- China

- /

- Electrical

- /

- SZSE:002452

3 Stocks Estimated To Be Trading At Discounts Of Up To 49.9%

Reviewed by Simply Wall St

As global markets navigate a challenging landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing the implications of rate adjustments and economic data on stock valuations. Amidst these fluctuations, identifying undervalued stocks becomes particularly appealing as they may offer potential opportunities for growth when the broader market sentiment is uncertain.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥62.17 | CN¥124.03 | 49.9% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.43 | CN¥30.85 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1133.35 | ₹2252.97 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409953.04 | 49.9% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.15 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.92 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.46 | 49.7% |

Let's uncover some gems from our specialized screener.

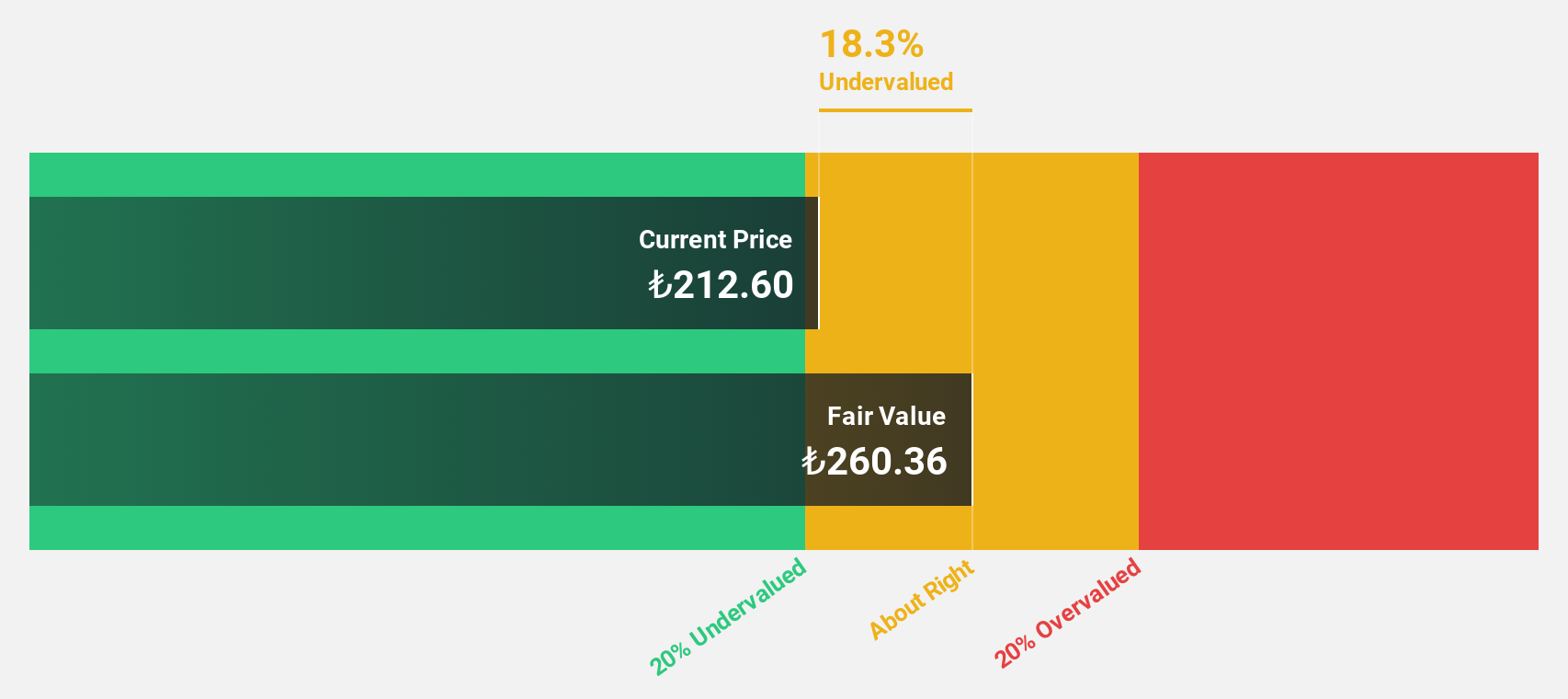

Tofas Türk Otomobil Fabrikasi Anonim Sirketi (IBSE:TOASO)

Overview: Tofas Türk Otomobil Fabrikasi Anonim Sirketi manufactures and sells passenger cars and light commercial vehicles in Turkey, with a market cap of TRY97.25 billion.

Operations: The company's revenue segments include Consumer Financing, which generated TRY6.53 billion, and Trading of Spare Parts and Automobile, contributing TRY89.17 billion.

Estimated Discount To Fair Value: 32.8%

Tofas Türk Otomobil Fabrikasi Anonim Sirketi is trading at TRY 194.5, below its estimated fair value of TRY 289.56, suggesting undervaluation based on discounted cash flow analysis. Despite recent declines in sales and net income for the third quarter, the company's earnings are forecast to grow significantly at 38.3% annually over the next three years, outpacing market expectations. However, its high dividend yield of 10.28% isn't well-supported by current earnings or cash flows.

- According our earnings growth report, there's an indication that Tofas Türk Otomobil Fabrikasi Anonim Sirketi might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Tofas Türk Otomobil Fabrikasi Anonim Sirketi.

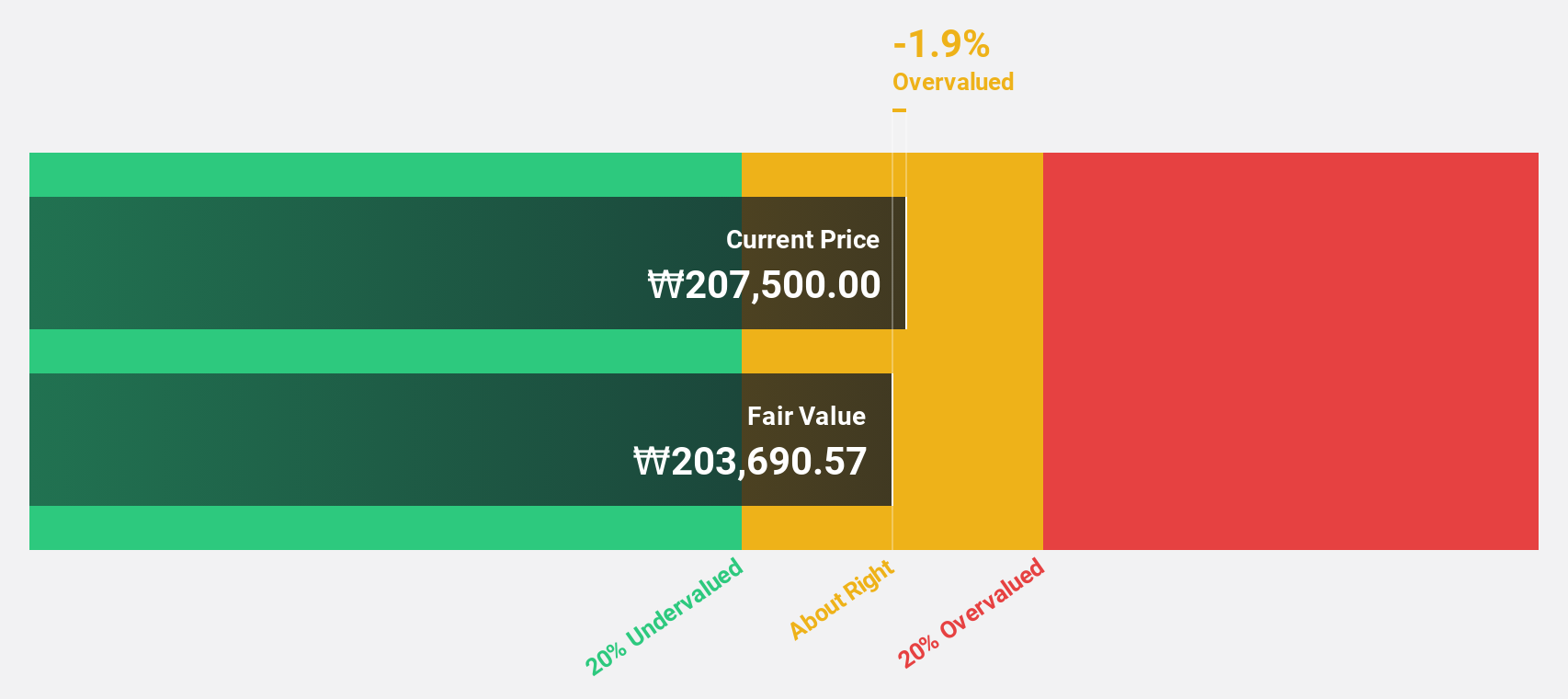

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩4.06 trillion.

Operations: The company's revenue is primarily derived from its online games and game services, amounting to ₩1.61 trillion.

Estimated Discount To Fair Value: 49.9%

NCSOFT is trading at ₩205,500, significantly below its fair value estimate of ₩409,953.04 based on discounted cash flow analysis. Despite experiencing a net loss in the recent quarter and declining sales year-over-year, its earnings are projected to grow robustly at 41.6% annually over the next three years, surpassing market growth expectations. However, the company faces challenges with an unstable dividend track record and lower forecasted return on equity.

- Insights from our recent growth report point to a promising forecast for NCSOFT's business outlook.

- Click here to discover the nuances of NCSOFT with our detailed financial health report.

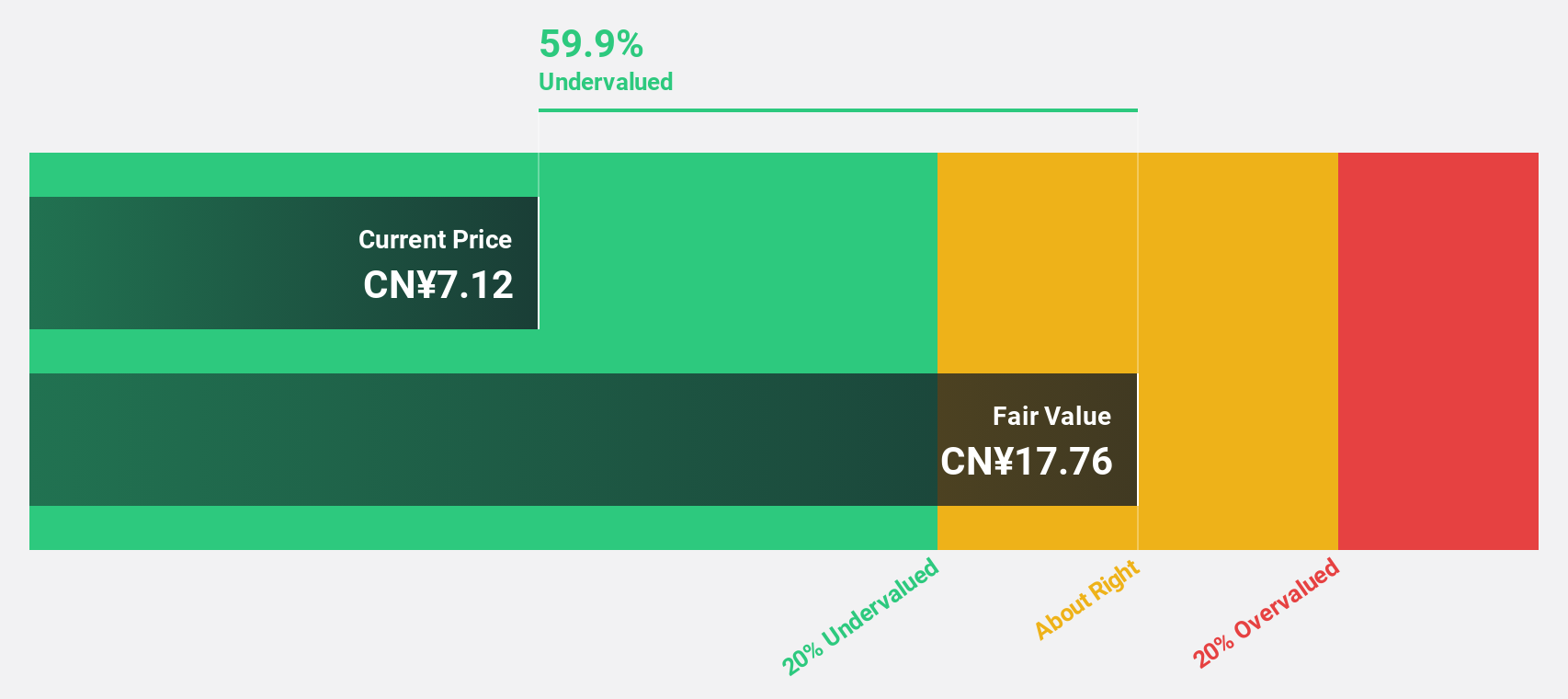

Changgao Electric Group (SZSE:002452)

Overview: Changgao Electric Group Co., Ltd. focuses on the research, development, manufacture, and sale of power transmission equipment in China with a market cap of CN¥4.58 billion.

Operations: The company generates revenue through its involvement in the research, development, manufacture, and sale of power transmission equipment within China.

Estimated Discount To Fair Value: 44.7%

Changgao Electric Group is trading at CN¥7.55, significantly below its estimated fair value of CN¥13.66, suggesting it is undervalued by over 44% based on discounted cash flow analysis. The company reported net income growth to CNY 181.04 million for the nine months ended September 2024, with earnings expected to grow significantly at 30.6% annually over the next three years, outpacing market growth rates despite a historically unstable dividend track record and lower forecasted return on equity.

- Our comprehensive growth report raises the possibility that Changgao Electric Group is poised for substantial financial growth.

- Take a closer look at Changgao Electric Group's balance sheet health here in our report.

Turning Ideas Into Actions

- Dive into all 871 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002452

Changgao Electric Group

Engages in the research, development, manufacture, and sale of power transmission equipment in the People's Republic of China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives