- South Korea

- /

- Biotech

- /

- KOSDAQ:A226950

Introducing OliX PharmaceuticalsInc (KOSDAQ:226950), The Stock That Zoomed 150% In The Last Year

It's been a soft week for OliX Pharmaceuticals,Inc (KOSDAQ:226950) shares, which are down 14%. Despite this, the stock is a strong performer over the last year, no doubt about that. Like an eagle, the share price soared 150% in that time. So some might not be surprised to see the price retrace some. More important, going forward, is how the business itself is going.

Check out our latest analysis for OliX PharmaceuticalsInc

We don't think OliX PharmaceuticalsInc's revenue of ₩1,519,162,150 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that OliX PharmaceuticalsInc comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some OliX PharmaceuticalsInc investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

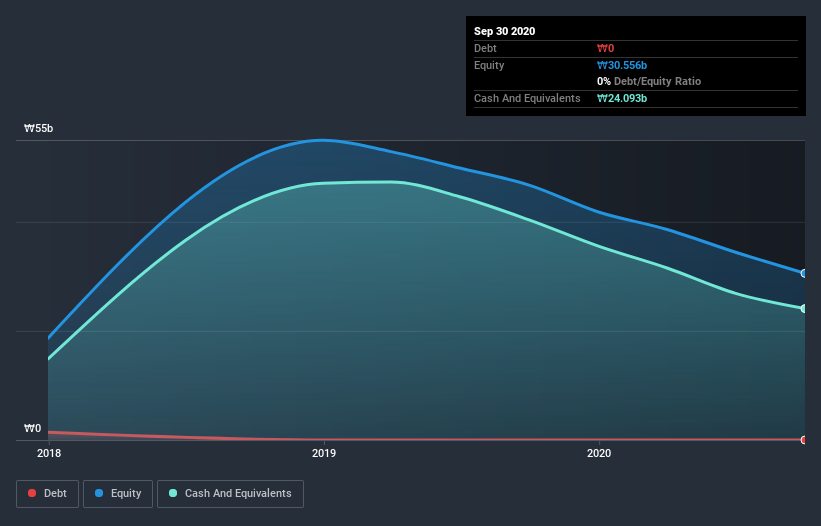

OliX PharmaceuticalsInc had cash in excess of all liabilities of when it last reported. That's not too bad but management decided to raise capital in any case to shore up the balance sheet since the company is not yet breaking even. With the share price up 84% in the last year , the market seems hopeful about the potential with a replenished balance sheet. The image below shows how OliX PharmaceuticalsInc's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

It's nice to see that OliX PharmaceuticalsInc shareholders have gained 150% over the last year. That's better than the more recent three month gain of 22%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for OliX PharmaceuticalsInc that you should be aware of.

We will like OliX PharmaceuticalsInc better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade OliX PharmaceuticalsInc, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A226950

OliX Pharmaceuticals

A clinical stage pharmaceutical company, focuses on developing RNA interference (RNAi) therapeutics for dermal, ophthalmic, and pulmonary diseases.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives