- South Korea

- /

- Entertainment

- /

- KOSDAQ:A112040

Exploring 3 High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.4%, and in the last 12 months, it is down by 3.8%, though earnings are forecast to grow by an impressive 29% annually. In this context, identifying high-growth tech stocks that can outperform despite current market conditions is crucial for investors seeking robust returns in South Korea's dynamic technology sector.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wemade Co., Ltd. develops and publishes games both in South Korea and internationally, with a market cap of ₩1.15 billion.

Operations: Wemade Co., Ltd. focuses on game development and publishing, catering to both domestic and international markets. The company generates revenue primarily through its gaming portfolio.

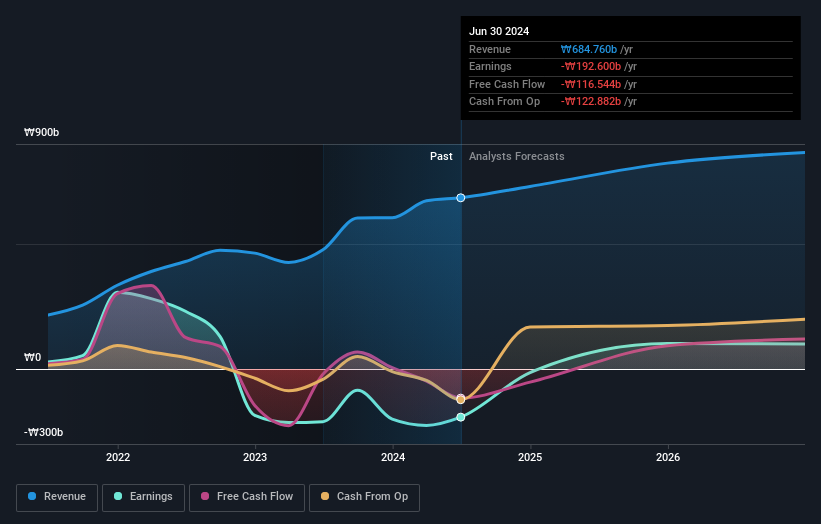

Wemade Ltd. has been making strides in the blockchain gaming sector, with its WEMIX ecosystem showing significant promise. The company reported Q2 2024 sales of ₩332.70 billion and a net loss of ₩51.60 billion, while six-month sales reached ₩171.39 billion, up from ₩159.28 billion last year, resulting in a net income of ₩4.11 billion compared to a previous net loss of ₩29.08 billion. Wemade's R&D expenses have been pivotal for innovation; their focus on WEMIX3.0 and GameFi initiatives underscores their commitment to leading the blockchain gaming space. The company's revenue is forecasted to grow at 9.5% annually, which is slower than both the market and industry averages but still notable given their strategic pivot towards blockchain technologies like dApps and NFTs within the WEMIX ecosystem—expected to drive future growth substantially as they aim for profitability over the next three years with earnings projected to grow by 106%.

- Click to explore a detailed breakdown of our findings in WemadeLtd's health report.

Examine WemadeLtd's past performance report to understand how it has performed in the past.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of ₩1.93 trillion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceuticals segment, which accounted for ₩296.59 billion. The company operates within the biopharmaceutical industry in South Korea, focusing on the development and commercialization of pharmaceutical products.

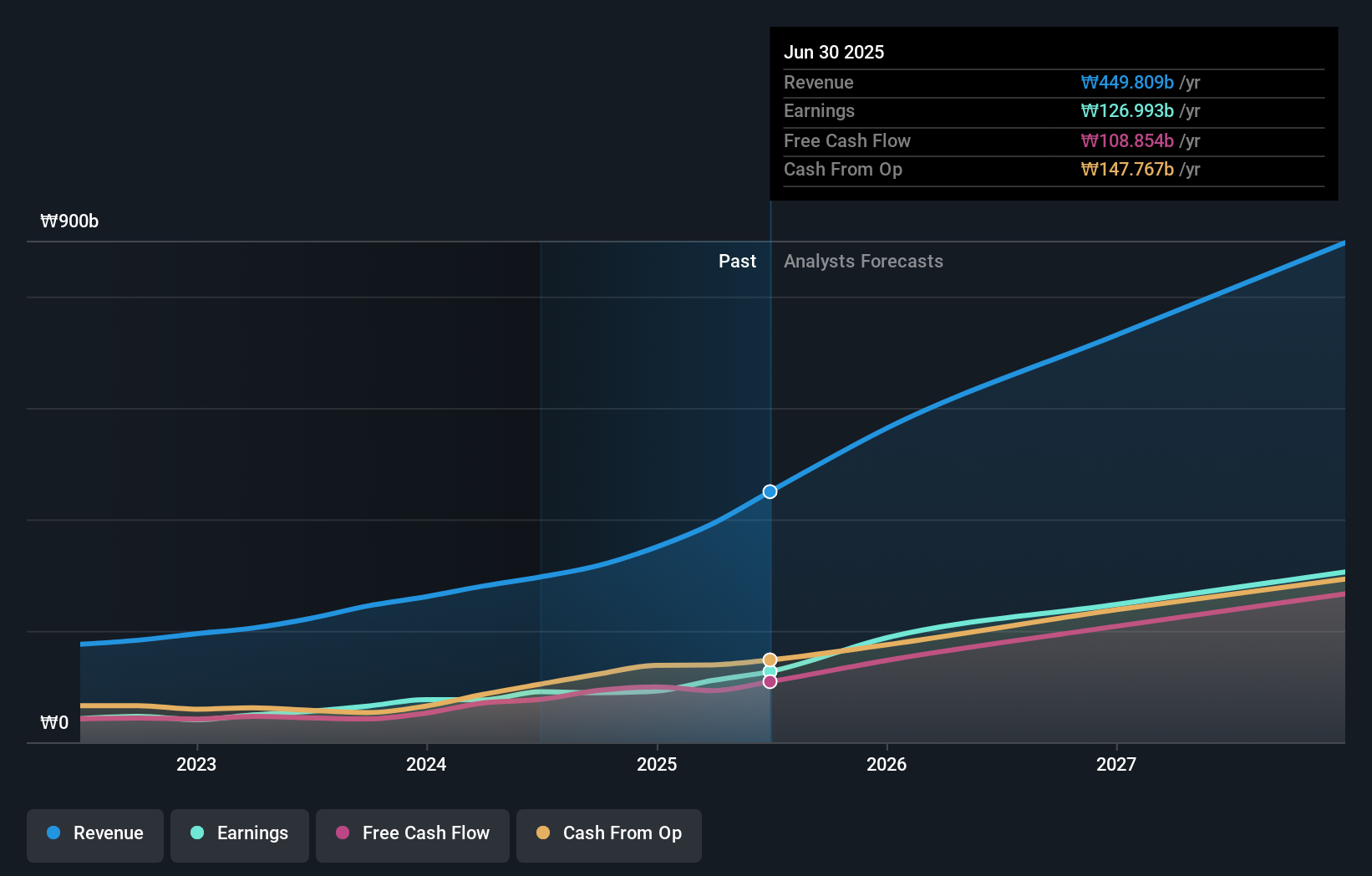

PharmaResearch has demonstrated robust earnings growth, with a notable 63.2% increase over the past year, outpacing the biotech industry's 6.1%. The company’s revenue is projected to grow at an impressive 22.1% annually, significantly higher than South Korea's market average of 10.3%. Investing heavily in R&D, PharmaResearch allocated ₩22 billion last year to drive innovation and maintain its competitive edge. Despite a volatile share price recently, the firm’s strategic focus on high-quality earnings and substantial R&D investments positions it well for future growth in the biotech sector.

- Take a closer look at PharmaResearch's potential here in our health report.

Gain insights into PharmaResearch's historical performance by reviewing our past performance report.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩988.95 billion.

Operations: Solum Co., Ltd. generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing ₩1.16 billion. The company serves both domestic and international markets.

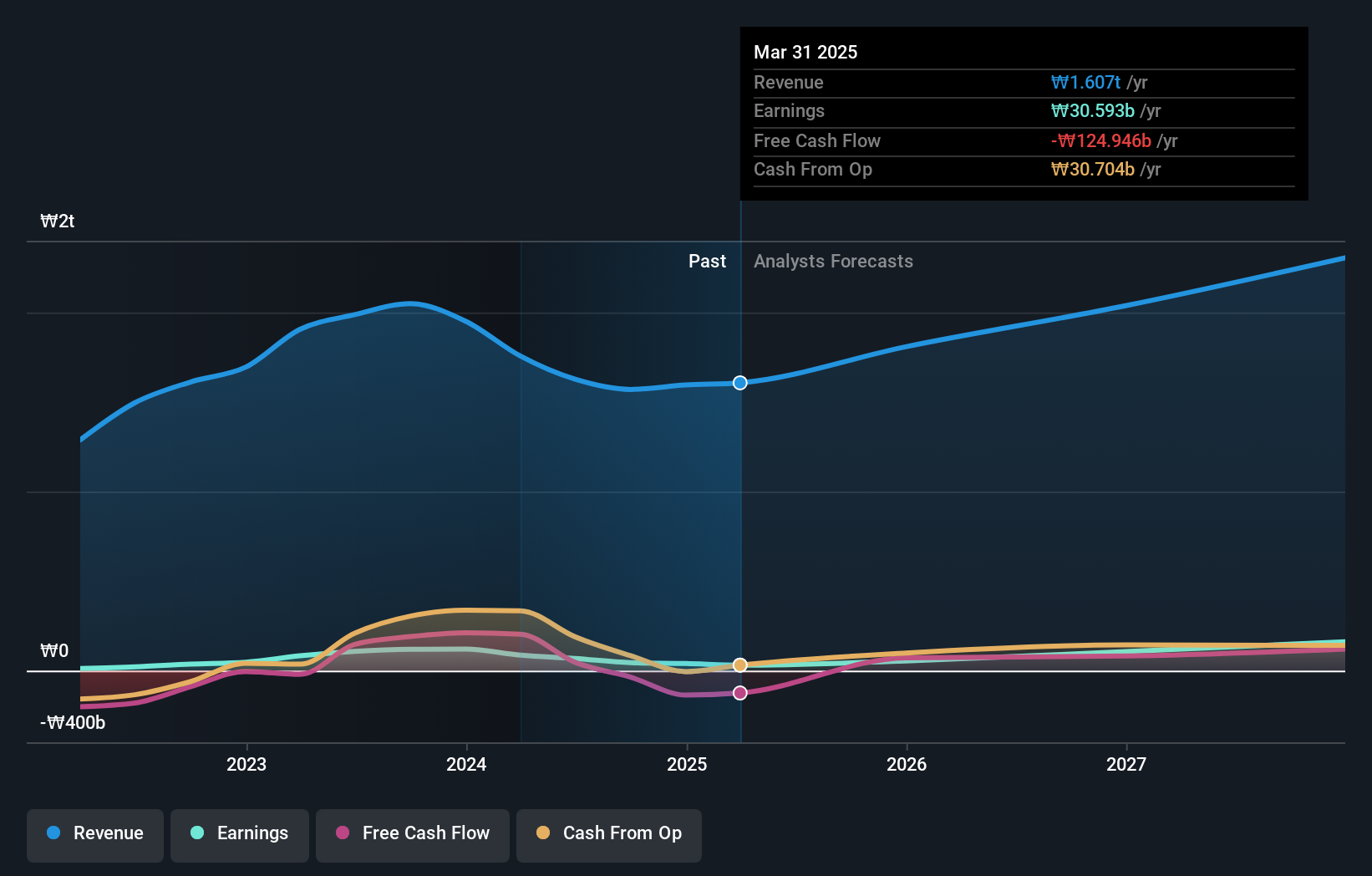

Solum's projected 37.2% annual earnings growth over the next three years significantly outpaces South Korea's market average of 28.6%. Despite a recent 37.1% decline in earnings, the company's R&D expenditure of ₩20 billion underscores its commitment to innovation and maintaining its competitive edge. The recently announced share repurchase program worth ₩20 billion aims to enhance shareholder value by stabilizing stock prices, reflecting a strategic move to bolster investor confidence amidst fluctuating earnings performance.

- Get an in-depth perspective on Solum's performance by reading our health report here.

Assess Solum's past performance with our detailed historical performance reports.

Summing It All Up

- Reveal the 49 hidden gems among our KRX High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WemadeLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A112040

WemadeLtd

Develops and publishes games in South Korea and internationally.

Undervalued with high growth potential.