- Taiwan

- /

- Tech Hardware

- /

- TPEX:3324

Asian Stocks Trading Below Estimated Value In April 2025

Reviewed by Simply Wall St

As of April 2025, Asian markets are navigating a landscape marked by easing trade tensions and cautious optimism, with China and Japan showing resilience amid global economic uncertainties. In this context, identifying undervalued stocks becomes crucial for investors seeking opportunities in Asia's diverse markets, where potential value can be unlocked through careful analysis of fundamentals and market positioning.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥74.29 | CN¥144.77 | 48.7% |

| BYD Electronic (International) (SEHK:285) | HK$31.80 | HK$63.03 | 49.5% |

| Alexander Marine (TWSE:8478) | NT$142.50 | NT$280.32 | 49.2% |

| Zhende Medical (SHSE:603301) | CN¥19.33 | CN¥37.64 | 48.6% |

| Members (TSE:2130) | ¥1137.00 | ¥2211.77 | 48.6% |

| Rakus (TSE:3923) | ¥2194.50 | ¥4296.95 | 48.9% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.51 | CN¥20.78 | 49.4% |

| BalnibarbiLtd (TSE:3418) | ¥1152.00 | ¥2223.40 | 48.2% |

| Swire Properties (SEHK:1972) | HK$16.82 | HK$32.75 | 48.6% |

| Yuhan (KOSE:A000100) | ₩113000.00 | ₩219128.89 | 48.4% |

Here we highlight a subset of our preferred stocks from the screener.

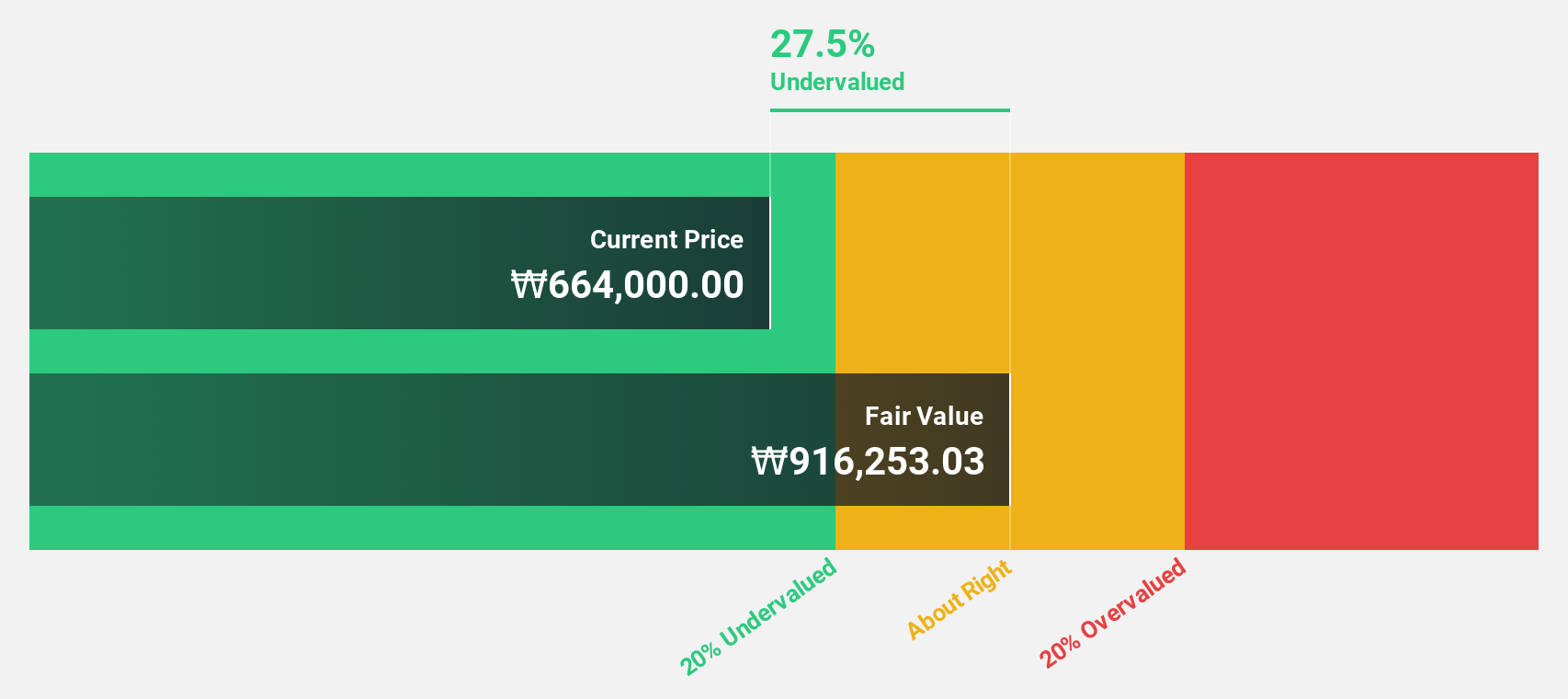

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea, with a market capitalization of approximately ₩3.91 trillion.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to approximately ₩350.12 billion.

Estimated Discount To Fair Value: 24.5%

PharmaResearch is trading at ₩376,000, below its estimated fair value of ₩497,834.15, indicating it may be undervalued based on cash flows. The company forecasts revenue growth of 19.7% annually, surpassing the Korean market's 7.8%. Earnings are expected to grow significantly at 25% per year over the next three years. Recent dividend increases and a strong return on equity forecast further enhance its investment appeal amidst robust financial performance indicators.

- Our growth report here indicates PharmaResearch may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of PharmaResearch stock in this financial health report.

Auras Technology (TPEX:3324)

Overview: Auras Technology Co., Ltd. manufactures, processes, and retails electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and internationally with a market cap of NT$45.67 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated NT$15.78 billion.

Estimated Discount To Fair Value: 44.1%

Auras Technology, trading at NT$506, is significantly undervalued with an estimated fair value of NT$904.98. It reported a notable earnings growth of 53.6% last year and forecasts revenue to grow at 21.4% annually, outpacing the Taiwan market's 9.5%. Earnings are expected to rise by 28.5% per year over the next three years, despite recent share price volatility, highlighting its potential as an undervalued stock based on cash flows in Asia.

- Our expertly prepared growth report on Auras Technology implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Auras Technology's balance sheet by reading our health report here.

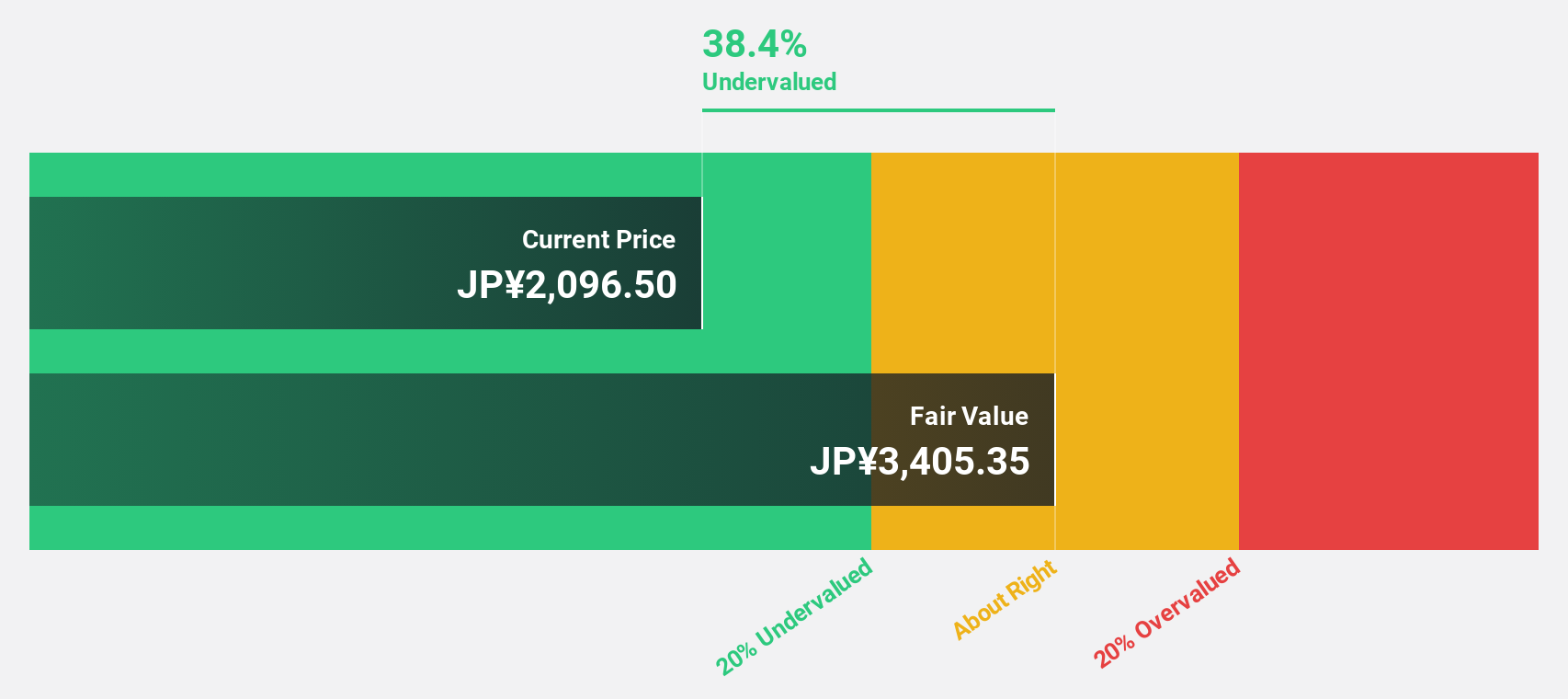

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market capitalization of ¥272.33 billion.

Operations: Aozora Bank, Ltd. generates revenue through its diverse banking products and services offered domestically and internationally.

Estimated Discount To Fair Value: 46.6%

Aozora Bank is trading at ¥1,968, significantly below its estimated fair value of ¥3,685.05, highlighting its status as undervalued based on cash flows. The bank reported a turnaround with a net income of ¥16.23 billion for the nine months ending December 2024 compared to a loss previously. However, it faces challenges with high bad loans (2.1%) and past shareholder dilution but anticipates profitability growth above market averages over the next three years.

- Insights from our recent growth report point to a promising forecast for Aozora Bank's business outlook.

- Take a closer look at Aozora Bank's balance sheet health here in our report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 263 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3324

Auras Technology

Engages in the manufacturing, processing, and retailing of electronic materials and computer cooling modules in China, Taiwan, Ireland, Singapore, the United States, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives