- China

- /

- Personal Products

- /

- SHSE:603983

Asian Equity Opportunities With Estimated Value Discrepancies

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and economic uncertainties, Asian equities present intriguing opportunities for investors seeking value amidst the volatility. In this environment, identifying undervalued stocks requires a keen focus on companies with strong fundamentals that remain resilient despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.16 | CN¥30.21 | 49.8% |

| Power Wind Health Industry (TWSE:8462) | NT$112.00 | NT$223.88 | 50% |

| Aoshikang Technology (SZSE:002913) | CN¥29.20 | CN¥58.34 | 50% |

| Samyang Foods (KOSE:A003230) | ₩884000.00 | ₩1721951.23 | 48.7% |

| Food & Life Companies (TSE:3563) | ¥4052.00 | ¥8096.60 | 50% |

| LITALICO (TSE:7366) | ¥1090.00 | ¥2149.14 | 49.3% |

| Sung Kwang BendLtd (KOSDAQ:A014620) | ₩28200.00 | ₩55950.78 | 49.6% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥12.72 | CN¥24.90 | 48.9% |

| BalnibarbiLtd (TSE:3418) | ¥1069.00 | ¥2085.86 | 48.8% |

| Shenzhen Dynanonic (SZSE:300769) | CN¥39.04 | CN¥77.10 | 49.4% |

We'll examine a selection from our screener results.

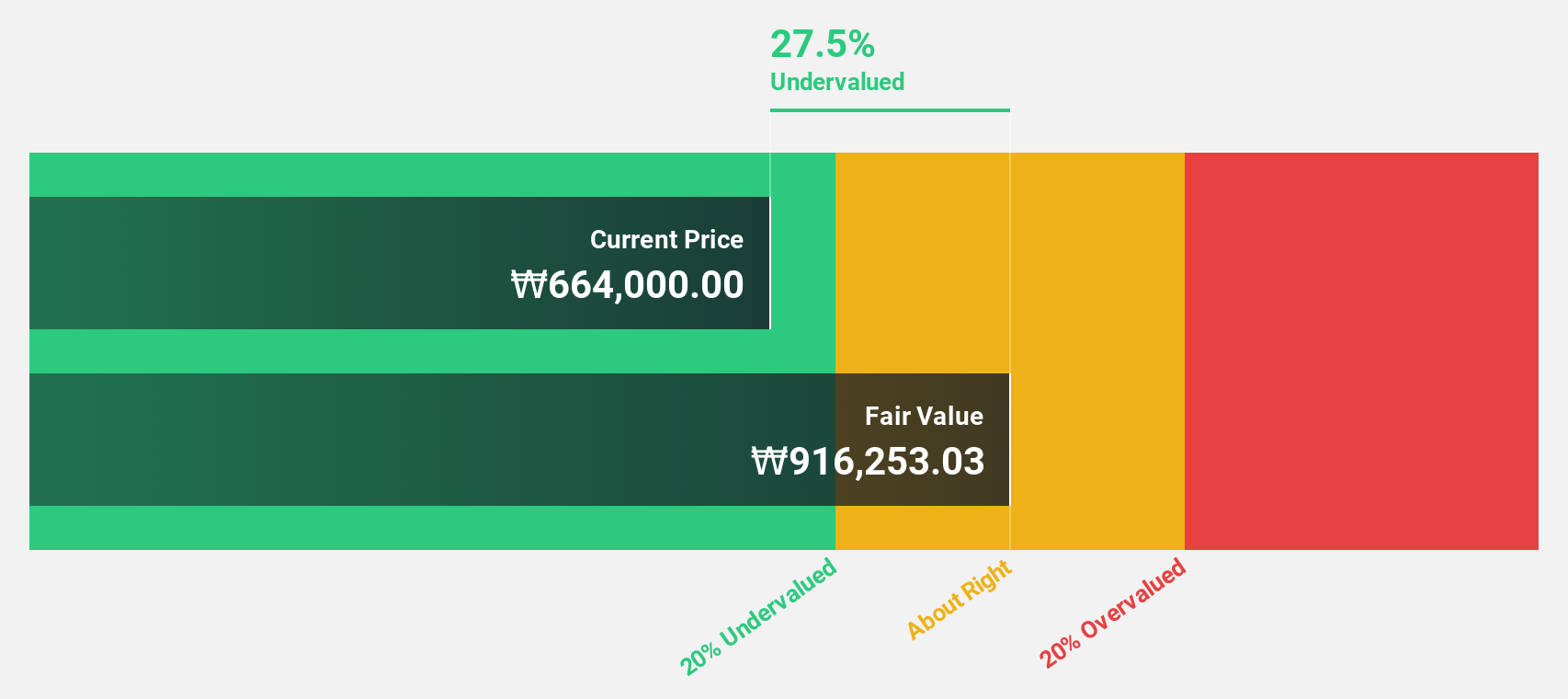

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating mainly in South Korea, with a market capitalization of approximately ₩3.13 trillion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated ₩317.00 billion.

Estimated Discount To Fair Value: 11.9%

PharmaResearch is trading at ₩301,000, which is 11.9% below its estimated fair value of ₩341,596.13. The stock's earnings and revenue are forecast to grow significantly over the next three years, with earnings expected to increase by 26.4% annually and revenue by 23.4%, both outpacing the Korean market averages. Despite being undervalued based on discounted cash flow analysis, the margin isn't significant but suggests potential for growth driven by strong future performance forecasts.

- The analysis detailed in our PharmaResearch growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in PharmaResearch's balance sheet health report.

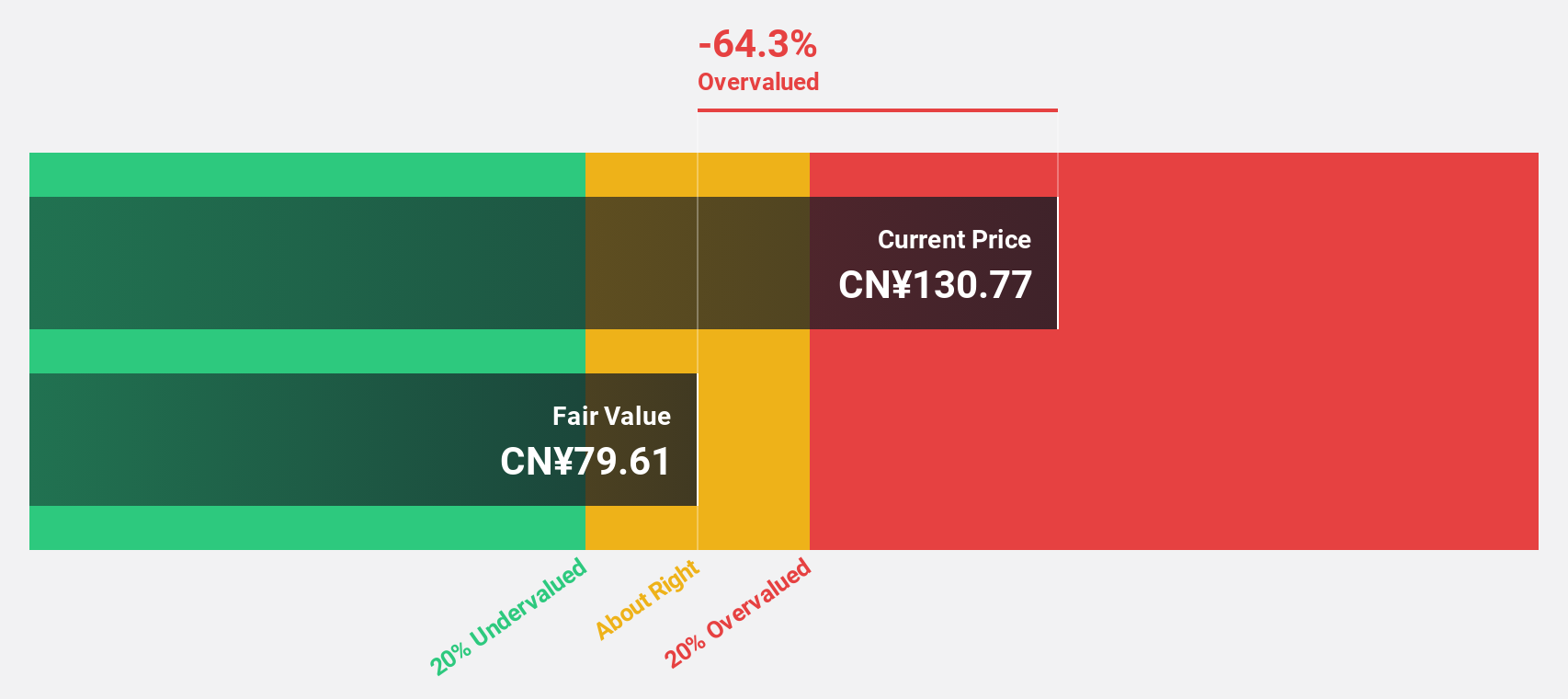

Seres GroupLtd (SHSE:601127)

Overview: Seres Group Co., Ltd. is involved in the research, development, manufacturing, sales, and supply of automobiles and auto parts in China with a market capitalization of CN¥191.07 billion.

Operations: The company's revenue from the automobile industry is CN¥125.79 billion.

Estimated Discount To Fair Value: 19.8%

Seres Group Ltd., trading at CN¥126.88, is undervalued by 19.8% against its fair value estimate of CN¥158.23 based on discounted cash flow analysis. The company's earnings are projected to grow significantly at 32.78% annually over the next three years, surpassing the Chinese market average of 25.5%. Recent inclusion in the Shanghai Stock Exchange indices enhances its visibility, although revenue growth is forecasted to be moderate at 16.7% per year.

- Our comprehensive growth report raises the possibility that Seres GroupLtd is poised for substantial financial growth.

- Navigate through the intricacies of Seres GroupLtd with our comprehensive financial health report here.

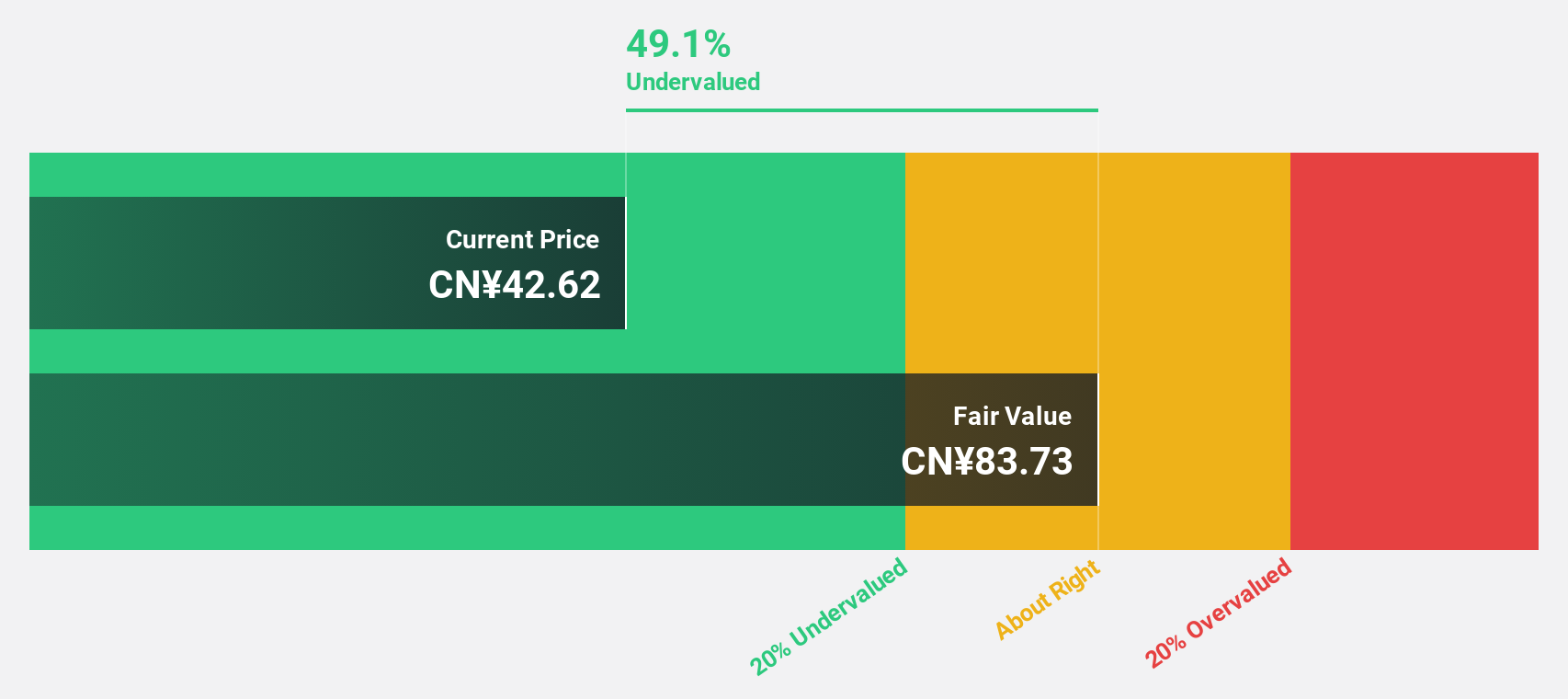

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. is involved in the research, development, design, production, sale, and service of various cosmetics in China with a market cap of CN¥13.21 billion.

Operations: The company generates its revenue primarily from the Personal Products segment, totaling CN¥2.64 billion.

Estimated Discount To Fair Value: 16%

Guangdong Marubi Biotechnology, trading at CN¥32.95, is undervalued by 16% relative to its fair value estimate of CN¥39.21 based on discounted cash flow analysis. While earnings grew by 42.3% last year and are forecasted to grow significantly at 25.11% annually, this lags behind the broader Chinese market's growth rate of 25.5%. Despite large one-off items impacting results, revenue is expected to grow robustly at 22% per year.

- Insights from our recent growth report point to a promising forecast for Guangdong Marubi Biotechnology's business outlook.

- Click here to discover the nuances of Guangdong Marubi Biotechnology with our detailed financial health report.

Where To Now?

- Click this link to deep-dive into the 284 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603983

Guangdong Marubi Biotechnology

Engages in the research and development, design, production, sale, and service of various cosmetics in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives