- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets have been buoyed by expectations of government stimulus and positive economic indicators, with key indices like the Hang Seng Index reflecting this optimism. In this environment, identifying high-growth tech stocks in Asia involves looking for companies that are well-positioned to leverage these favorable conditions through innovation and strategic market positioning.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.31% | 28.32% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 30.19% | 28.84% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

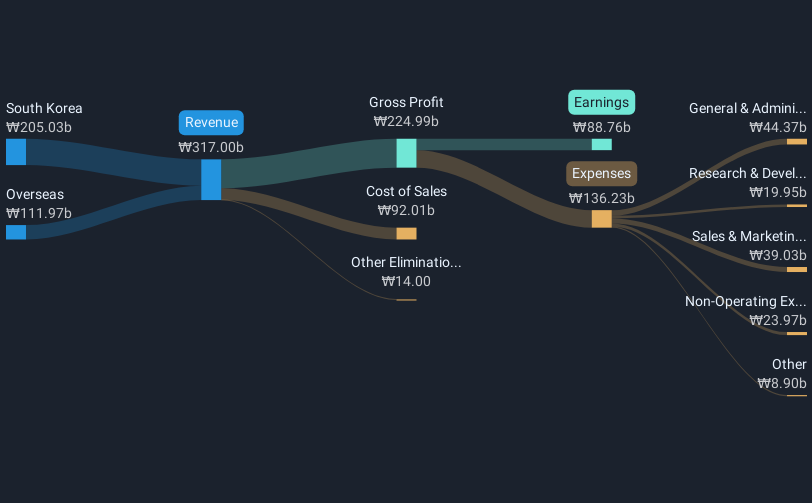

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market capitalization of ₩4.05 trillion.

Operations: PharmaResearch generates revenue primarily from its pharmaceuticals segment, amounting to ₩350.12 billion.

PharmaResearch stands out in the Asian biotech landscape with a robust track record and bright prospects. Despite earnings growth of 20.2% last year trailing the industry's 33.1%, the company is poised for significant expansion, with projected annual earnings increases of 25% over the next three years, surpassing Korea's market growth rate of 21.5%. Additionally, its revenue is expected to rise by 19.7% annually, outpacing the local market's 7.8%. This financial vitality is underpinned by high-quality earnings and a positive free cash flow status, indicating efficient operations and profitability sustainability. With an anticipated Return on Equity of 23%, PharmaResearch not only demonstrates financial health but also strategic agility in navigating market dynamics and investing in future growth areas.

- Take a closer look at PharmaResearch's potential here in our health report.

Gain insights into PharmaResearch's past trends and performance with our Past report.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

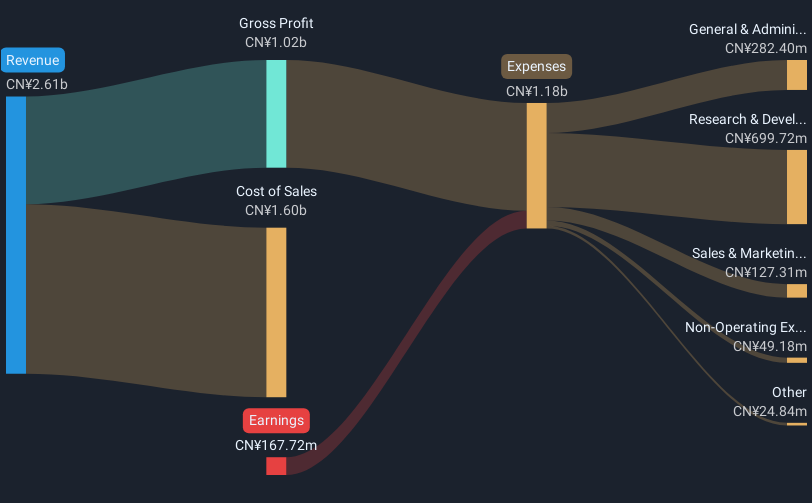

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology in Asia and has a market cap of CN¥33.78 billion.

Operations: The company generates revenue primarily from the manufacturing of other electronic equipment, which contributes CN¥2.62 billion. It also earns from technical services and leasing industries, with revenues of CN¥42.78 million and CN¥7.63 million respectively.

Wuhan Guide Infrared, a key player in Asia's high-tech sector, has demonstrated significant financial dynamics with its revenue surging by 27.6% annually, outpacing the Chinese market growth of 12.6%. This growth is underscored by a remarkable increase in net income from CNY 8.38 million to CNY 83.55 million in the latest quarter. Despite facing challenges that led to a net loss last year, the company's aggressive R&D spending—evident from its substantial year-over-year sales increase—positions it for potential future profitability and innovation-driven market leadership.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

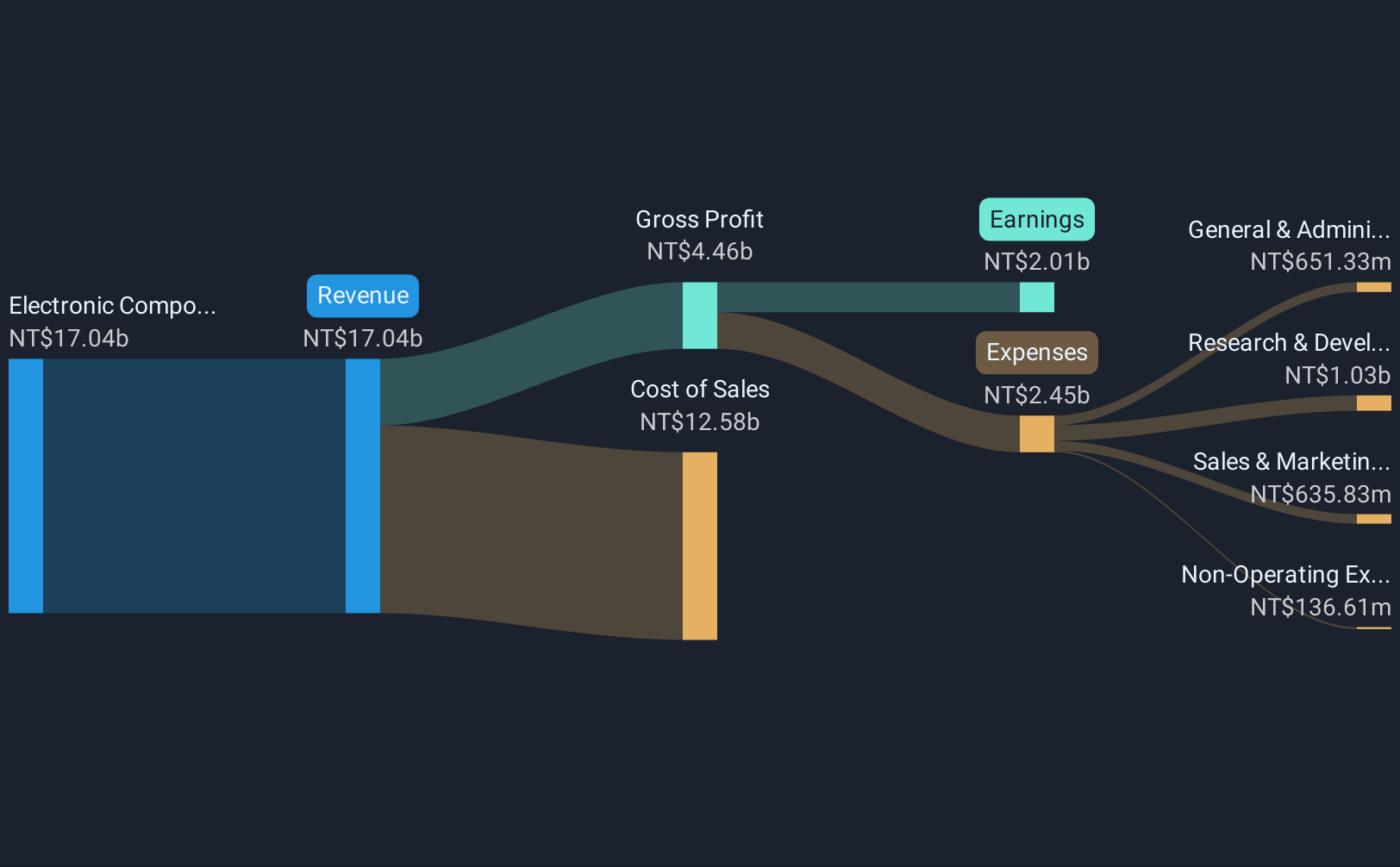

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across several countries including China, Taiwan, Ireland, Singapore, and the United States with a market capitalization of NT$46.03 billion.

Operations: Auras Technology focuses on producing electronic components and parts, generating revenue of NT$15.78 billion. The company operates in various international markets, leveraging its expertise in manufacturing and retailing computer cooling modules.

Auras Technology, amid a bustling schedule of industry forums and earnings announcements, has showcased robust growth metrics that underscore its ascent in Asia's tech landscape. With annual revenue growth reported at 21.4% and earnings amplifying by 28.5%, the firm is outpacing many regional counterparts. Notably, its R&D investment surged to TWD 2.3 billion last year, aligning with a strategic push into advanced tech sectors which could further catalyze its market position. These financial and operational strides, coupled with high-profile conference presentations across major Asian cities, reflect Auras's proactive engagement with global investors and stakeholders—potentially setting the stage for sustained growth trajectories in innovative technology domains.

- Unlock comprehensive insights into our analysis of Auras Technology stock in this health report.

Understand Auras Technology's track record by examining our Past report.

Turning Ideas Into Actions

- Click here to access our complete index of 486 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives