- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

3 Global Growth Companies With High Insider Ownership And 79% Earnings Growth

Reviewed by Simply Wall St

As global markets experience a surge, with U.S. indices like the S&P 500 and Nasdaq Composite reaching all-time highs, investors are keenly observing the interplay between inflation trends and economic growth. Amid these developments, identifying growth companies with substantial insider ownership can be particularly compelling, as such ownership often aligns management's interests with those of shareholders and may signal confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.1% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

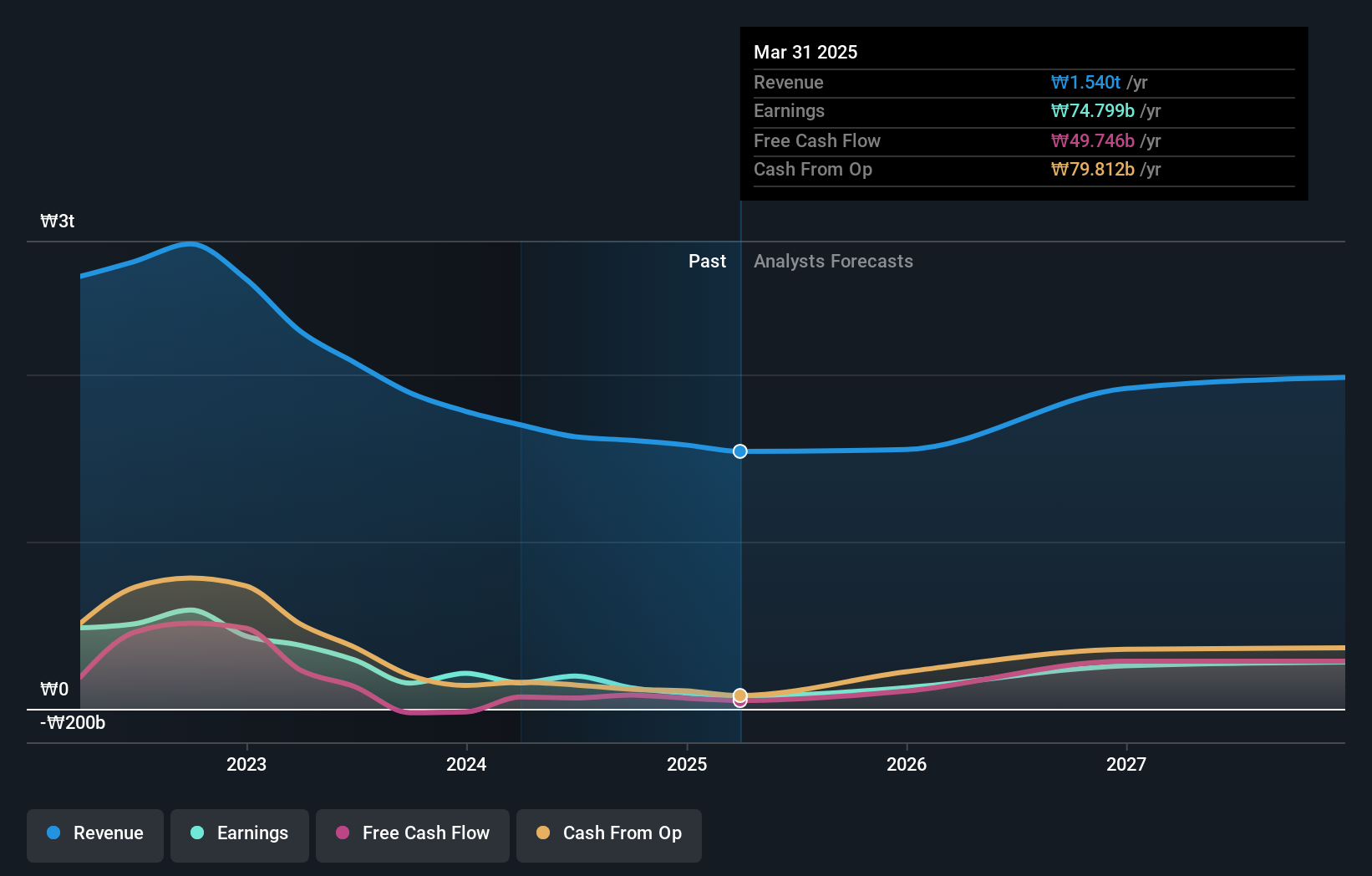

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩3.97 trillion.

Operations: The company generates revenue primarily from online games and game services, amounting to ₩1.54 trillion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 31.1% p.a.

NCSOFT demonstrates potential as a growth company with high insider ownership, despite recent challenges. Earnings are forecast to grow significantly at 31.1% per year, outpacing the Korean market's 21.3%. However, first-quarter results showed a decline in sales to ₩360.28 billion and net income to ₩37.76 billion compared to last year, partly due to large one-off items affecting earnings quality. Revenue growth is expected at 10.7% annually but remains below the 20% benchmark for high growth rates.

- Navigate through the intricacies of NCSOFT with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, NCSOFT's share price might be too optimistic.

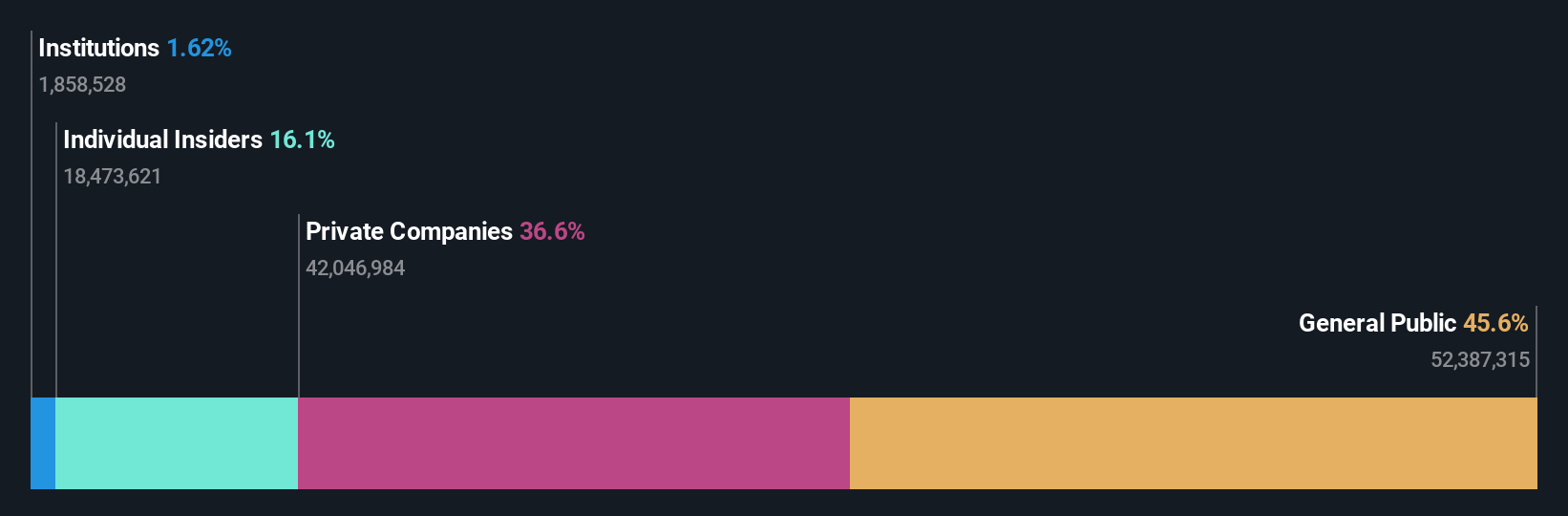

Fawaz Abdulaziz Al Hokair (SASE:4240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fawaz Abdulaziz Al Hokair & Company is a franchise retailer of fashion products operating in several countries including Saudi Arabia, Jordan, and the United States, with a market cap of SAR3.02 billion.

Operations: The company's revenue segments include Saudi Retail, generating SAR4.66 billion, and F&B, contributing SAR321.41 million.

Insider Ownership: 16.1%

Earnings Growth Forecast: 79.4% p.a.

Fawaz Abdulaziz Al Hokair shows potential for growth with high insider ownership, as earnings are forecast to grow significantly at 79.4% per year, surpassing the Saudi market's average. Recent first-quarter results indicate a return to profitability with net income of SAR 1.81 million from a previous loss, although revenue growth is modest at 2.7% annually. The company faces challenges such as negative shareholder equity and concerns about financial stability due to insufficient interest coverage by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Fawaz Abdulaziz Al Hokair.

- Our valuation report here indicates Fawaz Abdulaziz Al Hokair may be overvalued.

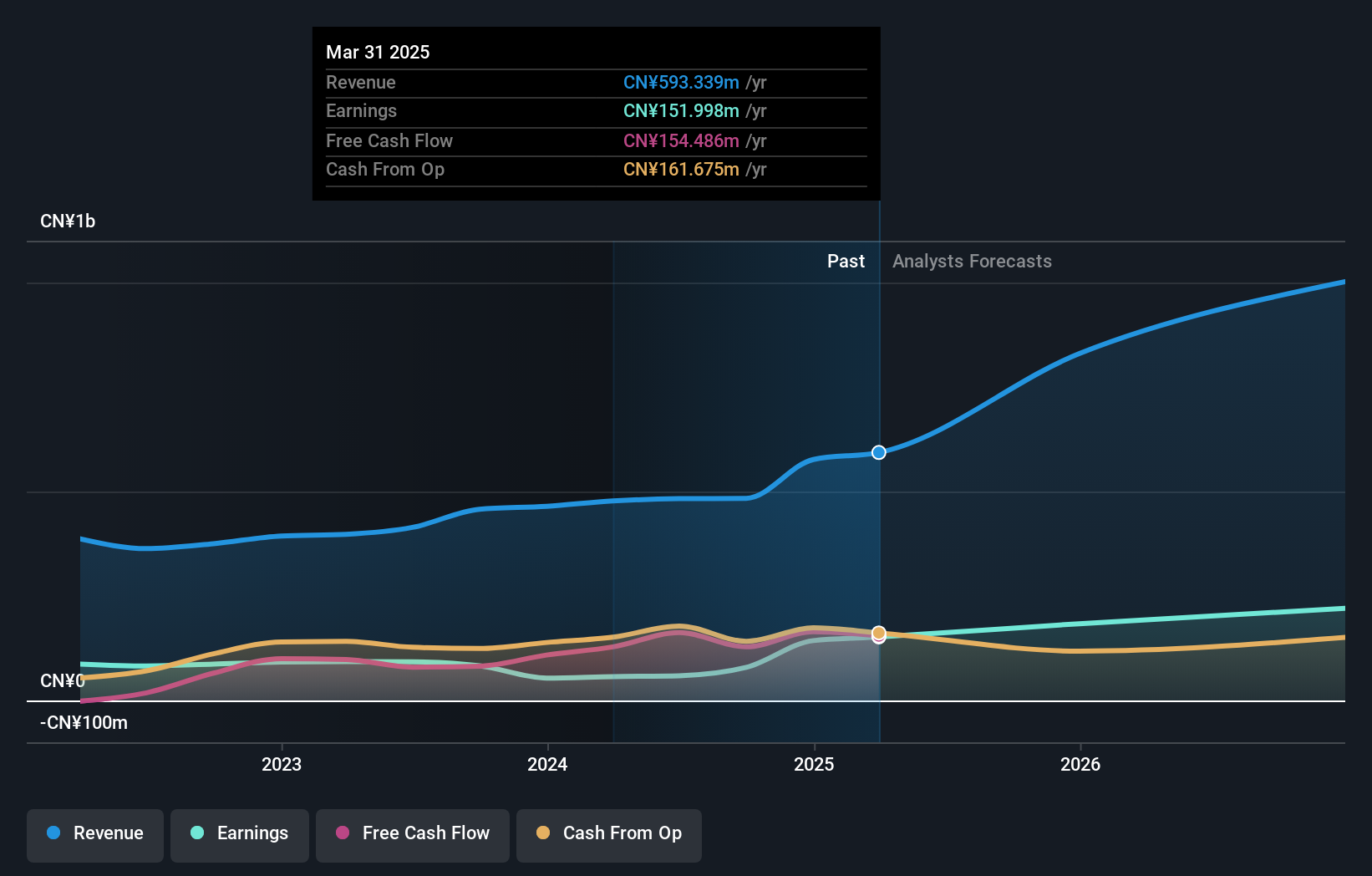

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both in the People’s Republic of China and internationally, with a market cap of CN¥4.72 billion.

Operations: The company generates revenue of CN¥593.34 million from its instrumentation industry segment, offering coal analysis solutions domestically and internationally.

Insider Ownership: 23.3%

Earnings Growth Forecast: 21% p.a.

Hunan Sundy Science and Technology demonstrates potential with strong insider ownership and a notable increase in net income, rising to CNY 143.24 million from CNY 53.74 million year-over-year. Revenue is forecast to grow at 28.4% annually, outpacing the Chinese market average of 12.4%. Despite this growth, the company's dividend track record remains unstable and its share price has been highly volatile recently, which may concern risk-averse investors seeking stability.

- Dive into the specifics of Hunan Sundy Science and Technology here with our thorough growth forecast report.

- The analysis detailed in our Hunan Sundy Science and Technology valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Delve into our full catalog of 833 Fast Growing Global Companies With High Insider Ownership here.

- Curious About Other Options? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, and Armenia.

Reasonable growth potential and fair value.

Market Insights

Community Narratives