- South Korea

- /

- Biotech

- /

- KOSDAQ:A086890

Even after rising 12% this past week, ISU Abxis (KOSDAQ:086890) shareholders are still down 29% over the past three years

ISU Abxis Co., Ltd. (KOSDAQ:086890) shareholders should be happy to see the share price up 12% in the last week. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 29% in the last three years, falling well short of the market return.

While the last three years has been tough for ISU Abxis shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for ISU Abxis

ISU Abxis isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, ISU Abxis grew revenue at 28% per year. That's well above most other pre-profit companies. The share price drop of 9% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

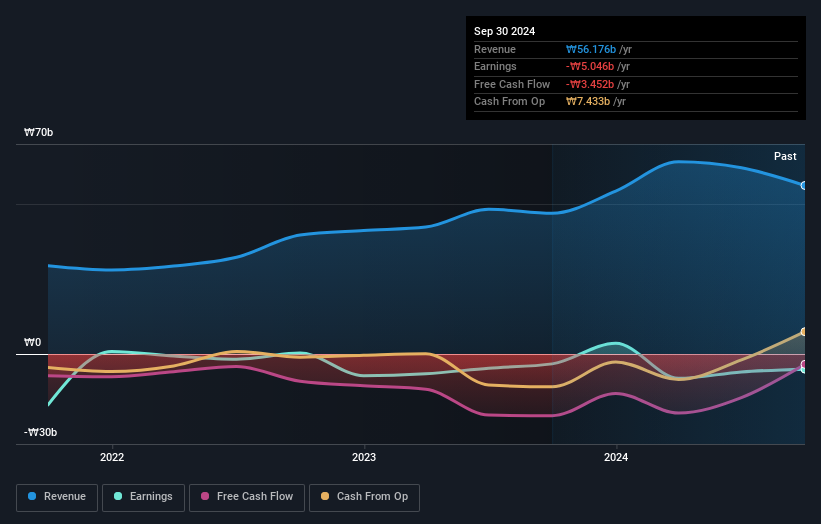

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at ISU Abxis' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 3.3% in the twelve months, ISU Abxis shareholders did even worse, losing 10%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of ISU Abxis' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like ISU Abxis better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086890

ISU Abxis

A biopharmaceutical company, develops and markets products for the treatment of cancer and rare diseases worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives