- Japan

- /

- Trade Distributors

- /

- TSE:9896

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, investors are paying close attention to corporate earnings and the evolving AI sector. Amidst these dynamics, dividend stocks offer a potential avenue for stability and income generation, making them an attractive consideration in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.81% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

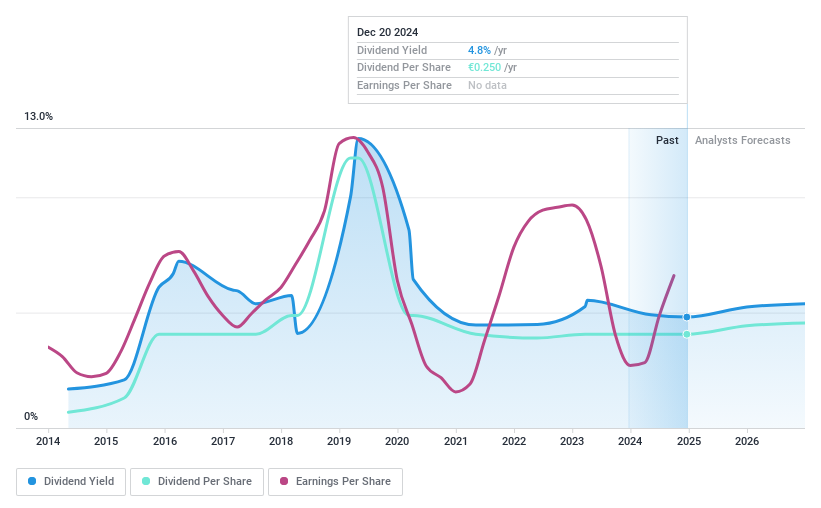

Altri SGPS (ENXTLS:ALTR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Altri SGPS is a company that produces and sells cellulosic fibers both in Portugal and internationally, with a market cap of €1.18 billion.

Operations: Altri SGPS generates revenue primarily from the production and commercialization of cellulosic fibers, amounting to €841.88 million.

Dividend Yield: 4.2%

Altri SGPS demonstrates a solid dividend coverage with a payout ratio of 49.2% and cash payout ratio of 22.6%, indicating dividends are well-supported by earnings and cash flows. However, its dividend history is marked by volatility over the past decade, despite recent growth in payments. The company's debt level remains high, which could impact future stability. Recent financial results show significant revenue and net income growth, potentially supporting future dividend sustainability amidst market challenges.

- Navigate through the intricacies of Altri SGPS with our comprehensive dividend report here.

- The analysis detailed in our Altri SGPS valuation report hints at an deflated share price compared to its estimated value.

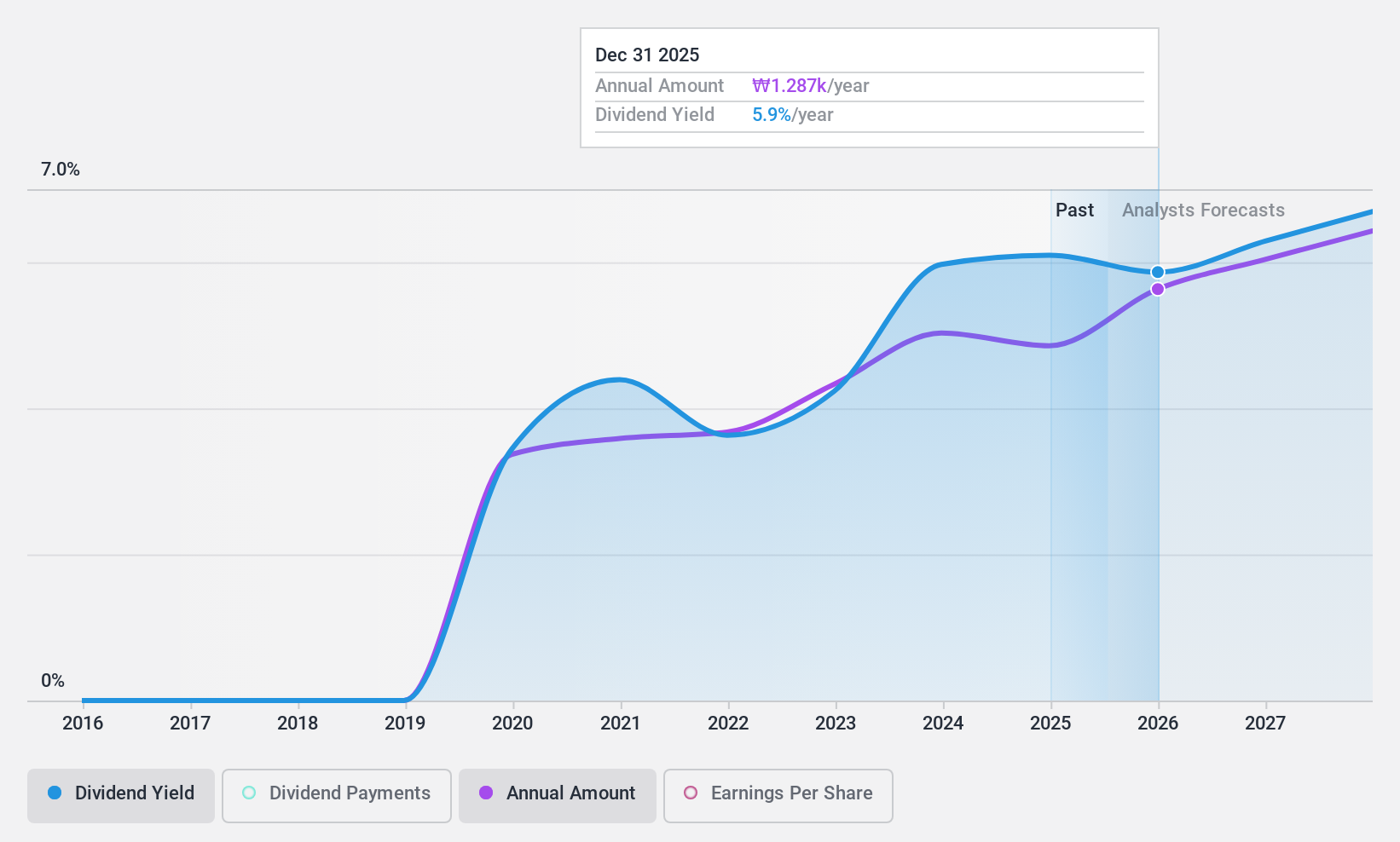

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market capitalization of approximately ₩1.77 trillion.

Operations: Cheil Worldwide Inc.'s revenue primarily comes from its advertising segment, which generated approximately ₩4.33 billion.

Dividend Yield: 6.3%

Cheil Worldwide's dividend payments are supported by a payout ratio of 60.2% and a cash payout ratio of 81.4%, indicating strong coverage by earnings and cash flows. Despite being relatively new to dividends with only five years of history, the company has maintained stable and reliable payouts. Trading at significant value compared to peers, Cheil offers an attractive dividend yield in the top quartile of the KR market, though its short history may concern some investors.

- Get an in-depth perspective on Cheil Worldwide's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Cheil Worldwide's current price could be quite moderate.

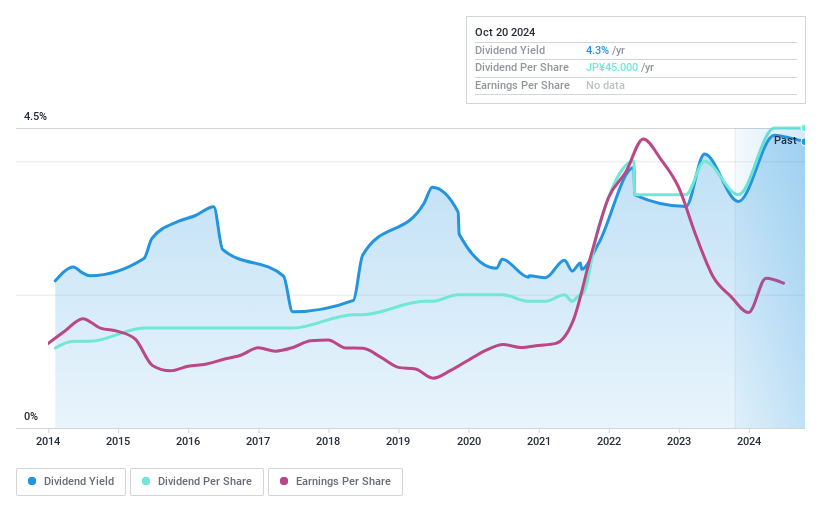

JK Holdings (TSE:9896)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JK Holdings Co., Ltd. operates through its subsidiaries in wholesale, plywood manufacturing and wood processing, franchise, and construction works both in Japan and internationally, with a market cap of ¥29.60 billion.

Operations: JK Holdings Co., Ltd.'s revenue is primarily derived from its General Building Materials Wholesale Business at ¥349.06 billion, followed by the General Building Materials Retail Business at ¥52.43 billion, and the Plywood Manufacturing/Wood Processing Business at ¥19.70 billion.

Dividend Yield: 4.4%

JK Holdings' dividend payments are well covered by earnings and free cash flow, with a payout ratio of 28.5% and a cash payout ratio of 45.9%. Despite being in the top 25% for dividend yield in Japan at 4.39%, its dividends have been volatile over the past decade, lacking stability and reliability. The company trades at a favorable price-to-earnings ratio of 6.5x compared to the broader JP market's 13.4x, suggesting potential value for investors seeking dividends amidst volatility concerns.

- Take a closer look at JK Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility JK Holdings' shares may be trading at a premium.

Where To Now?

- Click this link to deep-dive into the 1959 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9896

JK Holdings

Through its subsidiaries, engages in the wholesale, plywood manufacturing and wood processing, franchise, construction works, and other businesses in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives