As global markets experience significant movements, with the Federal Reserve's interest rate cuts propelling the small-cap Russell 2000 Index to notable gains and renewed concerns over tech valuations impacting the Nasdaq Composite, investors are keeping a close eye on high-growth tech stocks. In such a dynamic environment, identifying promising stocks often involves looking at companies that can navigate economic shifts effectively and leverage technological advancements to sustain growth.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

We'll examine a selection from our screener results.

Aimed Bio (KOSDAQ:A0009K0)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aimed Bio Inc. focuses on developing therapeutic solutions for brain diseases, including neuro-oncological and degenerative conditions, with a market cap of ₩4.64 trillion.

Operations: The company generates revenue of ₩20.71 billion from the research, development, production, and sale of antibody-based therapeutics targeting brain diseases.

Aimed Bio, recently public via a KRW 70.73 billion IPO, is poised for significant strides in the biotech sector, underscored by a promising collaboration with Boehringer Ingelheim to develop cancer therapies. This partnership could funnel up to $991 million to Aimed Bio, enhancing its financial runway and R&D capabilities. Despite current unprofitability and market challenges indicated by its illiquid shares, the company's revenue surged by 134% last year and is projected to grow at an annual rate of 35.2%. This growth trajectory, coupled with an anticipated shift into profitability within three years, positions Aimed Bio intriguingly in high-stakes biotech innovation.

- Navigate through the intricacies of Aimed Bio with our comprehensive health report here.

Review our historical performance report to gain insights into Aimed Bio's's past performance.

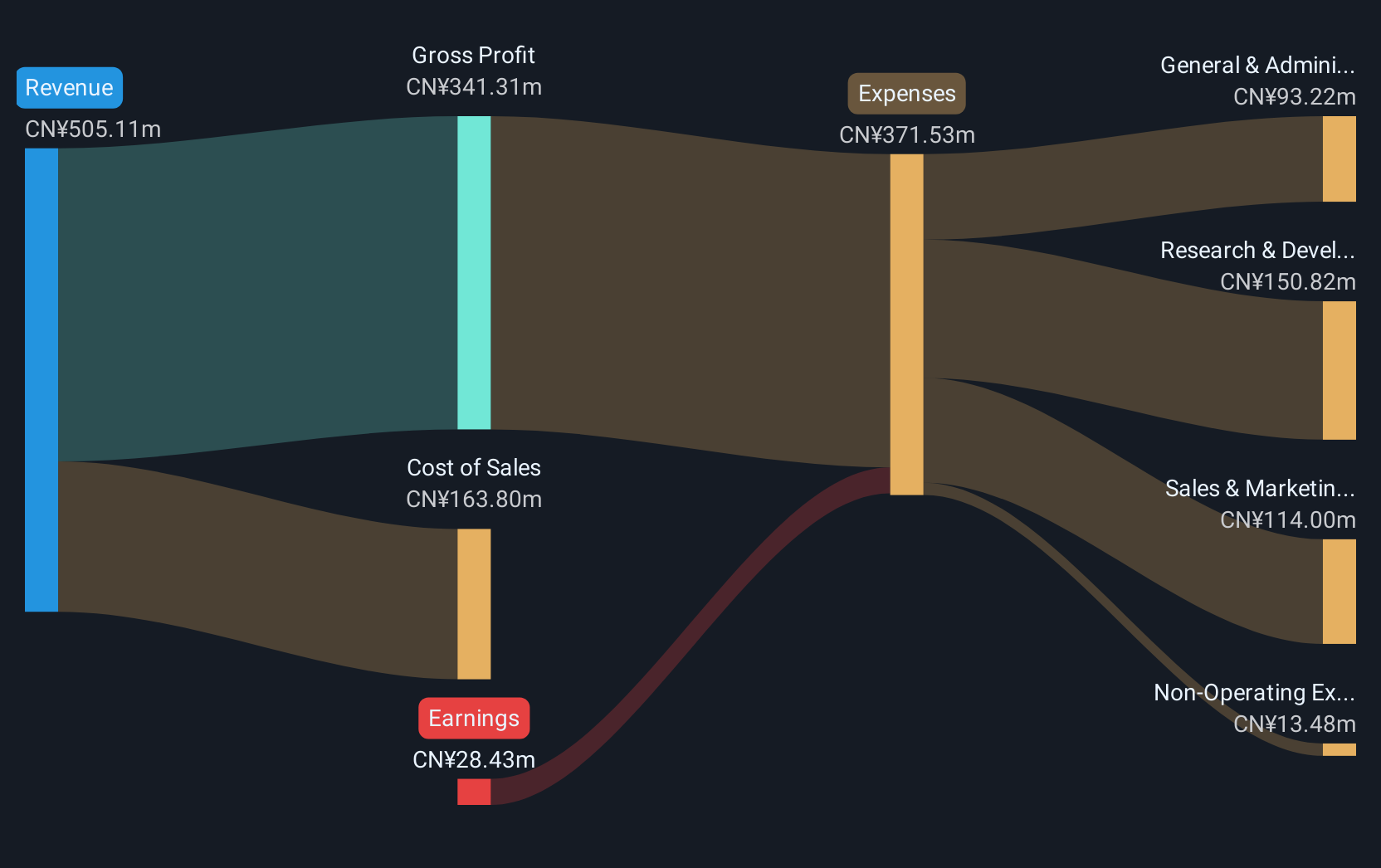

Beijing Infosec TechnologiesLtd (SHSE:688201)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Infosec Technologies Co., Ltd. specializes in developing and providing application security products in China, with a market cap of CN¥4.08 billion.

Operations: The company focuses on application security products in China. It operates with a market capitalization of CN¥4.08 billion, reflecting its position in the cybersecurity sector.

Beijing Infosec Technologies has turned a corner this fiscal year, transitioning from a net loss to posting a net income of CNY 14.64 million, up from last year's CNY 49.03 million loss, reflecting significant operational improvements and market adaptation. With an annual revenue growth rate of 18.8% and earnings projected to expand by 72.2% annually, the company is navigating its competitive landscape adeptly despite its share price volatility over the past three months. This performance is underscored by substantial R&D investments that are integral to sustaining innovation and securing its position in the rapidly evolving tech sector.

- Take a closer look at Beijing Infosec TechnologiesLtd's potential here in our health report.

Understand Beijing Infosec TechnologiesLtd's track record by examining our Past report.

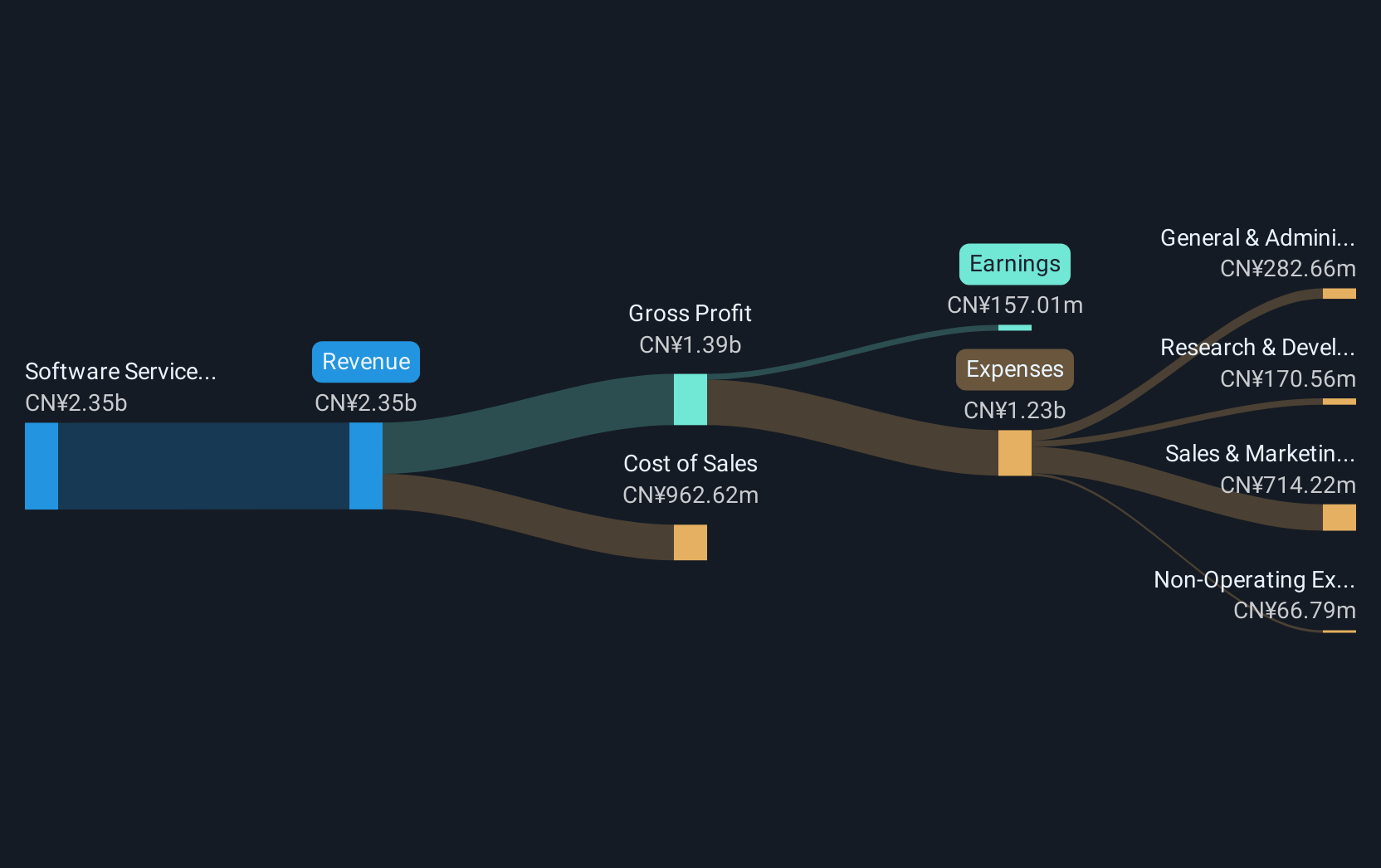

Digiwin (SZSE:300378)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digiwin Co., Ltd. offers industry-specific software solutions both in Mainland China and internationally, with a market cap of approximately CN¥10.87 billion.

Operations: Digiwin Co., Ltd. generates revenue primarily through its software services, amounting to approximately CN¥2.37 billion. The company operates in both Mainland China and international markets, focusing on industry-specific solutions.

Digiwin's strategic focus on R&D, with a significant allocation of its revenue towards these efforts, underscores its commitment to innovation and market competitiveness. In the latest fiscal period, R&D expenses accounted for 15% of total revenue, aligning with industry standards for fostering technological advancements. The company's recent fixed-income offering of CNY 827.66 million highlights a robust financial strategy to support these initiatives further. Amidst regulatory changes and governance enhancements, Digiwin has maintained a steady growth trajectory with an annual revenue increase of 17.5% and an impressive earnings growth forecast at 34.6% per year, outpacing many in the software sector where average growth lingers around 20%. This financial vigor is coupled with operational adjustments that promise sustained profitability and market relevance in the evolving tech landscape.

Where To Now?

- Discover the full array of 248 Global High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)