- South Korea

- /

- Biotech

- /

- KOSDAQ:A226950

Market Cool On OliX Pharmaceuticals, Inc's (KOSDAQ:226950) Revenues Pushing Shares 27% Lower

OliX Pharmaceuticals, Inc (KOSDAQ:226950) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

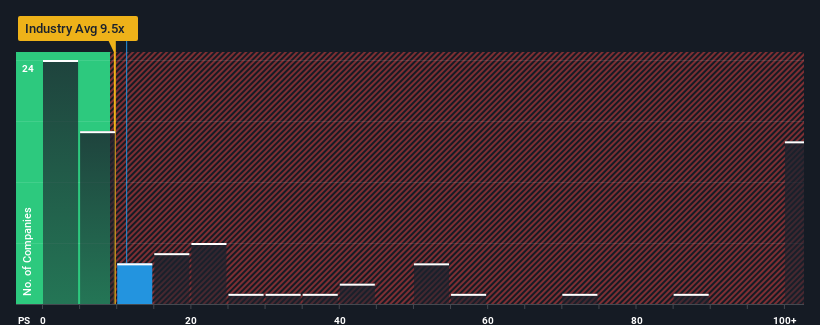

Even after such a large drop in price, you could still be forgiven for feeling indifferent about OliX Pharmaceuticals' P/S ratio of 11.2x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Korea is also close to 9.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for OliX Pharmaceuticals

How Has OliX Pharmaceuticals Performed Recently?

OliX Pharmaceuticals certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on OliX Pharmaceuticals' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For OliX Pharmaceuticals?

The only time you'd be comfortable seeing a P/S like OliX Pharmaceuticals' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 85% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 28% shows it's noticeably more attractive.

With this information, we find it interesting that OliX Pharmaceuticals is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From OliX Pharmaceuticals' P/S?

Following OliX Pharmaceuticals' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that OliX Pharmaceuticals currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for OliX Pharmaceuticals you should be aware of, and 3 of them are a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A226950

OliX Pharmaceuticals

A clinical stage pharmaceutical company, focuses on developing RNA interference (RNAi) therapeutics for dermal, ophthalmic, and pulmonary diseases.

Moderate with weak fundamentals.

Market Insights

Community Narratives