- China

- /

- Metals and Mining

- /

- SZSE:000426

Global Value Stocks That May Be Trading Below Estimated Worth In September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed economic signals, investors are closely watching how recent developments may influence central bank policies and market dynamics. In this environment, identifying undervalued stocks can be particularly appealing, as these equities may offer potential opportunities for growth when trading below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$313.50 | NT$620.18 | 49.4% |

| Suzhou Zelgen Biopharmaceuticals (SHSE:688266) | CN¥112.50 | CN¥223.99 | 49.8% |

| Sinolong New Materials (SZSE:301565) | CN¥26.87 | CN¥53.57 | 49.8% |

| Rusta (OM:RUSTA) | SEK64.00 | SEK127.40 | 49.8% |

| Kuraray (TSE:3405) | ¥1750.50 | ¥3477.15 | 49.7% |

| Inner Mongolia Xingye Silver&Tin MiningLtd (SZSE:000426) | CN¥25.45 | CN¥50.82 | 49.9% |

| Getinge (OM:GETI B) | SEK212.50 | SEK423.41 | 49.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €9.80 | €19.40 | 49.5% |

| Dogus Otomotiv Servis ve Ticaret (IBSE:DOAS) | TRY169.90 | TRY336.06 | 49.4% |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$531.50 | MX$1057.36 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

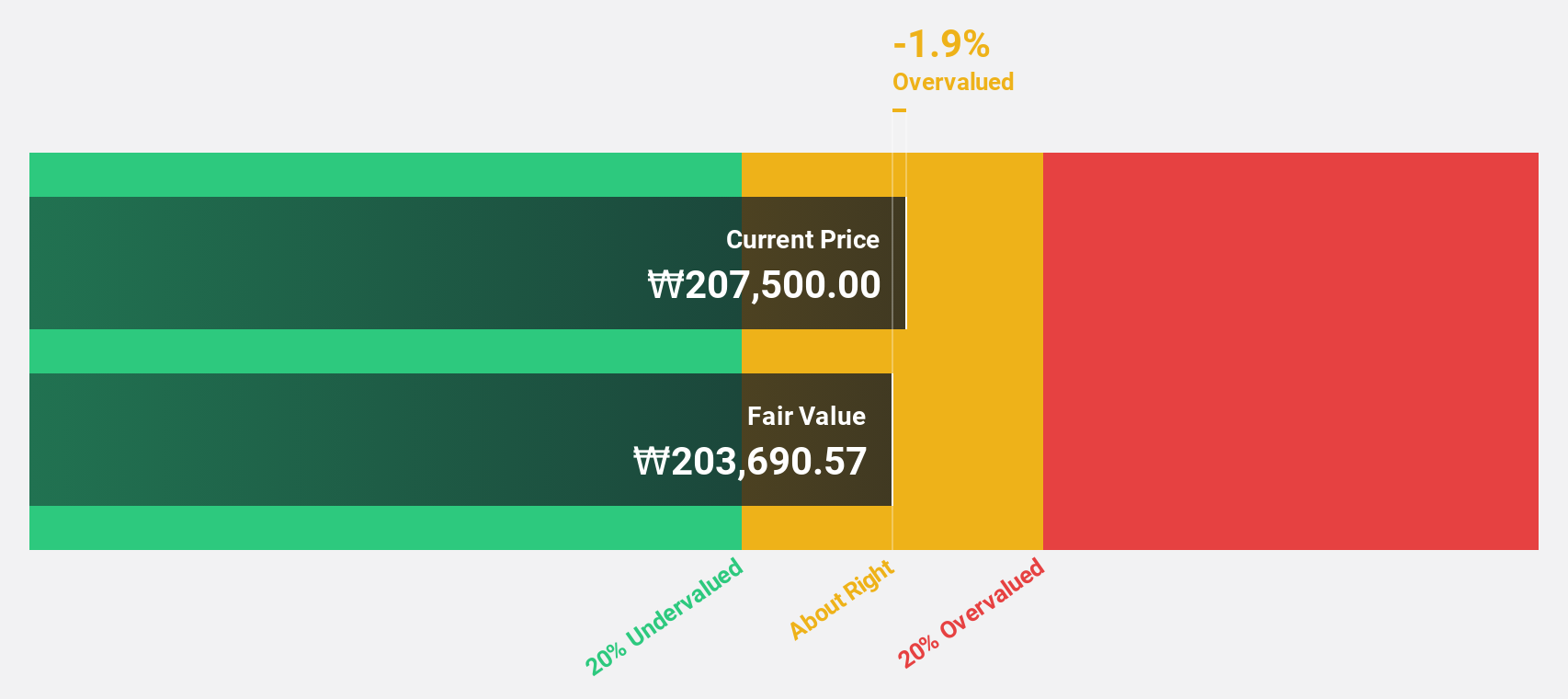

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩3.92 trillion.

Operations: The company's revenue from online games and game services amounts to ₩1.55 trillion.

Estimated Discount To Fair Value: 19.1%

NCSOFT is trading at ₩220,000, approximately 19.1% below its estimated fair value of ₩271,940.23, suggesting it may be undervalued based on cash flows. Despite a recent net loss and reduced earnings per share for Q2 2025 compared to the previous year, the company is expected to achieve profitability within three years with earnings projected to grow significantly annually. Revenue growth forecasts also exceed the broader Korean market's average growth rate.

- Our earnings growth report unveils the potential for significant increases in NCSOFT's future results.

- Click to explore a detailed breakdown of our findings in NCSOFT's balance sheet health report.

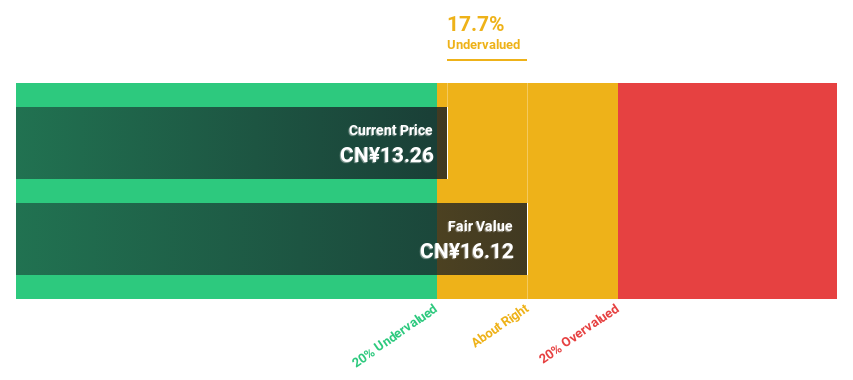

Inner Mongolia Xingye Silver&Tin MiningLtd (SZSE:000426)

Overview: Inner Mongolia Xingye Silver&Tin Mining Co., Ltd operates in China, focusing on the mining and smelting of non-ferrous and precious metals, with a market capitalization of CN¥42.06 billion.

Operations: The company's revenue primarily stems from its operations in the mining industry, amounting to CN¥4.51 billion.

Estimated Discount To Fair Value: 49.9%

Inner Mongolia Xingye Silver & Tin Mining Ltd is trading at CN¥25.45, significantly below its estimated fair value of CN¥50.82, highlighting potential undervaluation based on cash flows. Despite a decline in net income for the first half of 2025, earnings are projected to grow 25% annually over the next three years. Revenue growth forecasts surpass China's market average, although earnings growth is slightly below the market's expected rate. Recent bylaw amendments may impact governance and management practices.

- The analysis detailed in our Inner Mongolia Xingye Silver&Tin MiningLtd growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Inner Mongolia Xingye Silver&Tin MiningLtd.

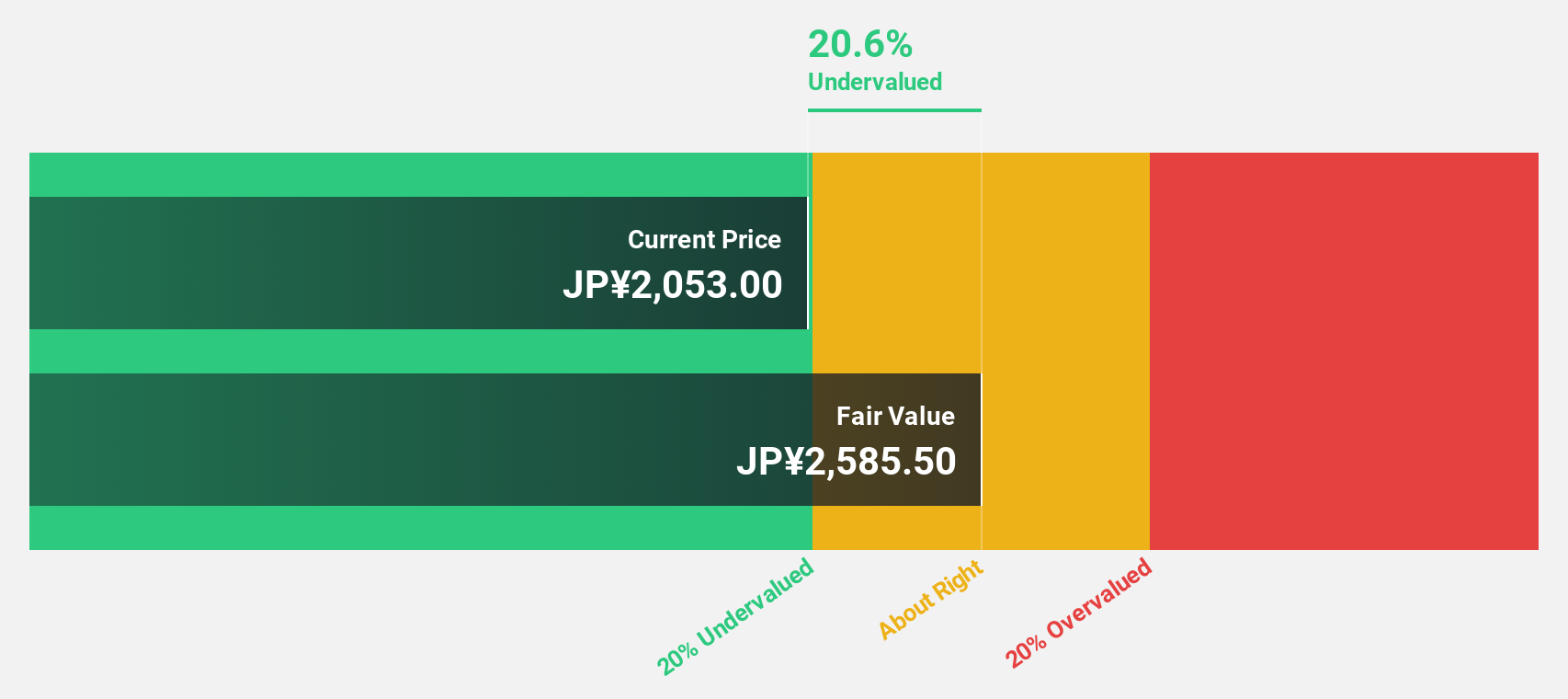

Mandom (TSE:4917)

Overview: Mandom Corporation manufactures and sells cosmetics, perfumes, and quasi-drugs in Japan, Indonesia, and internationally with a market cap of ¥80.52 billion.

Operations: The company generates revenue from the manufacture and sale of cosmetics, perfumes, and quasi-drugs across Japan, Indonesia, and international markets.

Estimated Discount To Fair Value: 20.4%

Mandom Corporation, trading at ¥2053, is significantly undervalued based on cash flows with a fair value estimate of ¥2578. Despite high earnings growth forecasts of 32.1% annually, revenue growth remains moderate at 5.7%. The recent tender offer by CVC Capital Partners for a major stake at ¥1960 per share reflects potential strategic shifts and management buyout plans. However, the dividend yield of 1.95% is not well supported by free cash flows, presenting a mixed financial outlook.

- Insights from our recent growth report point to a promising forecast for Mandom's business outlook.

- Click here to discover the nuances of Mandom with our detailed financial health report.

Where To Now?

- Access the full spectrum of 522 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Good value with reasonable growth potential.

Market Insights

Community Narratives