- South Korea

- /

- Biotech

- /

- KOSDAQ:A086890

ISU Abxis'(KOSDAQ:086890) Share Price Is Down 21% Over The Past Three Years.

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term ISU Abxis Co., Ltd. (KOSDAQ:086890) shareholders have had that experience, with the share price dropping 21% in three years, versus a market return of about 22%. There was little comfort for shareholders in the last week as the price declined a further 1.6%.

Check out our latest analysis for ISU Abxis

ISU Abxis wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, ISU Abxis grew revenue at 8.1% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 7% per year, for three years. This implies the market had higher expectations of ISU Abxis. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

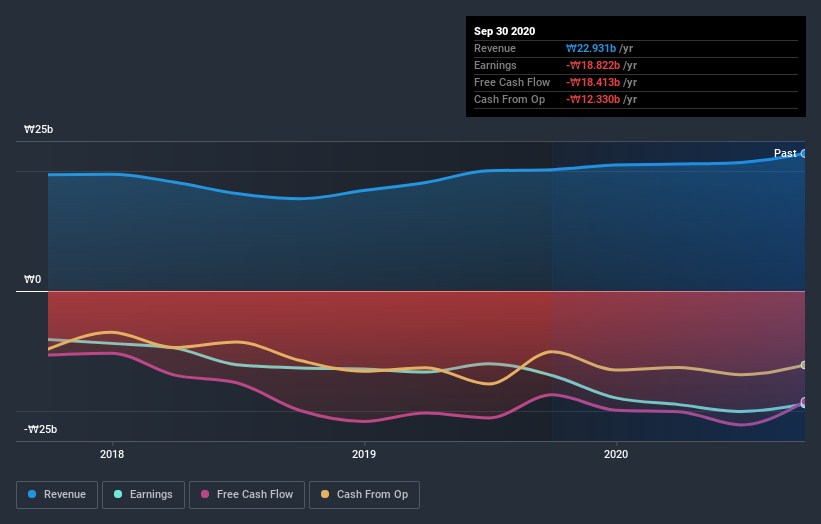

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

ISU Abxis shareholders gained a total return of 5.7% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.8% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - ISU Abxis has 4 warning signs (and 2 which are concerning) we think you should know about.

But note: ISU Abxis may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade ISU Abxis, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A086890

ISU Abxis

A biopharmaceutical company, develops and markets products for the treatment of cancer and rare diseases worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives