- South Korea

- /

- Entertainment

- /

- KOSDAQ:A063080

With Com2uS Holdings Corporation (KOSDAQ:063080) It Looks Like You'll Get What You Pay For

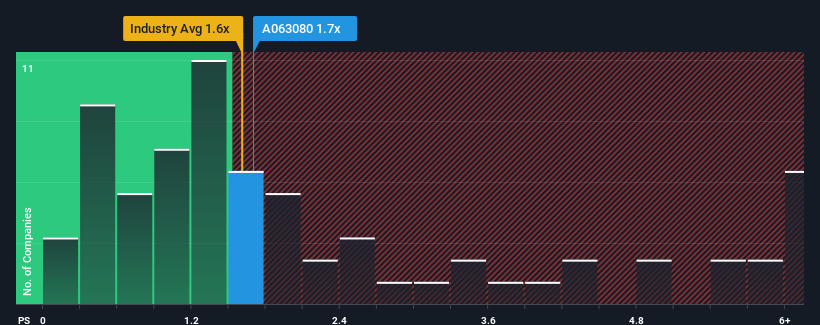

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Entertainment industry in Korea, you could be forgiven for feeling indifferent about Com2uS Holdings Corporation's (KOSDAQ:063080) P/S ratio of 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Com2uS Holdings

What Does Com2uS Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Com2uS Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Com2uS Holdings.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Com2uS Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The latest three year period has also seen a 9.0% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 14% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Com2uS Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Com2uS Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Com2uS Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 1 warning sign for Com2uS Holdings that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A063080

Low risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026