- China

- /

- Life Sciences

- /

- SHSE:688114

3 Global Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are carefully evaluating their portfolios amidst heightened geopolitical and economic uncertainty. With major indices showing mixed performance, the search for stocks trading below fair value becomes particularly compelling as investors look to identify opportunities that may offer resilience or potential growth in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.18 | €2.32 | 49.2% |

| Profoto Holding (OM:PRFO) | SEK17.85 | SEK35.19 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.29 | 49.5% |

| Kitron (OB:KIT) | NOK58.65 | NOK119.08 | 50.7% |

| High Quality Food (BIT:HQF) | €0.604 | €1.21 | 49.9% |

| Everest Medicines (SEHK:1952) | HK$53.20 | HK$105.04 | 49.4% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥66.70 | CN¥132.90 | 49.8% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.85 | ₱7.66 | 49.8% |

| Atea (OB:ATEA) | NOK143.80 | NOK282.84 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN33.20 | PLN66.10 | 49.8% |

Here's a peek at a few of the choices from the screener.

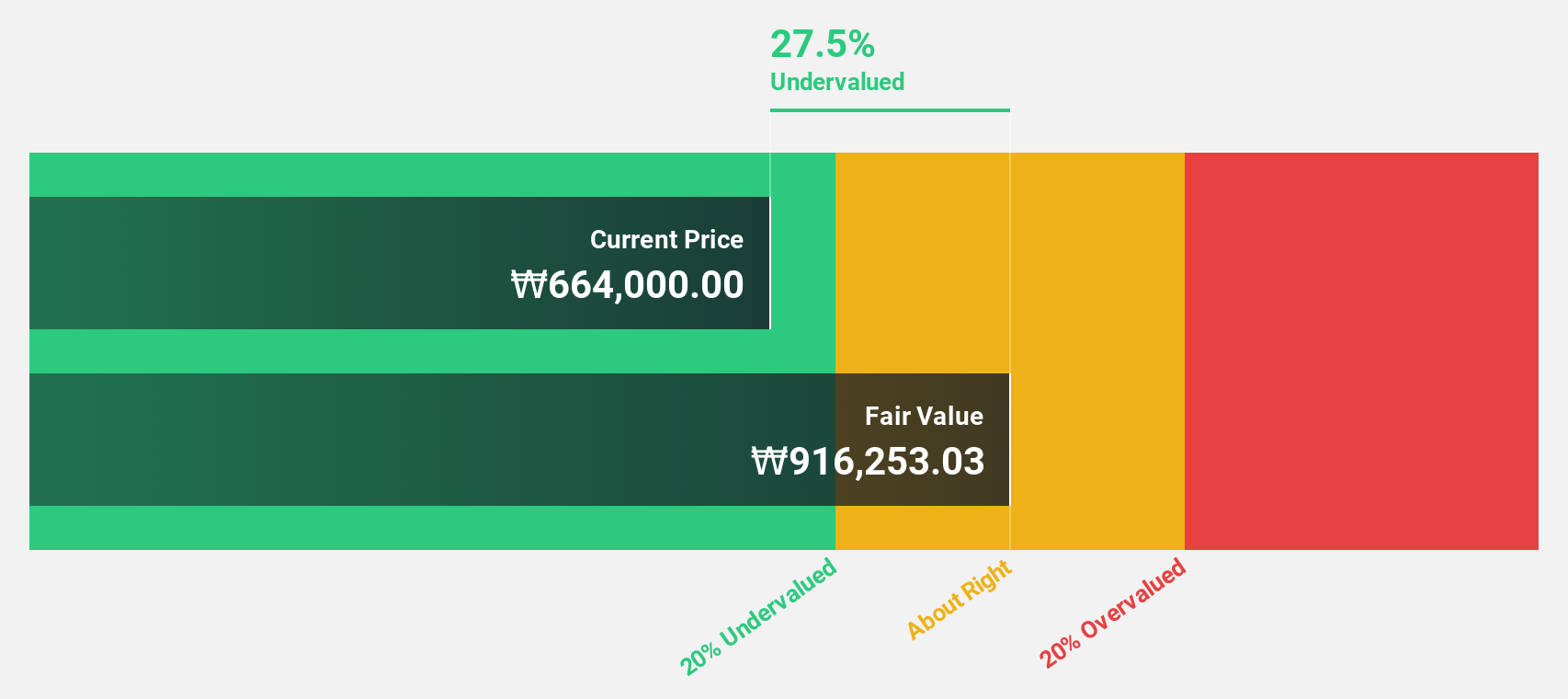

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of approximately ₩5.63 trillion.

Operations: The company's revenue is primarily generated from its Pharmaceuticals segment, which accounts for approximately ₩449.81 billion.

Estimated Discount To Fair Value: 37.4%

PharmaResearch is trading 37.4% below its estimated fair value, with a forecasted revenue growth of 26.6% annually, surpassing the KR market's growth rate. Earnings are expected to grow significantly at 31.8% per year, outpacing the market average. Recent strategic partnership with VIVACY for Rejuran distribution in Europe, valued at EUR 54.5 million over five years, enhances its international presence and could positively impact cash flows and valuation perceptions.

- Upon reviewing our latest growth report, PharmaResearch's projected financial performance appears quite optimistic.

- Get an in-depth perspective on PharmaResearch's balance sheet by reading our health report here.

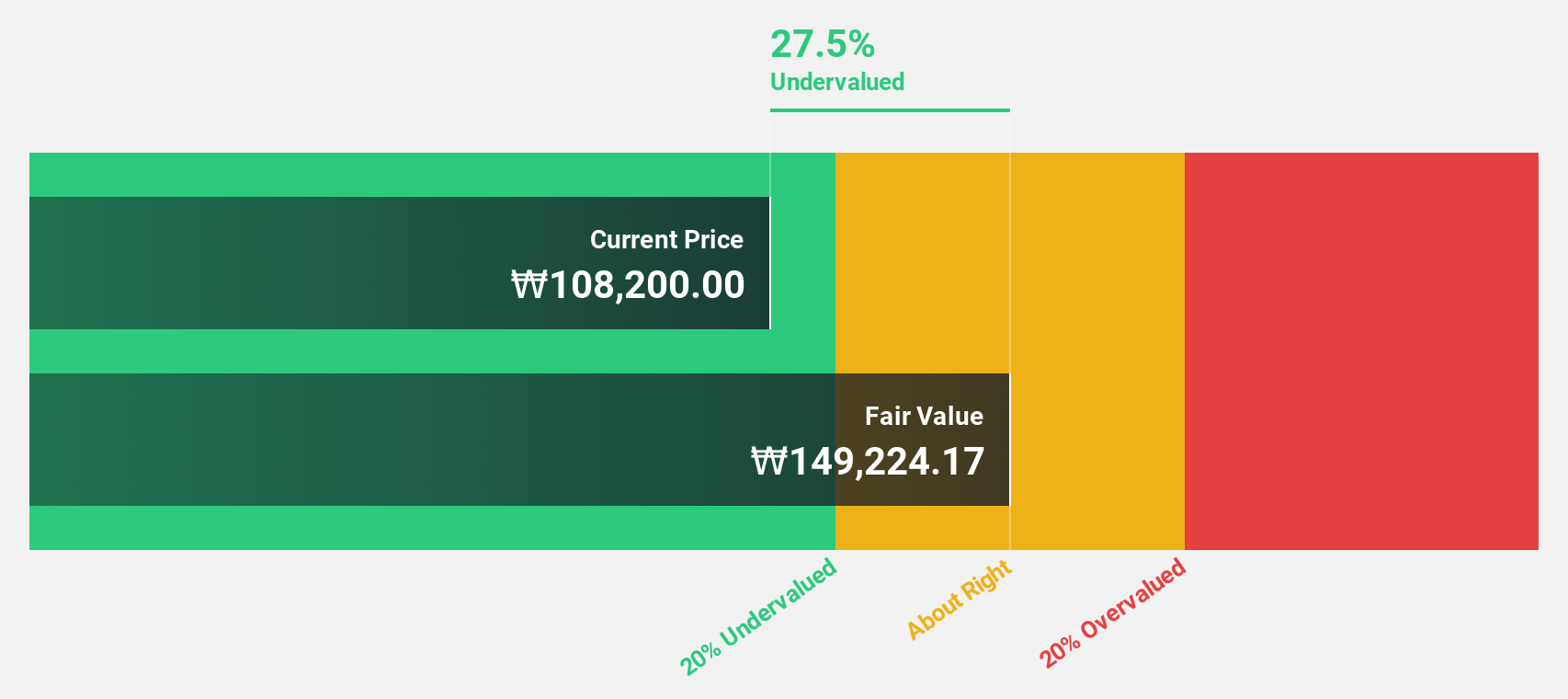

ST PharmLtd (KOSDAQ:A237690)

Overview: ST Pharm Co., Ltd. offers custom manufacturing services for active pharmaceutical ingredients and intermediates both in South Korea and internationally, with a market cap of ₩1.87 trillion.

Operations: The company's revenue is primarily derived from raw material manufacturing, contributing ₩270.88 billion, and clinical trial contract research, which adds ₩31.30 billion.

Estimated Discount To Fair Value: 12.3%

ST Pharm Ltd. is trading at ₩94,300, below its estimated fair value of ₩107,574.91, presenting a modest undervaluation based on discounted cash flow analysis. Earnings are forecasted to grow significantly at 33.16% annually, surpassing the KR market's growth rate of 24.4%. Despite this growth potential and recent presentations at the KIS Global Investors Conference 2025, its return on equity is expected to remain low at 11.6% in three years.

- According our earnings growth report, there's an indication that ST PharmLtd might be ready to expand.

- Take a closer look at ST PharmLtd's balance sheet health here in our report.

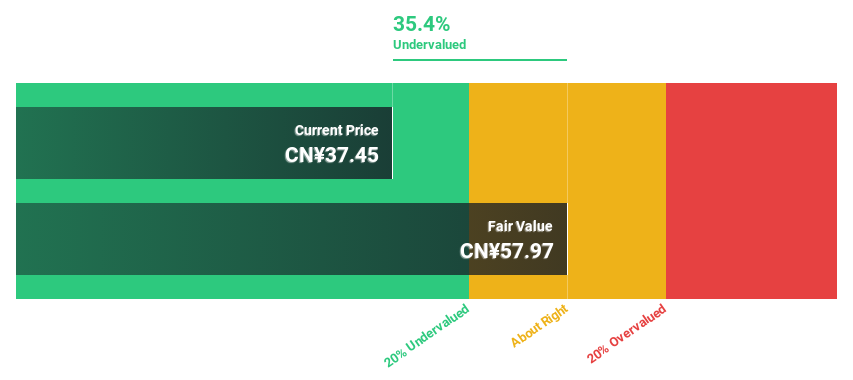

MGI Tech (SHSE:688114)

Overview: MGI Tech Co., Ltd. focuses on the research, development, production, and sale of DNA sequencing instruments and related products for various industries globally, with a market cap of CN¥28.43 billion.

Operations: MGI Tech Co., Ltd. generates revenue through the sale of DNA sequencing instruments, reagents, and related products catering to precision medicine, agriculture, healthcare, and other industries both in China and internationally.

Estimated Discount To Fair Value: 14.7%

MGI Tech Co., Ltd. is trading at CN¥72.35, below its estimated fair value of CN¥84.87, indicating a modest undervaluation based on discounted cash flow analysis. The company reported a net loss reduction from CNY 298.23 million to CNY 103.54 million year-over-year, reflecting improving financial health despite declining revenue and sales figures. Analysts anticipate significant earnings growth of 120.79% annually over the next three years as MGI continues technological advancements with products like the DNBSEQ-T7+.

- Our comprehensive growth report raises the possibility that MGI Tech is poised for substantial financial growth.

- Dive into the specifics of MGI Tech here with our thorough financial health report.

Taking Advantage

- Delve into our full catalog of 519 Undervalued Global Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688114

MGI Tech

Engages in the research, development, production, and sale of DNA sequencing instruments, reagents, and related products for precision medicine, agriculture, healthcare, and other relevant industries in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives