- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

3 Growth Companies With Insider Ownership Up To 26%

Reviewed by Simply Wall St

As global markets experience a surge, with U.S. stock indexes nearing record highs and inflation data shaping economic expectations, investors are keenly observing growth stocks that have been outperforming value shares. In this environment, companies with high insider ownership can be particularly appealing as they often signal confidence in the company's potential and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Here's a peek at a few of the choices from the screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., with a market cap of €1.50 billion, operates fitness clubs through its subsidiaries.

Operations: The company generates revenue from its fitness club operations, with €505.17 million coming from the Benelux region and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Basic-Fit has seen substantial insider buying over the past three months, indicating confidence in its growth potential. While profit margins have declined from 1.9% to 0.7%, earnings are forecast to grow significantly at 77.72% annually, outpacing the Dutch market's average of 12.9%. Revenue growth is expected at 14.6% per year, faster than the market's 8%. However, interest payments remain poorly covered by earnings, and large one-off items affect financial results.

- Delve into the full analysis future growth report here for a deeper understanding of Basic-Fit.

- According our valuation report, there's an indication that Basic-Fit's share price might be on the cheaper side.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

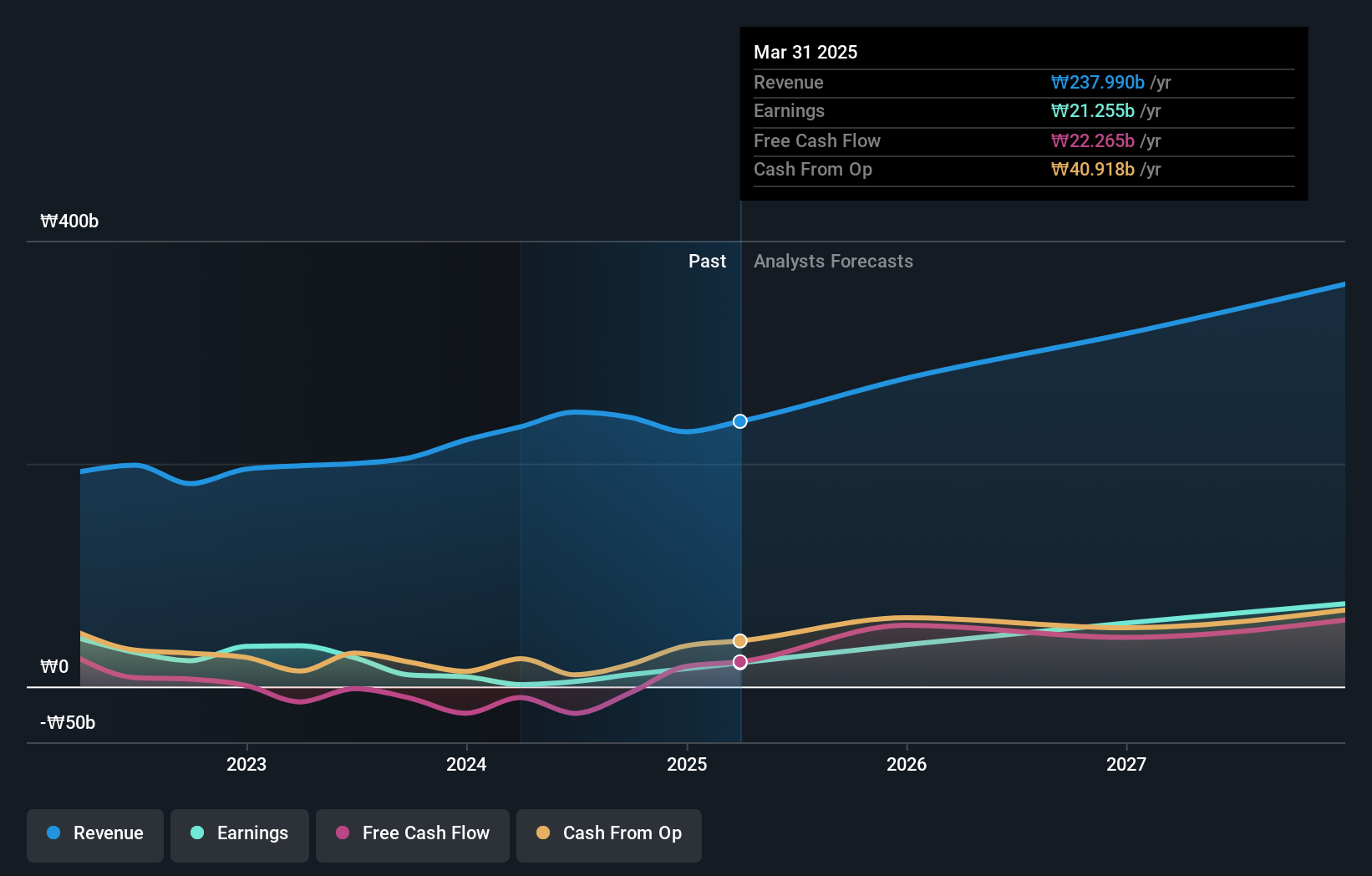

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea, with a market cap of ₩813.78 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩241.45 billion.

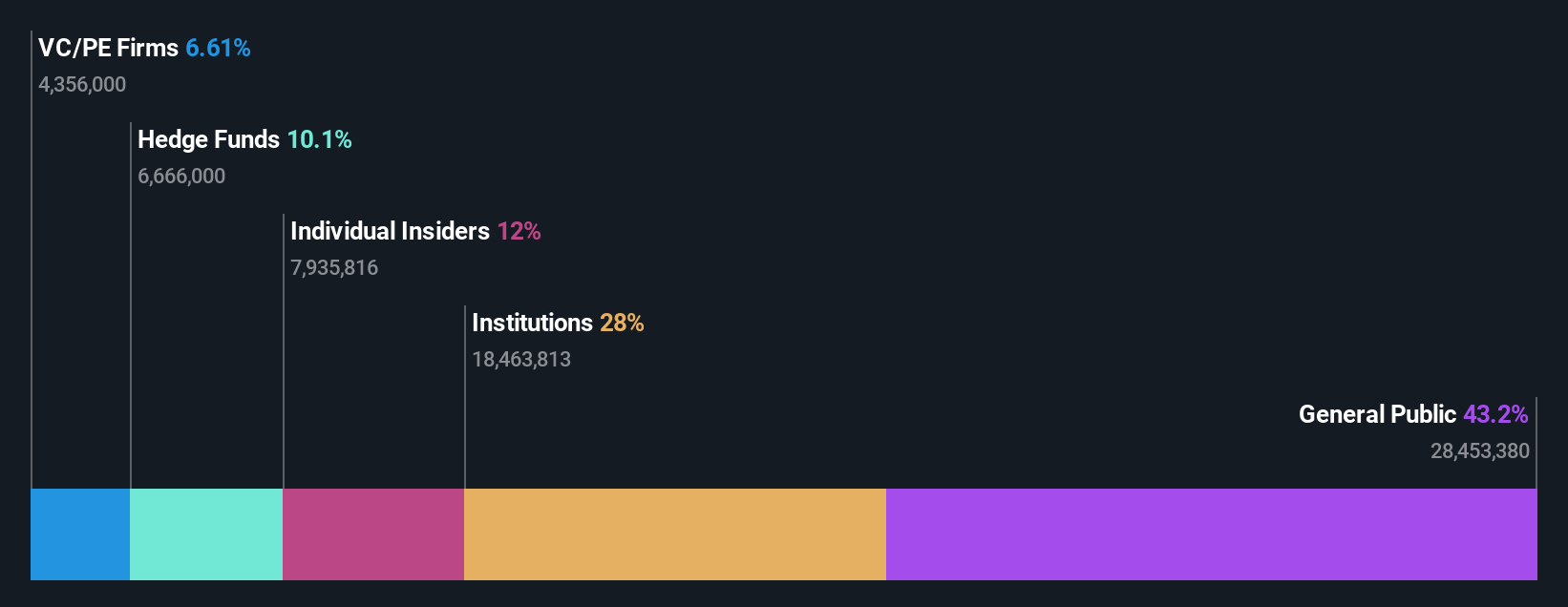

Insider Ownership: 20.2%

Medy-Tox is trading at 47.1% below its estimated fair value, presenting a potential opportunity for investors focused on growth companies with high insider ownership. The company has completed several share buyback programs aimed at stabilizing stock price and enhancing shareholder value, repurchasing shares worth billions of KRW recently. Earnings are projected to grow significantly at 61.33% annually, surpassing the Korean market's average growth rate of 25.8%, although revenue growth lags behind the ideal threshold of 20% per year.

- Click here to discover the nuances of Medy-Tox with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Medy-Tox shares in the market.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. is involved in the R&D, production, sale, and technical services of laser technology, intelligent equipment, and optical devices with a market cap of CN¥4.68 billion.

Operations: The company's revenue primarily comes from its Computer Communications and Other Electronic Equipment segment, totaling CN¥1.39 billion.

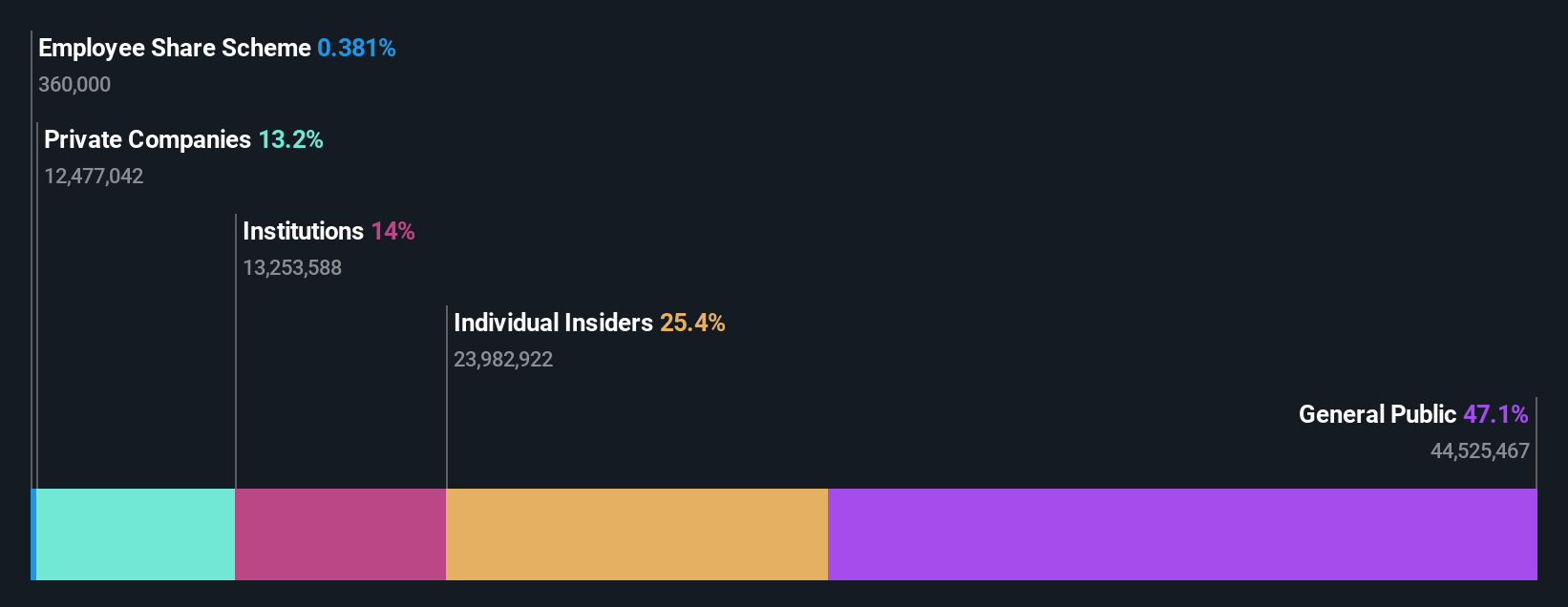

Insider Ownership: 26.9%

Shenzhen JPT Opto-Electronics is positioned as a growth-focused entity with strong insider ownership. The company is trading at a good value, with a P/E ratio of 38.2x, below the industry average of 50.7x. Its earnings are projected to grow significantly at 36% annually, outpacing the Chinese market's average growth rate of 25.1%. However, its recent removal from the S&P Global BMI Index may impact investor sentiment despite robust revenue forecasts exceeding market expectations.

- Click to explore a detailed breakdown of our findings in Shenzhen JPT Opto-Electronics' earnings growth report.

- Our valuation report here indicates Shenzhen JPT Opto-Electronics may be undervalued.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1460 more companies for you to explore.Click here to unveil our expertly curated list of 1463 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Shenzhen JPT Opto-Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives