As global markets navigate a complex landscape of trade uncertainties and policy shifts, smaller-cap indexes have shown resilience, with the S&P MidCap 400 and Russell 2000 posting gains despite broader declines in major indices. In this environment, identifying high growth tech stocks in Asia requires a keen focus on companies that can leverage innovation to counteract external pressures such as trade tensions and regulatory changes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 33.30% | 30.65% | ★★★★★★ |

| Zhongji Innolight | 23.02% | 24.14% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★☆☆

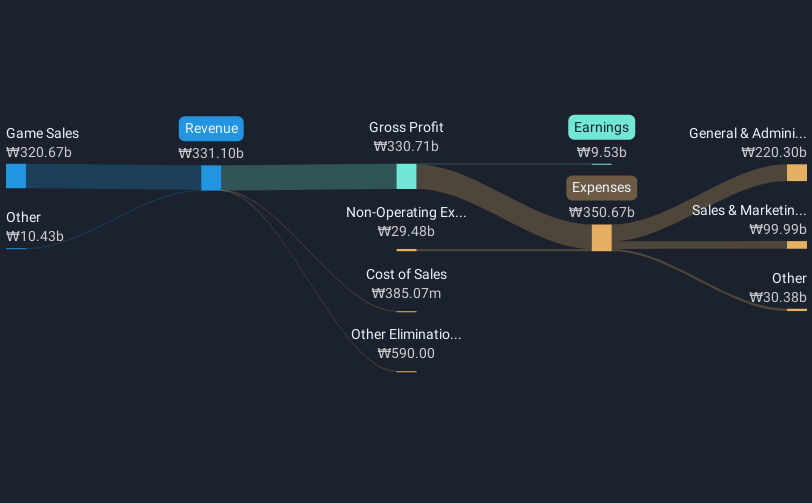

Overview: Pearl Abyss Corp. is a company involved in the development of game software, with a market capitalization of ₩2.06 trillion.

Operations: Pearl Abyss Corp. primarily generates revenue through game sales, totaling ₩331.88 billion. The company's focus on game software development positions it within the gaming industry, leveraging its expertise to drive income from its digital products.

Pearl Abyss, a key player in the entertainment sector, has demonstrated remarkable financial performance with its earnings skyrocketing by 296.8% over the past year, significantly outpacing the industry's -4.2%. This growth is underpinned by robust annual revenue projections of 15.8%, which surpasses Korea's market average of 7.6%. Despite these gains, challenges remain as the company’s Return on Equity is expected to moderate to 13.3% in three years. Furthermore, a substantial one-off gain of ₩29.4B last year suggests that some earnings may not be repeatable, highlighting the need for cautious optimism about its sustained financial health. Pearl Abyss continues to capture attention with its dynamic growth prospects and strategic positioning in high-growth markets, yet it must navigate potential volatility from non-recurring financial components.

- Unlock comprehensive insights into our analysis of Pearl Abyss stock in this health report.

Evaluate Pearl Abyss' historical performance by accessing our past performance report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market capitalization of ₩9.60 trillion.

Operations: HYBE generates revenue primarily from its Label segment, contributing ₩2.62 trillion, followed by the Platform segment at ₩333.45 billion and the Solution segment at ₩61.84 billion. The company's business model focuses on music production and artist management, leveraging these segments to drive growth in the entertainment industry.

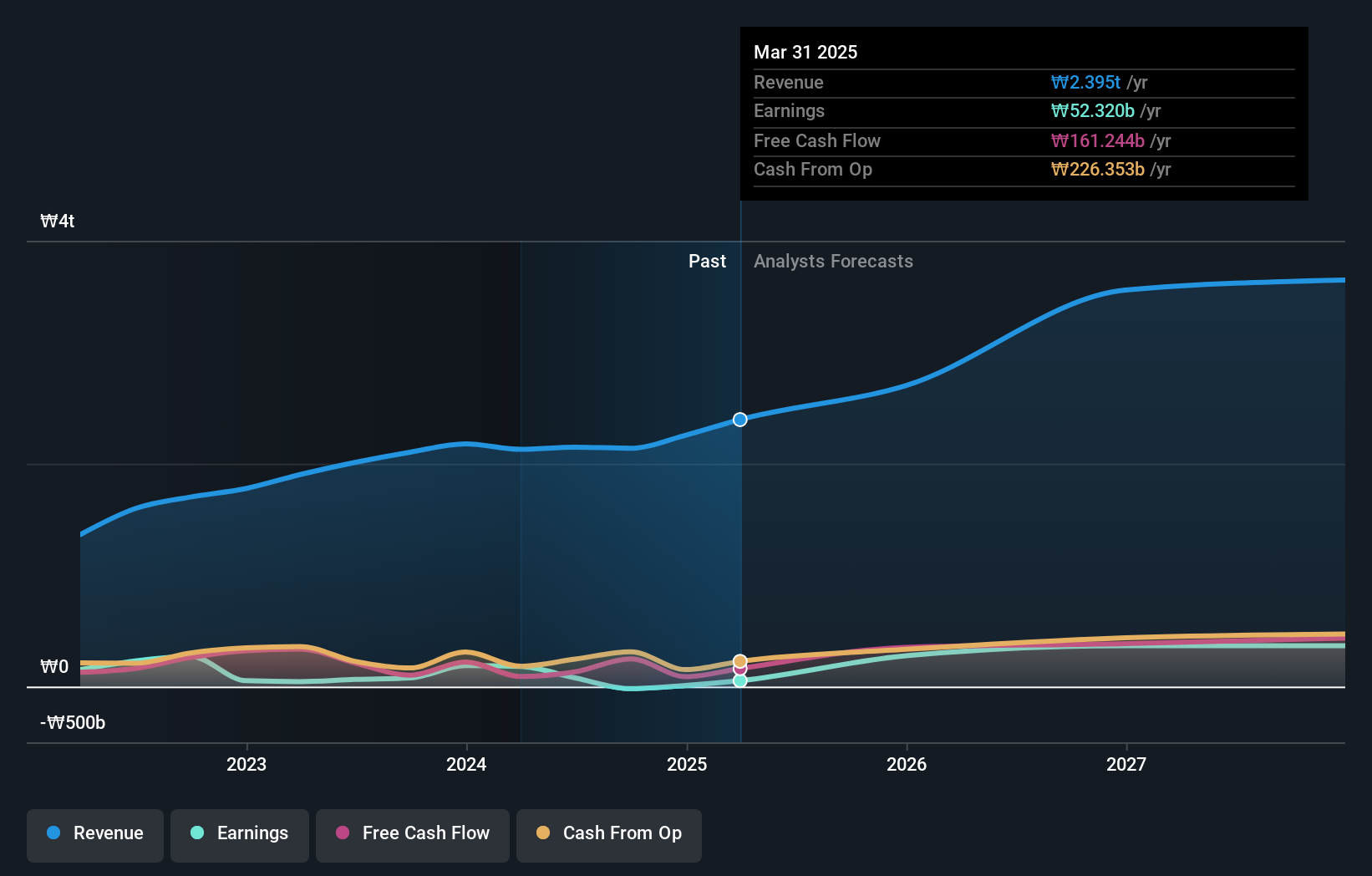

HYBE, navigating through a challenging year with a significant drop in net income from KRW 187.25 billion to KRW 9.38 billion, underscores the volatile nature of the entertainment industry. Despite this downturn, the company's revenue growth forecast at 14.8% annually outpaces South Korea's market average of 7.6%, showcasing its potential resilience and adaptability in a competitive landscape. Furthermore, an expected annual earnings growth of 42.2% positions HYBE to potentially rebound strongly as it continues to innovate and expand its global footprint in music and related media sectors.

- Click to explore a detailed breakdown of our findings in HYBE's health report.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Digital China Information Service Group (SZSE:000555)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Digital China Information Service Group Company Ltd. operates as a technology service provider focusing on digital transformation solutions, with a market capitalization of approximately CN¥10.70 billion.

Operations: The company generates revenue primarily from three segments: Finance (CN¥4.91 billion), Government and Enterprise (CN¥3.57 billion), and Operator (CN¥1.49 billion).

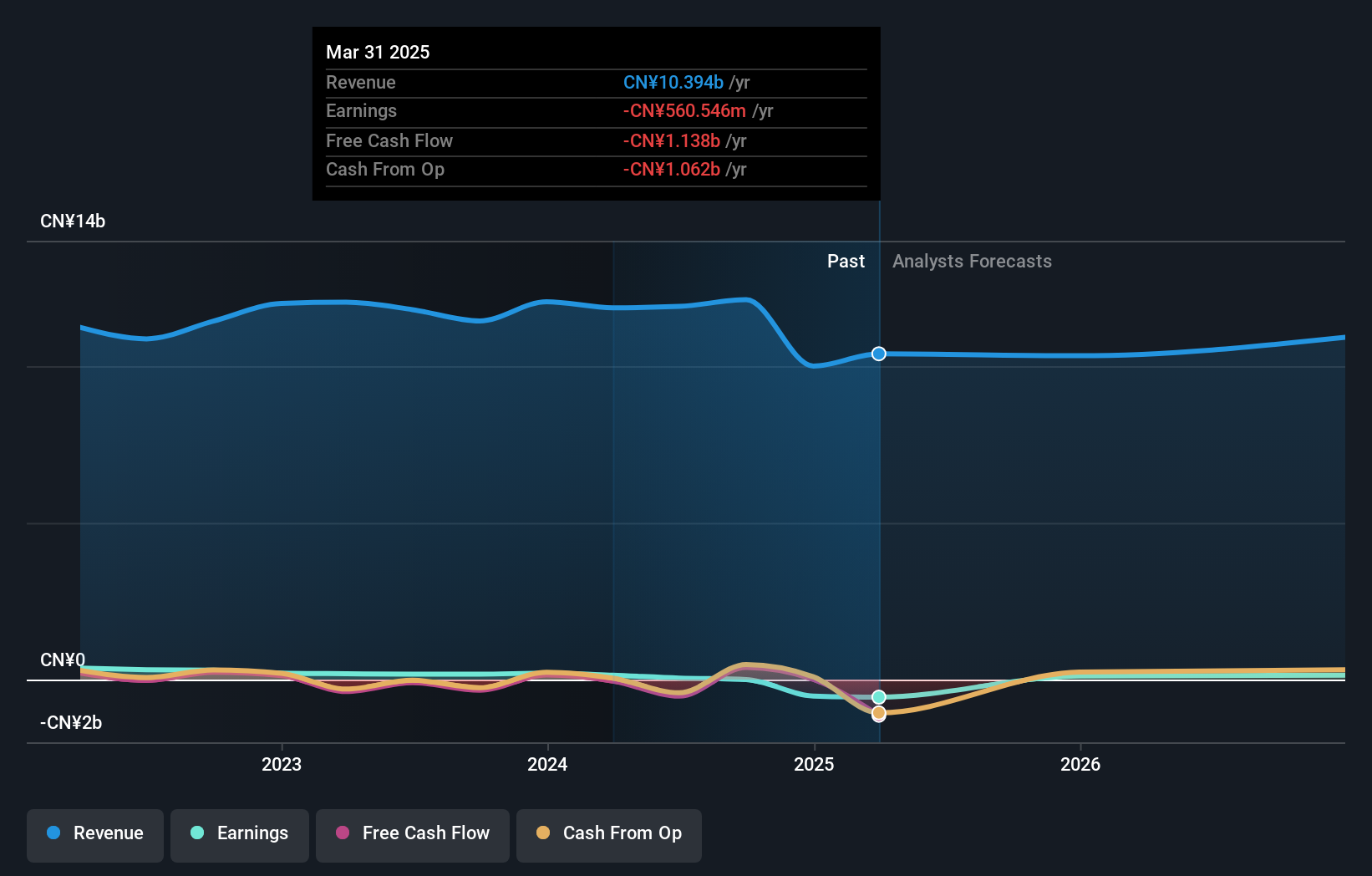

Digital China Information Service Group is navigating a transformative phase, evidenced by its robust annual revenue growth projection of 20.9%, significantly outpacing the Chinese market average of 12.6%. Despite recent challenges, including a shift from a net income to a net loss in 2024 as reported earnings dropped from CNY 207.13 million to a loss of CNY 524.06 million, the company's commitment to innovation is clear with substantial R&D investments aimed at reversing this downturn and fueling future profitability. The firm's strategic adjustments and focus on emerging technologies are poised to capitalize on growing digital demands within Asia, setting a stage for potential recovery and growth in the coming years.

Next Steps

- Click this link to deep-dive into the 495 companies within our Asian High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000555

Digital China Information Service Group

Digital China Information Service Group Company Ltd.

Fair value with moderate growth potential.

Market Insights

Community Narratives