- South Korea

- /

- Entertainment

- /

- KOSE:A352820

HYBE (KOSE:A352820) Strengthens Growth with KRW 400 Billion Convertible Bonds and Share Buyback

Reviewed by Simply Wall St

Take a closer look at HYBE's potential here.

Core Advantages Driving Sustained Success for HYBE

HYBE's strategic initiatives have propelled its earnings to forecast a 42.5% annual growth, surpassing the KR market's average of 29.3%. This impressive trajectory is supported by a 13.6% expected revenue growth, outpacing the market's 9.9% rate. Such growth underscores effective market strategies and strong customer relationships, as highlighted by Lee Jae-sang, CEO, during recent earnings discussions. Additionally, the company's commitment to innovation is evident in its new product lines, which have significantly expanded its customer base. Financially, HYBE maintains a positive cash runway with profits covering interest payments, reinforcing its stability.

To gain deeper insights into HYBE's historical performance, explore our detailed analysis of past performance.Strategic Gaps That Could Affect HYBE

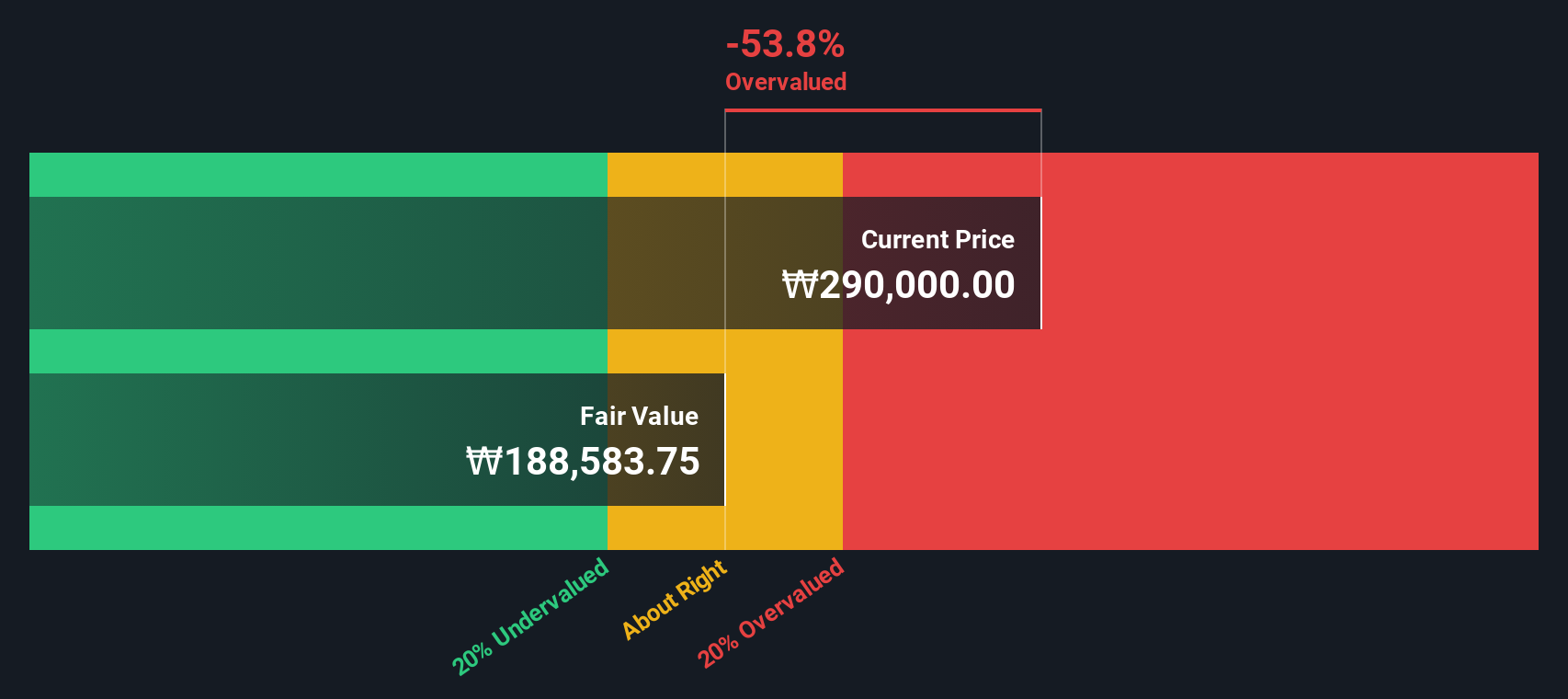

However, the company's valuation reveals potential challenges. Trading at a Price-To-Earnings Ratio of 106.1x, HYBE is considered expensive compared to industry and peer averages of 17.3x and 38.7x, respectively. This overvaluation could be a concern despite analysts projecting a 28.7% rise in stock price. Additionally, the Return on Equity stands at a modest 2%, below the 20% benchmark, coupled with low net profit margins of 3.6%. Operational inefficiencies, such as supply chain delays, further highlight areas needing improvement to fully capitalize on market demand.

To dive deeper into how HYBE's valuation metrics are shaping its market position, check out our detailed analysis of HYBE's Valuation.Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound for HYBE, with analysts forecasting a significant stock price increase, suggesting room for capital appreciation. The company's recent private placement of KRW 400 billion in convertible bonds, approved by shareholders, signals strategic financial maneuvers aimed at bolstering growth. This move, alongside a completed share buyback program, indicates a focus on enhancing shareholder value and stabilizing stock prices. Such initiatives position HYBE to leverage emerging market opportunities and strengthen its competitive edge.

See what the latest analyst reports say about HYBE's future prospects and potential market movements.Key Risks and Challenges That Could Impact HYBE's Success

Nevertheless, external threats persist, including a notable ₩189.4 billion one-off loss impacting recent financial results, raising concerns about earnings quality. Regulatory hurdles and economic headwinds also pose significant risks, as noted by Kyung-Jun Lee, CFO. The absence of a notable dividend may deter income-focused investors, while ongoing supply chain vulnerabilities necessitate proactive management to ensure resilience. These factors underscore the importance of strategic foresight in navigating potential challenges.

Learn about HYBE's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

HYBE's strategic initiatives have set a promising trajectory for growth, with projected earnings and revenue growth rates significantly surpassing market averages. This success is attributed to effective market strategies, strong customer relationships, and a commitment to innovation, which have expanded its customer base. However, the company's high Price-To-Earnings Ratio of 106.1x, compared to industry and peer averages, suggests that investors are paying a premium for its growth potential. This premium is justified by analysts' projections of a stock price increase of over 20%, indicating confidence in HYBE's ability to capitalize on emerging market opportunities and enhance shareholder value. Despite this optimism, challenges such as low Return on Equity, supply chain inefficiencies, and external economic risks require strategic foresight to ensure sustainable performance and resilience against potential setbacks.

Where To Now?

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026