- South Korea

- /

- Entertainment

- /

- KOSDAQ:A047820

The Chorokbaem Media (KOSDAQ:047820) Share Price Has Gained 55% And Shareholders Are Hoping For More

Some Chorokbaem Media Co., Ltd. (KOSDAQ:047820) shareholders are probably rather concerned to see the share price fall 36% over the last three months. But that doesn't change the reality that over twelve months the stock has done really well. After all, the share price is up a market-beating 55% in that time.

View our latest analysis for Chorokbaem Media

Chorokbaem Media isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

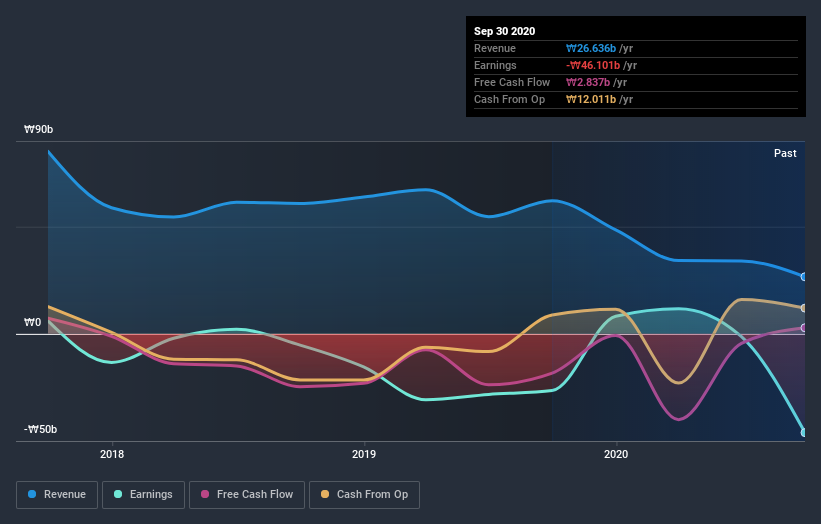

In the last year Chorokbaem Media saw its revenue shrink by 57%. Despite the lack of revenue growth, the stock has returned a solid 55% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Chorokbaem Media's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Chorokbaem Media's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Chorokbaem Media hasn't been paying dividends, but its TSR of 65% exceeds its share price return of 55%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Chorokbaem Media shareholders have received a total shareholder return of 65% over the last year. That certainly beats the loss of about 8% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Chorokbaem Media (2 are a bit unpleasant) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Chorokbaem Media, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A047820

Chorokbaem Media

Chorokbaem Media Co., Ltd. develops and produces entertainment content primarily in Asia.

Flawless balance sheet and slightly overvalued.