- South Korea

- /

- Biotech

- /

- KOSDAQ:A086900

Spotlight On Medy-Tox And 2 Insider-Favored Growth Stocks

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding policy changes and economic indicators, investors are keenly observing sectors that could benefit from potential deregulation and shifts in consumer behavior. In this environment, growth companies with substantial insider ownership often attract attention due to their potential for aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.5% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

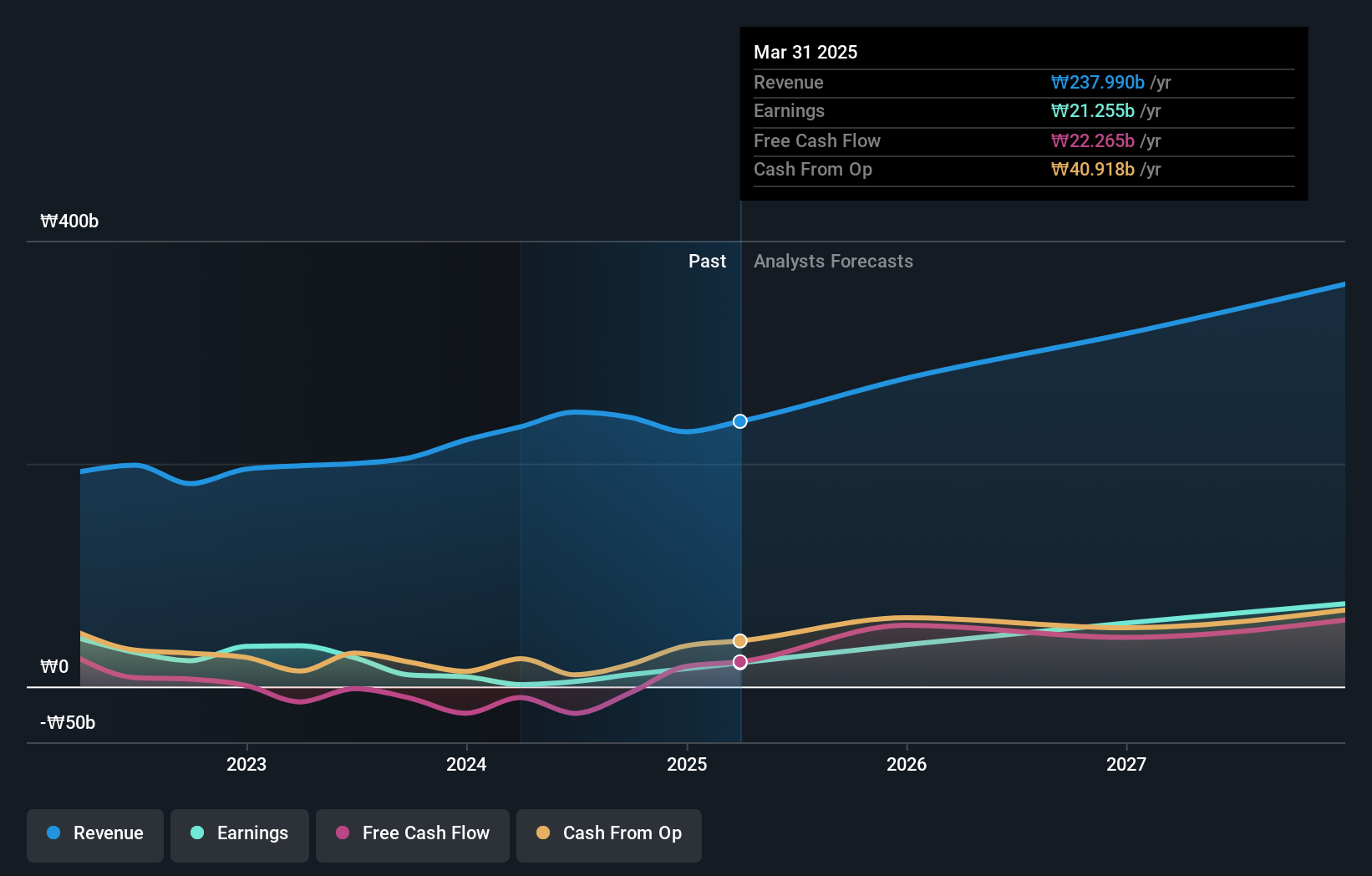

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of ₩829.97 billion, specializing in the development and production of medical and cosmetic products.

Operations: The company generates revenue primarily from its biotechnology segment, which amounts to ₩246.25 billion.

Insider Ownership: 19.8%

Medy-Tox's recent share repurchase program aims to stabilize stock prices and enhance shareholder value, with plans to buy back up to 23,828 shares by February 2025. Despite a decline in profit margins from 12.9% to 1.9%, the company is expected to outperform the Korean market with revenue growth of 12.5% annually and earnings projected to rise significantly at 68.1% per year, suggesting strong growth potential despite current challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Medy-Tox.

- The analysis detailed in our Medy-Tox valuation report hints at an deflated share price compared to its estimated value.

International Container Terminal Services (PSE:ICT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Container Terminal Services, Inc. is a company that develops, manages, and operates container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market cap of ₱777.18 billion.

Operations: The company's revenue primarily comes from cargo handling and related services, generating $2.64 billion.

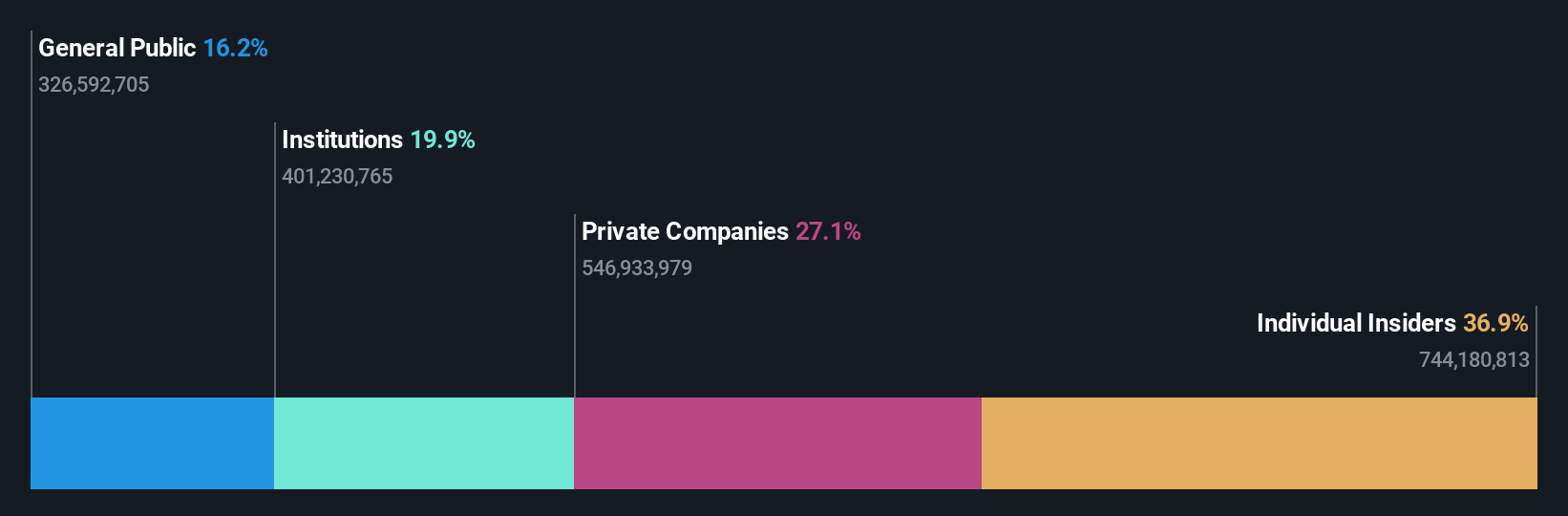

Insider Ownership: 36.7%

International Container Terminal Services shows potential as a growth company with high insider ownership. Despite moderate insider trading activity, ICT's revenue is forecast to grow at 8.1% annually, outpacing the Philippine market. Recent earnings reports reveal strong financial performance with Q3 revenue reaching US$715.36 million and net income of US$212.03 million, reflecting robust operational growth. However, the company's high debt level and unstable dividend track record may pose challenges for sustained growth momentum.

- Click here to discover the nuances of International Container Terminal Services with our detailed analytical future growth report.

- The analysis detailed in our International Container Terminal Services valuation report hints at an inflated share price compared to its estimated value.

M-Grass Ecology And Environment (Group) (SZSE:300355)

Simply Wall St Growth Rating: ★★★★★☆

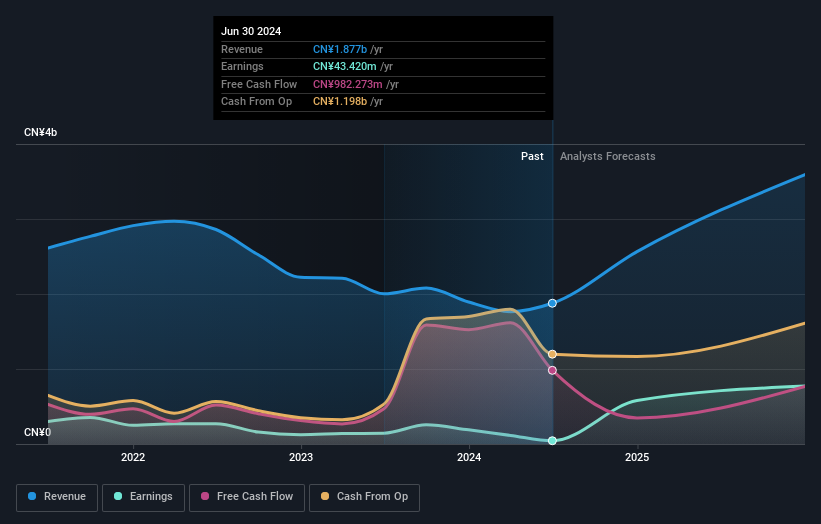

Overview: M-Grass Ecology And Environment (Group) Co., Ltd. operates in the ecological restoration and environmental protection industry, with a market cap of CN¥10.84 billion.

Operations: Unfortunately, the revenue segment details for M-Grass Ecology And Environment (Group) Co., Ltd. are not provided in the text.

Insider Ownership: 24.4%

M-Grass Ecology And Environment's insider ownership aligns with its projected revenue growth of 47.4% annually, surpassing the Chinese market average. Despite recent earnings showing a drop in net income to CNY 49.99 million for the first nine months of 2024, forecasts suggest earnings will grow by 112.15% per year and become profitable in three years. However, high share price volatility and insufficient operating cash flow to cover debt present potential risks for investors.

- Navigate through the intricacies of M-Grass Ecology And Environment (Group) with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that M-Grass Ecology And Environment (Group)'s share price might be on the expensive side.

Turning Ideas Into Actions

- Embark on your investment journey to our 1538 Fast Growing Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A086900

Flawless balance sheet with reasonable growth potential.