- South Korea

- /

- Pharma

- /

- KOSDAQ:A041910

If You Had Bought EstechPharma's (KOSDAQ:041910) Shares Five Years Ago You Would Be Down 60%

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the EstechPharma Co., Ltd. (KOSDAQ:041910) share price managed to fall 60% over five long years. That's not a lot of fun for true believers. The falls have accelerated recently, with the share price down 19% in the last three months.

View our latest analysis for EstechPharma

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, EstechPharma actually managed to increase EPS by an average of 32% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We don't think that the 0.9% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 3.7% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

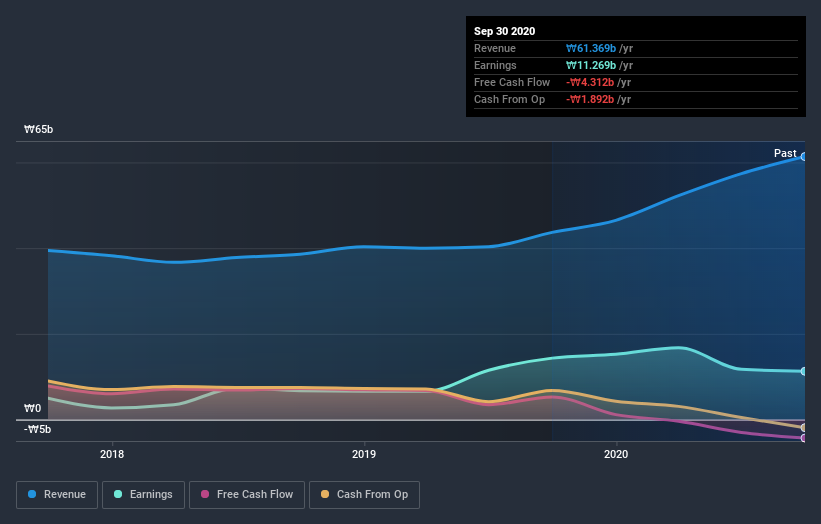

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling EstechPharma stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

EstechPharma provided a TSR of 2.7% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for EstechPharma you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade EstechPharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A041910

Polaris AI Pharma

Engages in the manufacture and sale of pharmaceuticals products in South Korea and internationally.

Low risk not a dividend payer.

Market Insights

Community Narratives