- South Korea

- /

- Entertainment

- /

- KOSDAQ:A253450

Can You Imagine How Studio Dragon's (KOSDAQ:253450) Shareholders Feel About The 24% Share Price Increase?

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, Studio Dragon Corporation (KOSDAQ:253450) shareholders have seen the share price rise 24% over three years, well in excess of the market return (5.5%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 9.1% in the last year.

Check out our latest analysis for Studio Dragon

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, Studio Dragon failed to grow earnings per share, which fell 42% (annualized).

This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at per year). The only thing that's clear is there is low correlation between Studio Dragon's share price and its historic fundamental data. Further research may be required!

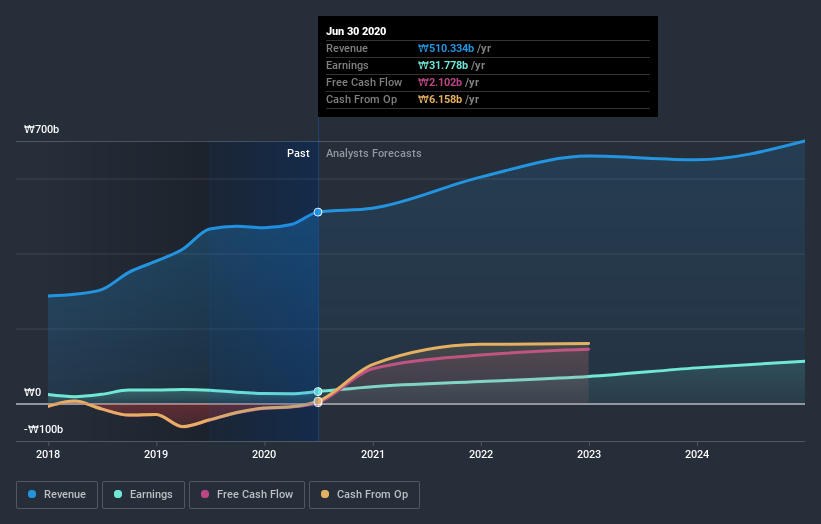

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Studio Dragon is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Studio Dragon shareholders are up 9.1% for the year. While you don't go broke making a profit, this return was actually lower than the average market return of about 27%. On the bright side that gain is actually better than the average return of 8% over the last three years, implying that the company is doing better recently. If the business can justify the share price gain with improving fundamental data, then there could be more gains to come. Is Studio Dragon cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Studio Dragon may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Studio Dragon, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A253450

Studio Dragon

A drama studio, produces and provides drama contents worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives