- South Korea

- /

- Entertainment

- /

- KOSDAQ:A086980

The three-year underlying earnings growth at Showbox (KOSDAQ:086980) is promising, but the shareholders are still in the red over that time

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Showbox Corp. (KOSDAQ:086980) shareholders, since the share price is down 32% in the last three years, falling well short of the market decline of around 15%. Unfortunately the share price momentum is still quite negative, with prices down 18% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Showbox isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Showbox

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Showbox moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 24% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Showbox more closely, as sometimes stocks fall unfairly. This could present an opportunity.

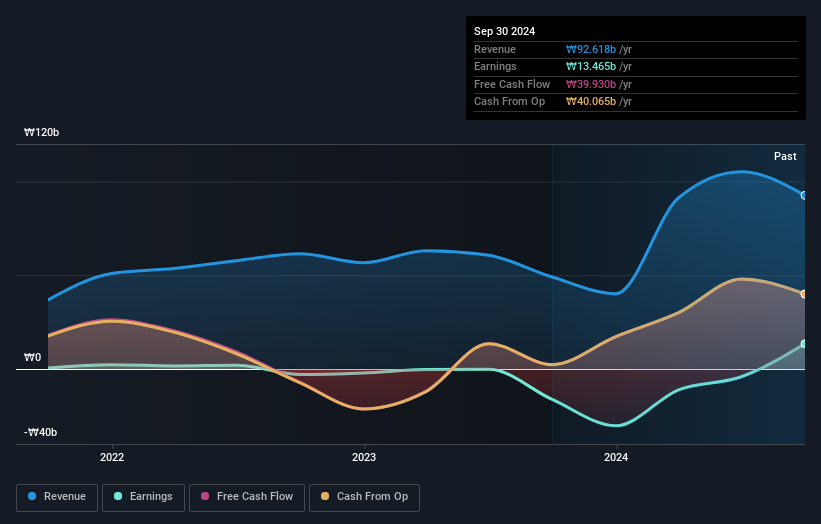

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Showbox stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Showbox has rewarded shareholders with a total shareholder return of 28% in the last twelve months. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Showbox , and understanding them should be part of your investment process.

Of course Showbox may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086980

Showbox

Engages in the investment, production, and distribution of films in South Korea, North America, Asia, Europe, and internationally.

Flawless balance sheet and fair value.