- South Korea

- /

- Media

- /

- KOSE:A068290

Here's Why Samsung Publishing's (KRX:068290) Statutory Earnings Are Arguably Too Conservative

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Samsung Publishing (KRX:068290).

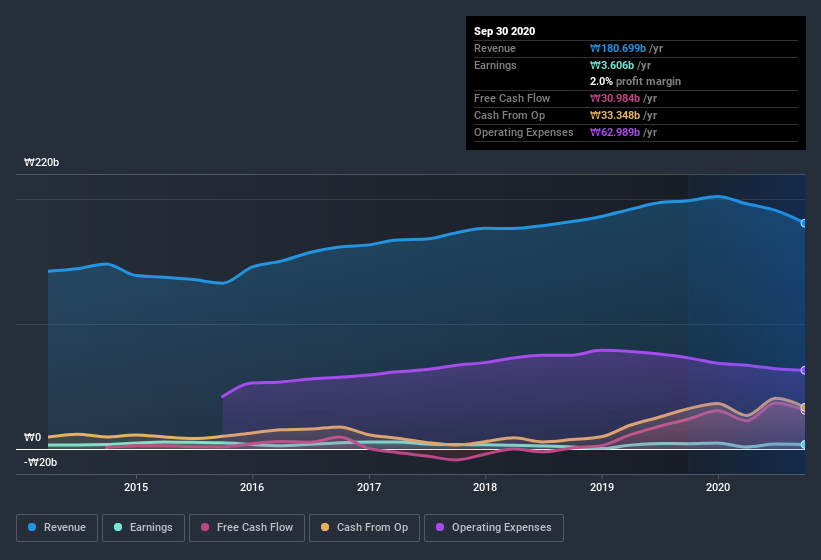

While Samsung Publishing was able to generate revenue of ₩180.7b in the last twelve months, we think its profit result of ₩3.61b was more important. We can see in the depiction below that while it did manage to grow its revenue over the last three years, profit has been pretty flat.

View our latest analysis for Samsung Publishing

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, today we're going to take a closer look at Samsung Publishing's cashflow, and unusual items, with a view to understanding what these might tell us about its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Samsung Publishing.

Examining Cashflow Against Samsung Publishing's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Samsung Publishing has an accrual ratio of -0.19 for the year to September 2020. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of ₩31b during the period, dwarfing its reported profit of ₩3.61b. Samsung Publishing shareholders are no doubt pleased that free cash flow improved over the last twelve months. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

How Do Unusual Items Influence Profit?

Samsung Publishing's profit was reduced by unusual items worth ₩1.6b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. In the twelve months to September 2020, Samsung Publishing had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Samsung Publishing's Profit Performance

In conclusion, both Samsung Publishing's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. After considering all this, we reckon Samsung Publishing's statutory profit probably understates its earnings potential! Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 1 warning sign for Samsung Publishing you should be aware of.

Our examination of Samsung Publishing has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Samsung Publishing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A068290

Not a dividend payer minimal.