- South Korea

- /

- Entertainment

- /

- KOSE:A259960

These 4 Measures Indicate That KRAFTON (KRX:259960) Is Using Debt Safely

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that KRAFTON, Inc. (KRX:259960) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for KRAFTON

How Much Debt Does KRAFTON Carry?

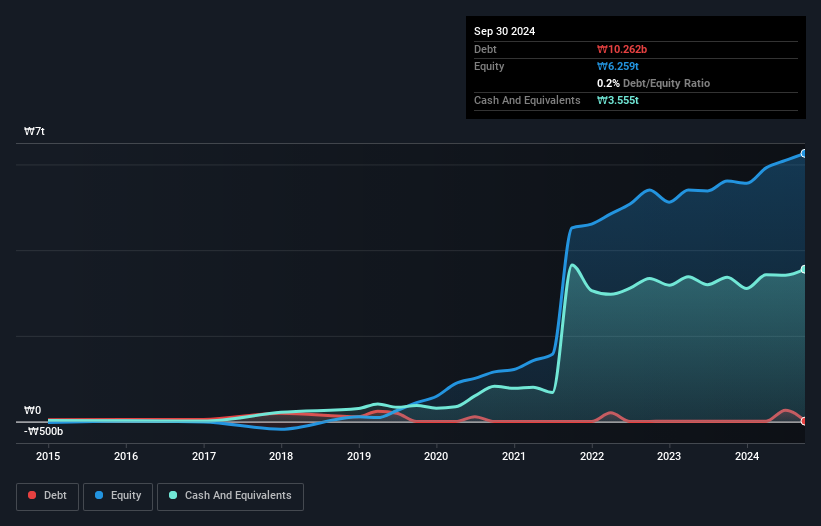

As you can see below, at the end of September 2024, KRAFTON had ₩10.3b of debt, up from ₩8.07b a year ago. Click the image for more detail. But it also has ₩3.56t in cash to offset that, meaning it has ₩3.54t net cash.

How Healthy Is KRAFTON's Balance Sheet?

We can see from the most recent balance sheet that KRAFTON had liabilities of ₩650.9b falling due within a year, and liabilities of ₩367.8b due beyond that. Offsetting this, it had ₩3.56t in cash and ₩868.7b in receivables that were due within 12 months. So it can boast ₩3.41t more liquid assets than total liabilities.

It's good to see that KRAFTON has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, KRAFTON boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, KRAFTON grew its EBIT by 55% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if KRAFTON can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While KRAFTON has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, KRAFTON produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to investigate a company's debt, in this case KRAFTON has ₩3.54t in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 55% over the last year. So is KRAFTON's debt a risk? It doesn't seem so to us. Over time, share prices tend to follow earnings per share, so if you're interested in KRAFTON, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if KRAFTON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A259960

KRAFTON

Engages in the software development and related ancillary businesses in Asia, Korea, the United States, Europe, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026