- South Korea

- /

- Pharma

- /

- KOSDAQ:A237690

ST Pharm Co.,Ltd. (KOSDAQ:237690) Stock Rockets 54% As Investors Are Less Pessimistic Than Expected

The ST Pharm Co.,Ltd. (KOSDAQ:237690) share price has done very well over the last month, posting an excellent gain of 54%. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

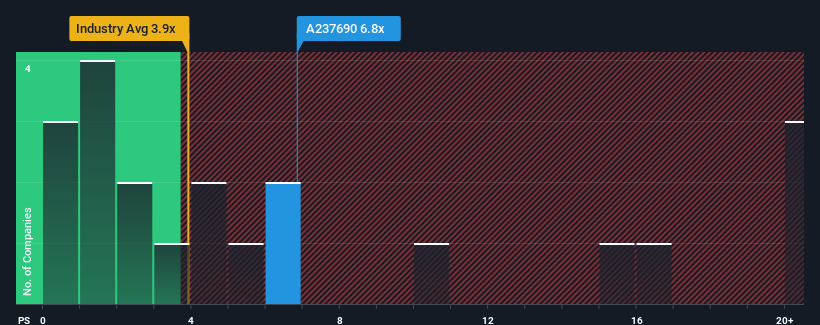

Since its price has surged higher, ST PharmLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 6.8x, since almost half of all companies in the Life Sciences industry in Korea have P/S ratios under 3.9x and even P/S lower than 1.6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for ST PharmLtd

What Does ST PharmLtd's Recent Performance Look Like?

ST PharmLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ST PharmLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ST PharmLtd?

The only time you'd be truly comfortable seeing a P/S as steep as ST PharmLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. The strong recent performance means it was also able to grow revenue by 129% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 20% per annum over the next three years. That's shaping up to be similar to the 19% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that ST PharmLtd's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

ST PharmLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given ST PharmLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ST PharmLtd you should know about.

If these risks are making you reconsider your opinion on ST PharmLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade ST PharmLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A237690

ST PharmLtd

Provides custom manufacturing services for active pharmaceutical ingredient and intermediates in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives