- South Korea

- /

- Pharma

- /

- KOSE:A000640

3 Growth Companies With High Insider Ownership And Earnings Growth Up To 84%

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and anticipated rate cuts, growth stocks continue to capture investor interest, particularly as the Nasdaq Composite hits record highs. In this environment, companies with strong insider ownership and robust earnings growth potential stand out as compelling opportunities for those seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's dive into some prime choices out of the screener.

Boditech Med (KOSDAQ:A206640)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Boditech Med Inc. provides instruments and diagnostic reagents both in South Korea and internationally, with a market cap of ₩374.26 billion.

Operations: The company generates revenue from diagnostic kits and equipment amounting to ₩141.86 billion.

Insider Ownership: 36.2%

Earnings Growth Forecast: 21.1% p.a.

Boditech Med is poised for growth, with earnings forecasted to increase by 21.06% annually, outpacing the KR market's 12.3%. Despite its revenue growth of 15.9% being slower than the desired threshold, it remains above market average. The company trades at a significant discount to its estimated fair value and has initiated a share buyback program worth ₩3 billion to enhance shareholder value and stabilize stock price through April 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Boditech Med.

- Our expertly prepared valuation report Boditech Med implies its share price may be lower than expected.

Dong-A Socio Holdings (KOSE:A000640)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dong-A Socio Holdings Co., Ltd. operates in the pharmaceutical industry both in South Korea and internationally, with a market cap of approximately ₩637.57 billion.

Operations: The company's revenue segments include General Medicines and Non-Prescription Drugs at ₩666.71 billion, Distribution at ₩390.92 billion, Packaging Container at ₩99.94 billion, Biosimilars and Contract Medicines at ₩65.52 billion, and Landlord activities contributing ₩59.45 billion.

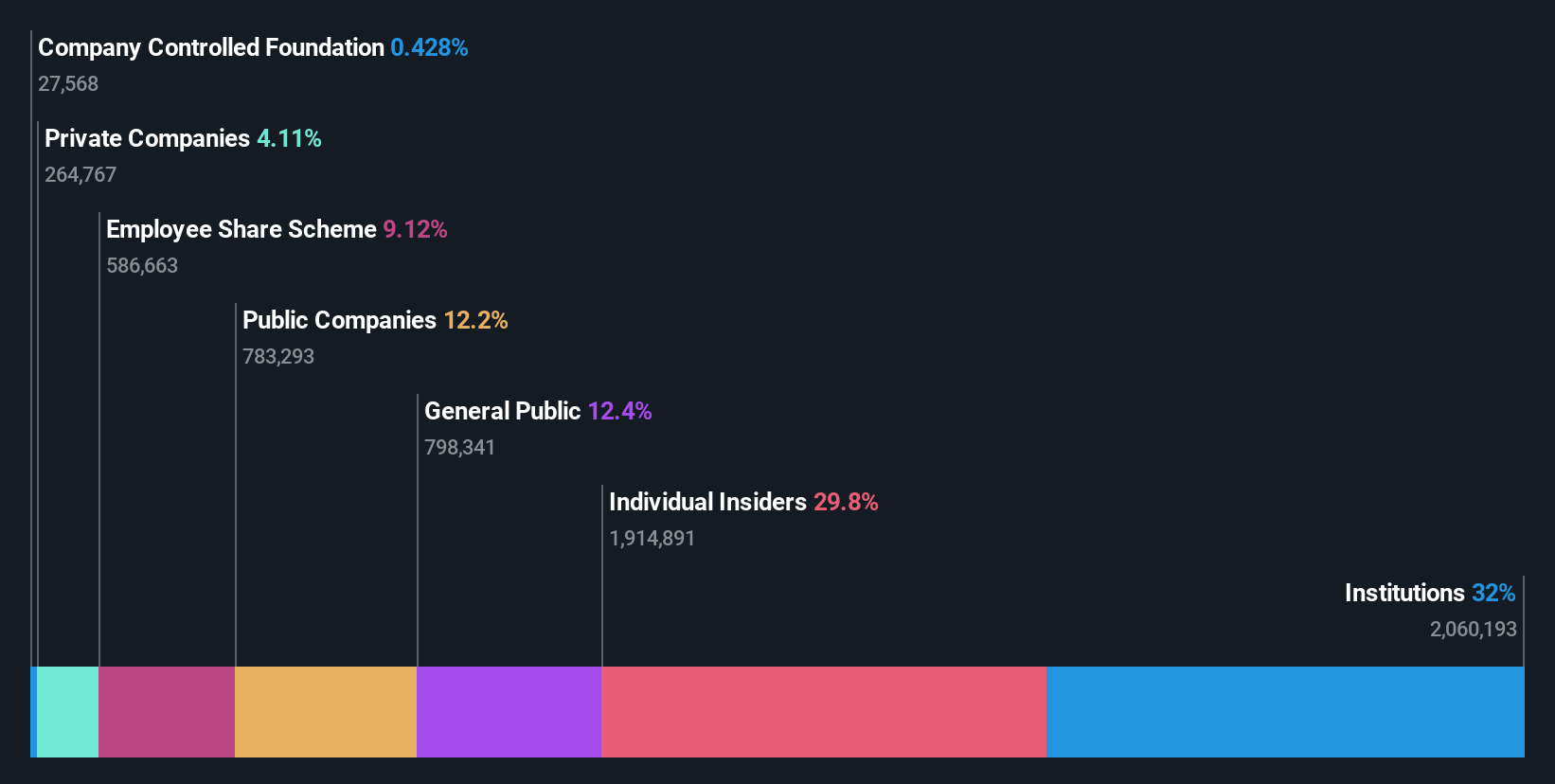

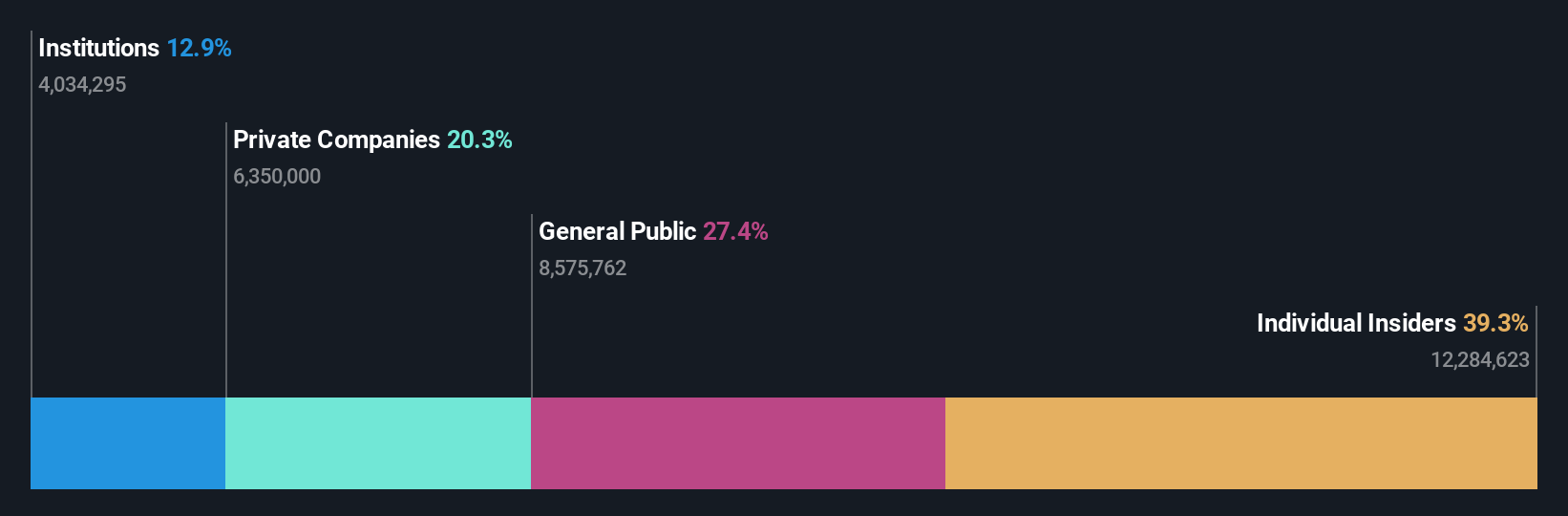

Insider Ownership: 29.8%

Earnings Growth Forecast: 40.8% p.a.

Dong-A Socio Holdings is positioned for growth, with earnings forecasted to rise by 40.84% annually, surpassing the KR market's 12.3%. Despite a decline in sales to ₩144.95 million for the nine months ended September 2024, net income improved to ₩52.78 billion. The stock trades significantly below its estimated fair value and analysts predict a potential price increase of 47.1%, indicating strong growth prospects despite current financial challenges.

- Get an in-depth perspective on Dong-A Socio Holdings' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Dong-A Socio Holdings' current price could be quite moderate.

NHN (KOSE:A181710)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NHN Corporation is an IT company offering gaming, payment, entertainment, IT, and advertisement solutions in South Korea and internationally, with a market cap of ₩613.55 billion.

Operations: The company's revenue segments include ₩460.85 billion from games and ₩1.16 trillion from payment and advertising solutions.

Insider Ownership: 31.4%

Earnings Growth Forecast: 84.6% p.a.

NHN Corporation is forecasted to become profitable within three years, with revenue growth expected at 8.2% annually, outpacing the KR market's 5.3%. Despite recent net losses of ₩69.39 billion for the nine months ended September 2024, NHN trades at a significant discount to its estimated fair value and has announced a share buyback program to enhance shareholder value. The company's earnings are projected to grow by 84.65% per year, indicating potential for substantial growth despite current challenges.

- Click to explore a detailed breakdown of our findings in NHN's earnings growth report.

- Upon reviewing our latest valuation report, NHN's share price might be too pessimistic.

Summing It All Up

- Click through to start exploring the rest of the 1525 Fast Growing Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000640

Dong-A Socio Holdings

Engages in the pharmaceutical business in South Korea.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives