- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A067310

3 Growth Stocks With High Insider Ownership And 32% Revenue Growth

Reviewed by Simply Wall St

In the midst of a choppy start to the year for global markets, characterized by inflation concerns and political uncertainties, investors are carefully navigating through fluctuating indices. As small-cap stocks underperform and growth stocks face challenges, identifying companies with strong fundamentals becomes crucial. One key aspect to consider is high insider ownership, which often indicates confidence from those closest to the company. In this context, exploring growth companies with significant insider stakes and impressive revenue growth can offer valuable insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 80.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. offers semiconductor back-end process packaging solutions in South Korea, with a market cap of approximately ₩691 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Manufacturing segment, which generated ₩1.58 billion, followed by the Semiconductor Material segment at ₩227.92 million.

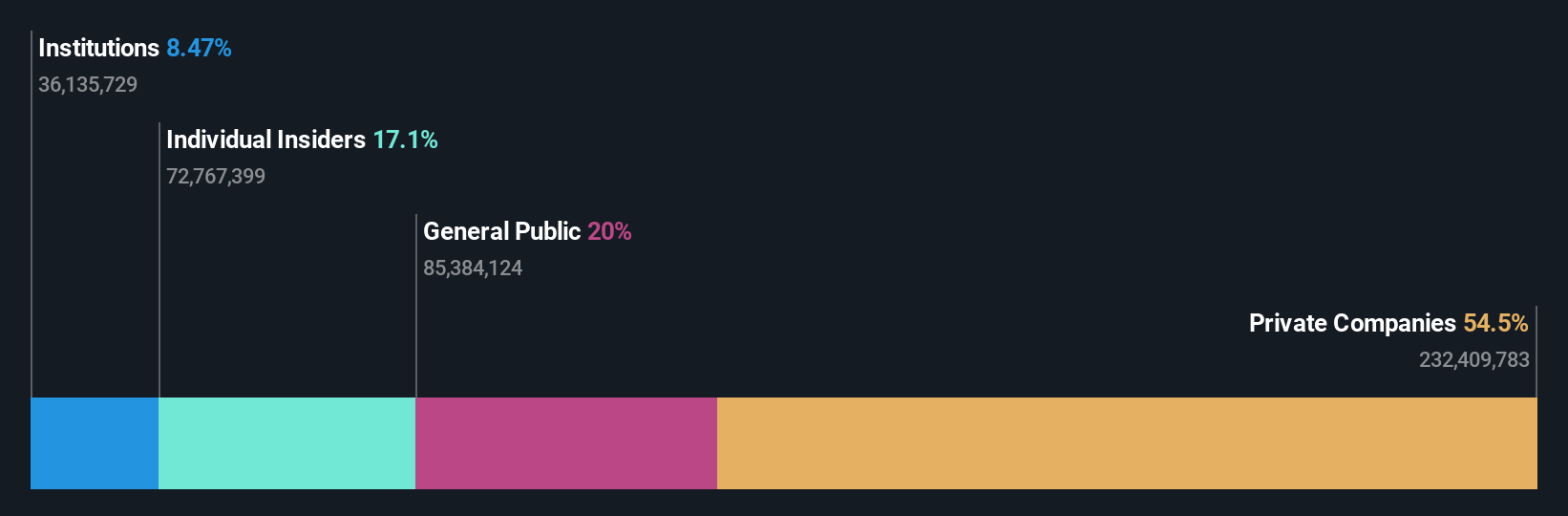

Insider Ownership: 18.3%

Revenue Growth Forecast: 22.9% p.a.

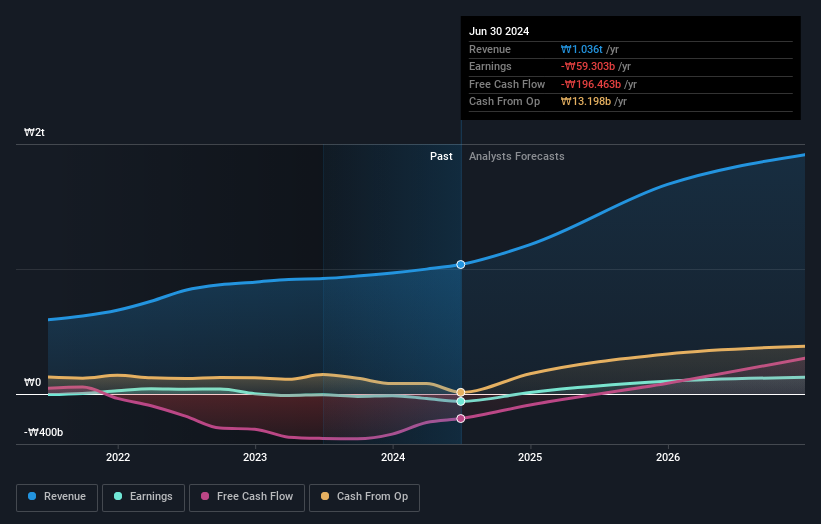

HANA Micron is poised for significant growth, with revenue expected to increase by 22.9% annually, outpacing the KR market's 9.2% growth rate. The company is trading at a substantial discount to its estimated fair value and shows good relative value compared to peers. Despite recent shareholder dilution and a net loss reported for the third quarter of 2024, HANA Micron's earnings are forecasted to grow substantially at 110.89% per year, becoming profitable within three years.

- Unlock comprehensive insights into our analysis of HANA Micron stock in this growth report.

- In light of our recent valuation report, it seems possible that HANA Micron is trading behind its estimated value.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating mainly in South Korea, with a market cap of ₩2.60 trillion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which amounts to ₩317.00 billion.

Insider Ownership: 38.6%

Revenue Growth Forecast: 24.2% p.a.

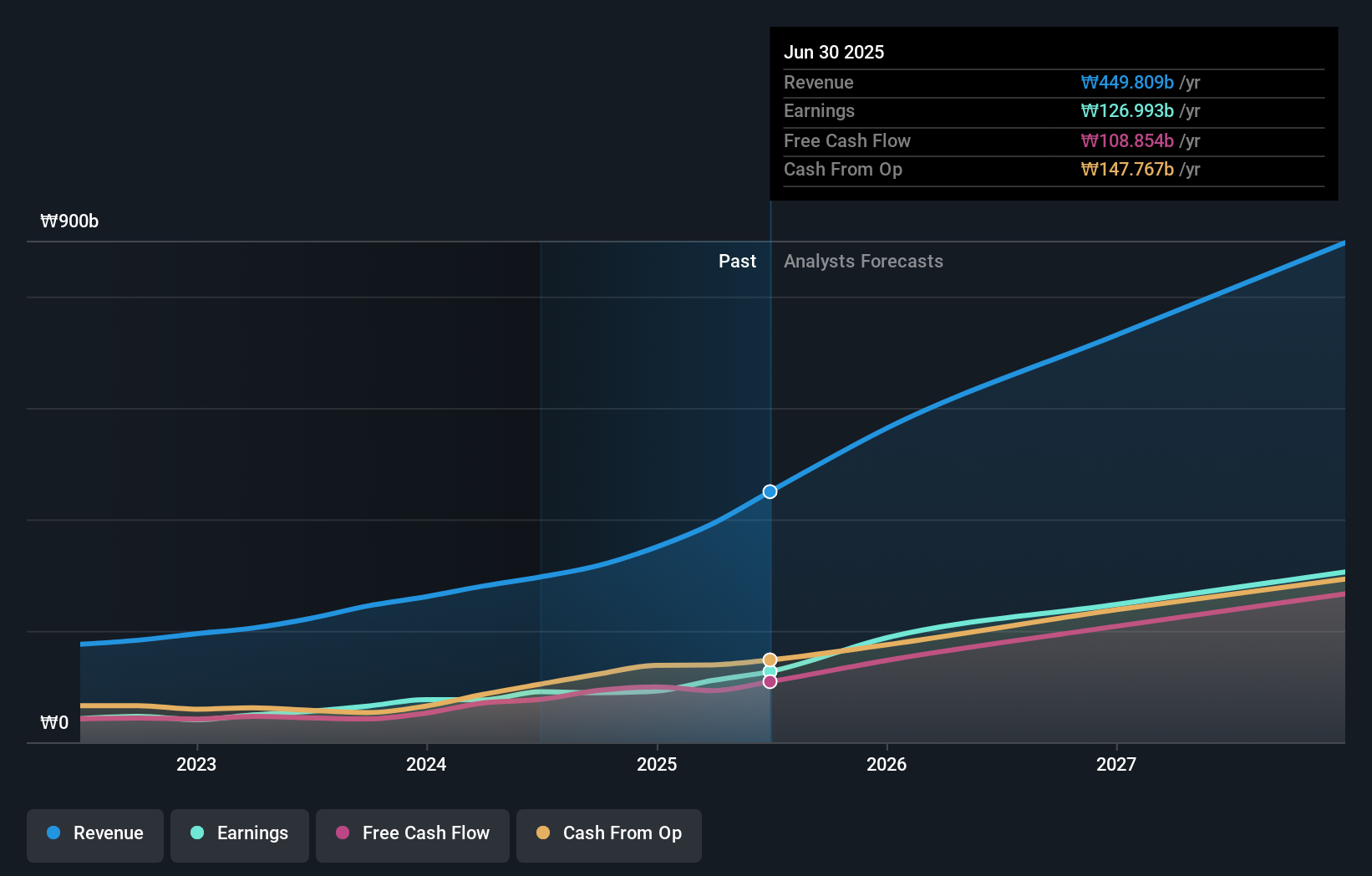

PharmaResearch is positioned for strong growth, with earnings projected to rise by 27.95% annually over the next three years, though slightly trailing the KR market's 28.8%. The company's revenue growth forecast of 24.2% per year surpasses the market's 9.2%, highlighting its competitive edge. Currently, it trades at a significant discount to estimated fair value, enhancing its appeal despite no recent insider trading activity reported in the past three months.

- Dive into the specifics of PharmaResearch here with our thorough growth forecast report.

- According our valuation report, there's an indication that PharmaResearch's share price might be on the cheaper side.

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanchip (Tianjin) Technology Co., Ltd. designs, manufactures, and sells radio frequency front end and high end analog chips in China, with a market cap of CN¥13.46 billion.

Operations: The company generates revenue of CN¥2.86 billion from its electronic components and parts segment.

Insider Ownership: 16.9%

Revenue Growth Forecast: 32.1% p.a.

Vanchip (Tianjin) Technology is poised for substantial growth, with earnings expected to rise significantly by 86.2% annually over the next three years, outpacing the CN market's 25.3%. Revenue is also forecast to grow rapidly at 32.1% per year, despite recent financial challenges including a CNY 32.12 million net loss for the first nine months of 2024. The company's high insider ownership aligns with its aggressive growth trajectory, though share price volatility remains a concern.

- Click here and access our complete growth analysis report to understand the dynamics of Vanchip (Tianjin) Technology.

- Our valuation report unveils the possibility Vanchip (Tianjin) Technology's shares may be trading at a premium.

Turning Ideas Into Actions

- Click here to access our complete index of 1458 Fast Growing Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HANA Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A067310

HANA Micron

Provides semiconductor back-end process packaging solutions in South Korea.

Exceptional growth potential and undervalued.