- South Korea

- /

- Pharma

- /

- KOSDAQ:A237690

Even though ST PharmLtd (KOSDAQ:237690) has lost ₩99b market cap in last 7 days, shareholders are still up 88% over 5 years

It hasn't been the best quarter for ST Pharm Co.,Ltd. (KOSDAQ:237690) shareholders, since the share price has fallen 19% in that time. Looking further back, the stock has generated good profits over five years. It has returned a market beating 84% in that time.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

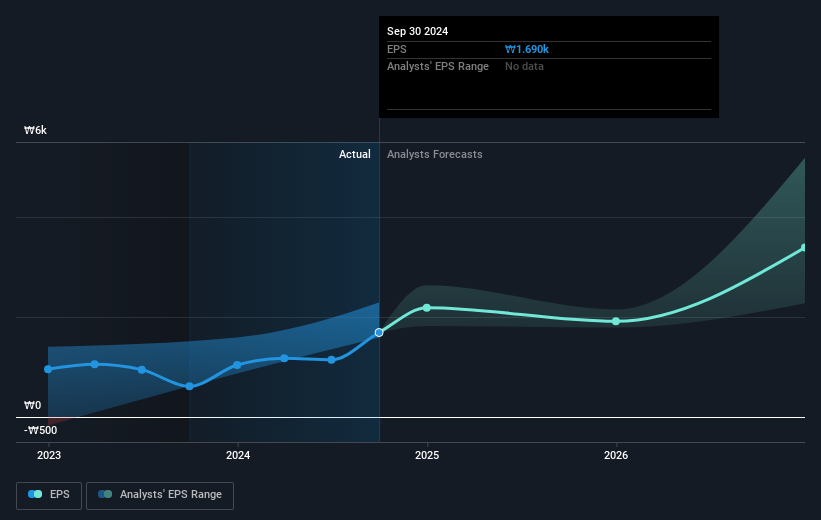

During the last half decade, ST PharmLtd became profitable. That's generally thought to be a genuine positive, so investors may expect to see an increasing share price. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the ST PharmLtd share price is down 26% in the last three years. In the same period, EPS is up 98% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -10% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that ST PharmLtd has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on ST PharmLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of ST PharmLtd, it has a TSR of 88% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 8.2% in the twelve months, ST PharmLtd shareholders did even worse, losing 20% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 13%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how ST PharmLtd scores on these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A237690

ST PharmLtd

Provides custom manufacturing services for active pharmaceutical ingredient and intermediates in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives