- South Korea

- /

- Biotech

- /

- KOSDAQ:A217330

Cytogen (KOSDAQ:217330 investor three-year losses grow to 72% as the stock sheds ₩14b this past week

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Cytogen, Inc. (KOSDAQ:217330), who have seen the share price tank a massive 72% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 59%, so we doubt many shareholders are delighted. Unfortunately the share price momentum is still quite negative, with prices down 28% in thirty days.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Cytogen

Cytogen isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Cytogen grew revenue at 89% per year. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

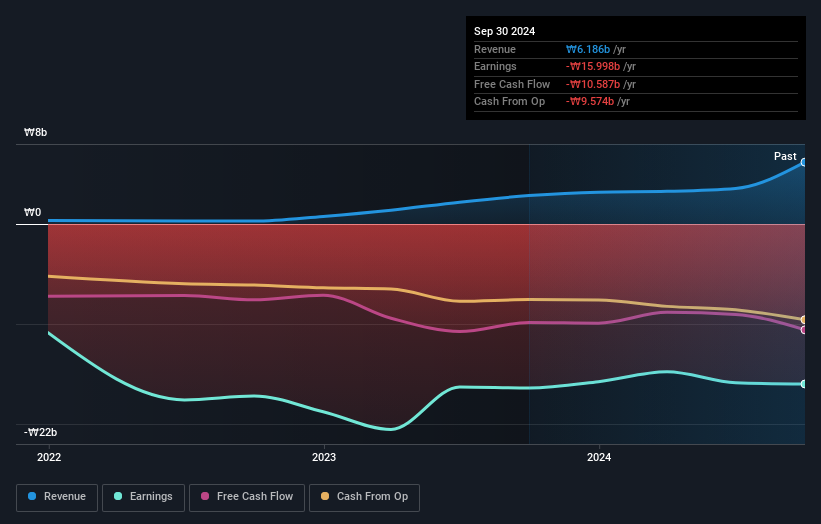

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Cytogen stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Cytogen shareholders are down 59% for the year. Unfortunately, that's worse than the broader market decline of 8.7%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Cytogen (of which 1 shouldn't be ignored!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A217330

Cytogen

A biotechnology company, engages in blood cancer cell-based Liquid Biopsy application business in South Korea.

Excellent balance sheet low.

Market Insights

Community Narratives