than the top quartile in the AE market. Its dividends are well covered by earnings and cash flows, with payout ratios of 37.2% and 21.7%, respectively, suggesting sustainability despite a volatile dividend history over the past decade. The company trades at a favorable valuation with a P/E ratio of 9.5x, below the market average, though share price volatility remains high recently.

- Unlock comprehensive insights into our analysis of Emaar Properties PJSC stock in this dividend report.

- Upon reviewing our latest valuation report, Emaar Properties PJSC's share price might be too pessimistic.

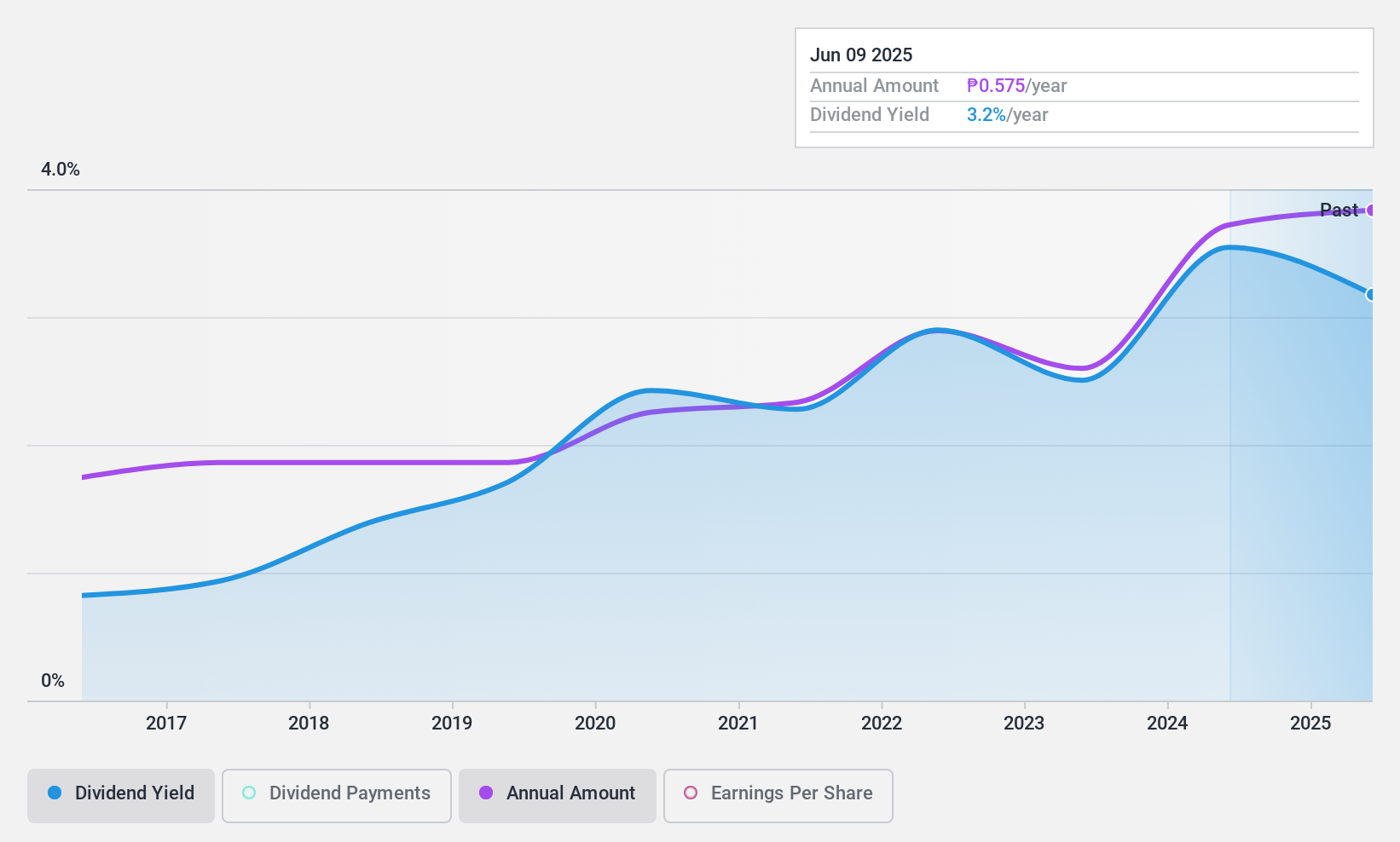

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation, with a market cap of ₱18.44 billion, operates in the Philippines through its subsidiaries to generate, distribute, and retail electric power.

Operations: Vivant Corporation's revenue segments include generating, distributing, and retailing electric power in the Philippines.

Dividend Yield: 3.1%

Vivant's dividends have been stable and reliable over the past decade, with a low payout ratio of 30%, indicating strong coverage by earnings. However, the dividend yield of 3.1% is below the top tier in the PH market and not supported by free cash flows. Recent earnings showed increased sales and revenue but a decline in net income for nine months, suggesting potential challenges for future dividend sustainability despite historical stability.

- Take a closer look at Vivant's potential here in our dividend report.

- Our valuation report here indicates Vivant may be overvalued.

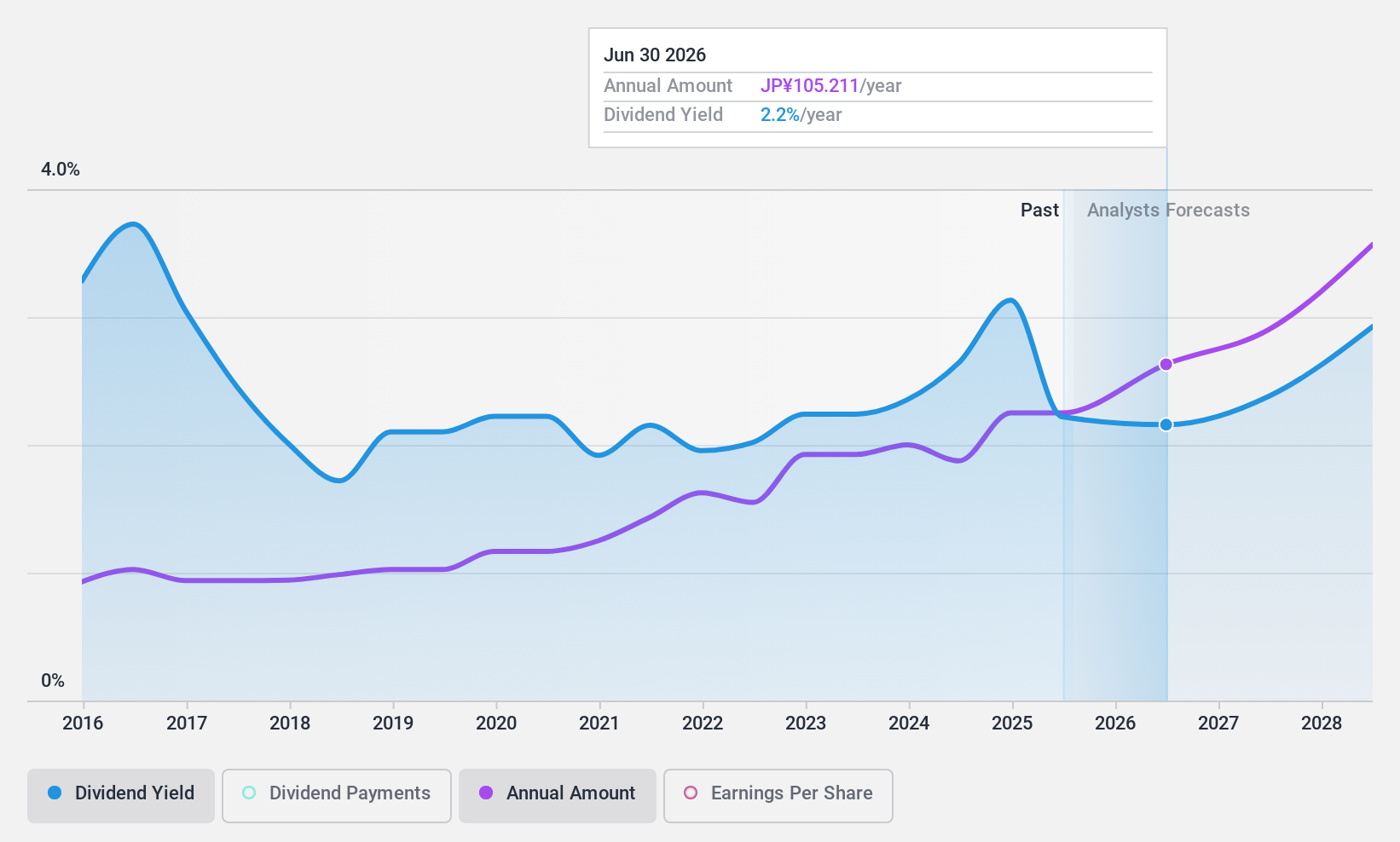

TechnoPro Holdings (TSE:6028)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company both in Japan and internationally, with a market cap of ¥303.30 billion.

Operations: TechnoPro Holdings generates revenue primarily from its R&D Outsourcing Business at ¥173.15 billion, followed by Construction Management Outsourcing at ¥23.86 billion, Overseas Businesses contributing ¥25.62 billion, and Domestic Other Business adding ¥4.85 billion.

Dividend Yield: 3.1%

TechnoPro Holdings' dividend yield of 3.09% is below the top tier in Japan, yet dividends are well-covered by earnings and cash flows with payout ratios of 55.1% and 38.6%, respectively. Despite a history of volatility over the past decade, dividends have grown overall during this period. The recent completion of a share buyback worth ¥4.99 billion might support future dividend payments, although historical instability remains a concern for long-term reliability.

- Dive into the specifics of TechnoPro Holdings here with our thorough dividend report.

- The analysis detailed in our TechnoPro Holdings valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2004 more companies for you to explore.Click here to unveil our expertly curated list of 2007 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives