- South Korea

- /

- Entertainment

- /

- KOSE:A036570

Only Four Days Left To Cash In On NCSOFT's (KRX:036570) Dividend

NCSOFT Corporation (KRX:036570) stock is about to trade ex-dividend in four days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, NCSOFT investors that purchase the stock on or after the 21st of March will not receive the dividend, which will be paid on the 25th of April.

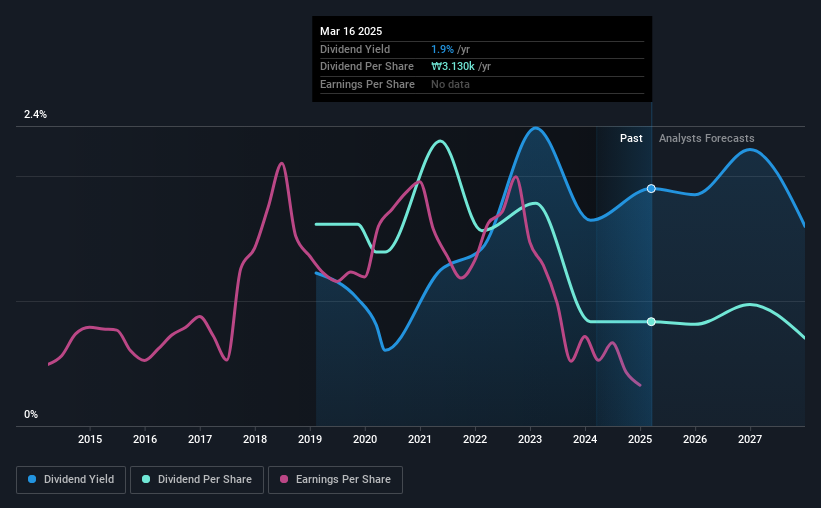

The company's next dividend payment will be ₩1460.00 per share, and in the last 12 months, the company paid a total of ₩3,130 per share. Based on the last year's worth of payments, NCSOFT stock has a trailing yield of around 1.9% on the current share price of ₩164800.00. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for NCSOFT

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see NCSOFT paying out a modest 50% of its earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see NCSOFT's earnings per share have dropped 23% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. NCSOFT has seen its dividend decline 10% per annum on average over the past six years, which is not great to see. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

To Sum It Up

From a dividend perspective, should investors buy or avoid NCSOFT? Earnings per share have shrunk noticeably in recent years, although we like that the company has a low payout ratio. This could suggest a cut to the dividend may not be a major risk in the near future. NCSOFT ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

On that note, you'll want to research what risks NCSOFT is facing. Every company has risks, and we've spotted 2 warning signs for NCSOFT you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NCSOFT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A036570

NCSOFT

Develops and publishes online games in Korea, Japan, Taiwan, the United States of America, Europe, and Canada.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Shopify: The Quiet Shift From Store Builder to Commerce Operating System

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)